Three Drivers of Negative Sentiment in Natural Gas Right Now

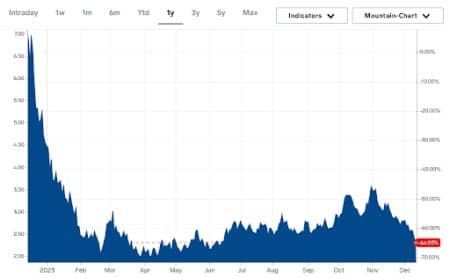

U.S. natural gas futures have failed to sustain earlier gains, with markets succumbing to the trifecta of forecasts for milder weather during the holiday season, record gas output, and fears of a global economic slowdown in 2024.

Henry Hub natural gas fell nearly 5% on Tuesday to $2.31/MMBtu, the lowest settlement since June. Chinese demand is quickly turning into oversupply, with traders now being forced to seek other regions to offload the surplus. Meanwhile, European gas inventories are at record levels. The EIA estimates the continent will end the winter at more than 2 Tcf–22% higher than the five-year average.

The bearish outlook has prompted the EIA to cut its estimate for average spot prices at Henry Hub by more than 60 cents to around $2.80/mmBtu for the November 2023-March 2024 period, citing a warmer-than-average start to winter and high natural gas production. For 2024, the agency has cut its Henry Hub price estimate to $2.79 from $3.25.

Oil and gas markets have issued a tepid response after the just-ended COP28 summit in Dubai marked the first time ever a host nation has requested less severe agreement in terms of climate control and reduction of usage for fossil fuels.

A draft of a potential climate deal at the COP28 summit on Monday suggested a host of measures to cut emissions, but tactfully failed to mention"phase out" of fossil fuels that many nations have demanded–a move that has drawn criticism from the U.S., EU and several climate-vulnerable countries.

Natural Gas (Henry Hub) USD/MMBtu

Source: Business Insider

Natural Gas Sector In Limbo

The massive natural gas selloff has created mayhem in the sector with scores of natural gas companies deeply distressed.

Shares of Houston, Texas natural gas player Tellurian Inc. (NYSE:TELL) have cratered further bringing them to -62.4% in the year-to-date after the company reported a larger Q3 loss than in the year-ago quarter and warned it’s in real danger of going under. Tellurian reported it lost $65.4M in Q3 compared with a $14.2M loss in last year’s corresponding quarter, when its natural gas production revenues enjoyed a strong boost from high gas prices while Q3 revenues were nearly cut in half to $43.3M from $81.1M a year earlier.

More alarmingly, Tellurian’s management has warned that its financial situation raises "substantial doubt" that it can continue as a going concern. The company said it had $59.3M in cash at the end of the third quarter, hardly sufficient to meet its obligations and fund working capital needs for the next 12 months.

"These conditions raise substantial doubt about the company's ability to continue as a going concern within one year after the date that the financial statements are issued," Tellurian said in its latest 10-Q filing.

On a more positive note, Tellurian revealed it is “having a number of discussions with counterparties for both equity partnership and LNG offtake" for its proposed $14.5B Driftwood export project in Louisiana. The company has invested more than $1B to develop and advance construction of Driftwood LNG, with the project on target to produce first liquefied natural gas in 2027.

A week ago, Truist Securities downgraded Antero Resources (NYSE:AR) to Hold from Buy with a $28 price target, cut from $37, saying the company's unhedged strategy which previously favored the company when gas prices were rising is now a major risk as prices fall and is likely to lower cash flow. According to the analysts, Antero "has the depth and quality inventory to appeal to large institutional investors in the coming years, we see limited upside for the unhedged producer over winter in the absence of a material commodity recovery."

Erstwhile high-flying EQT Corp. (NYSE:EQT) has also come under pressure after Bernstein initiated coverage of the top U.S. natural gas producer with an Underperform rating, citing weak gas prices and limited pipeline capacity especially out of the Appalachia basin.

Thankfully, it’s not all doom and gloom.

Truist has upgraded CNX Resources (NYSE:CNX) to Buy from Neutral with a $27 PT, raised from $20, saying the company’s strong hedging profile will insulate the company from falling prices while still providing investors exposure to longer-term gas asset upside. The analyst also said CNX's New Tech business "could provide enough non-gas linked upside catalysts to keep investors interested during a reduced sentiment period."

The U.S.’ largest LNG producer Cheniere Energy (NYSE:LNG) is one of the rare natural gas names in the green after gaining 20.9% in the year-to-date. A month ago, Cheniere reaffirmed full year 2023 Consolidated Adjusted EBITDA guidance of $8.3 billion - $8.8 billion and full year 2023 Distributable Cash Flow guidance of $5.8 billion - $6.3 billion.

Cheniere’s LNG continues to be in high demand. Two weeks ago, the company entered into a long-term natural gas supply agreement with ARC Resources (OTCPK:AETUF), as well as an LNG sale and purchase agreement with OMV (OTCPK:OMVJF).

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com: