The three-year loss for Teleflex (NYSE:TFX) shareholders likely driven by its shrinking earnings

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term Teleflex Incorporated (NYSE:TFX) shareholders have had that experience, with the share price dropping 36% in three years, versus a market return of about 34%.

The recent uptick of 3.6% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Teleflex

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

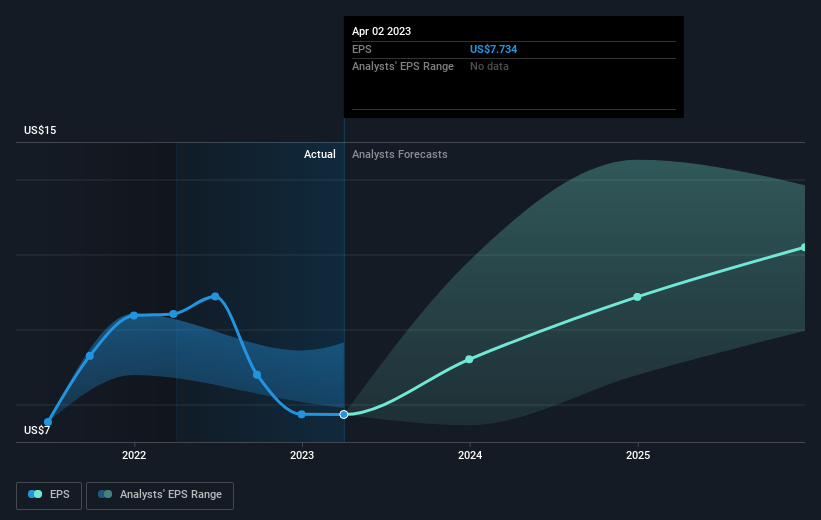

During the three years that the share price fell, Teleflex's earnings per share (EPS) dropped by 13% each year. So do you think it's a coincidence that the share price has dropped 14% per year, a very similar rate to the EPS? We don't. So it seems like sentiment towards the stock hasn't changed all that much over time. It seems like the share price is reflecting the declining earnings per share.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Teleflex's key metrics by checking this interactive graph of Teleflex's earnings, revenue and cash flow.

A Different Perspective

Teleflex shareholders are down 15% for the year (even including dividends), but the market itself is up 3.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before deciding if you like the current share price, check how Teleflex scores on these 3 valuation metrics.

Of course Teleflex may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here