Three Reasons to Add DaVita (DVA) Stock to Your Portfolio

DaVita Inc. DVA has been gaining from its DaVita Kidney Care. The optimism led by a solid second-quarter 2023 performance and the acquisition of dialysis centers are expected to contribute further. However, concerns regarding dependence on commercial payers and integration risks persist.

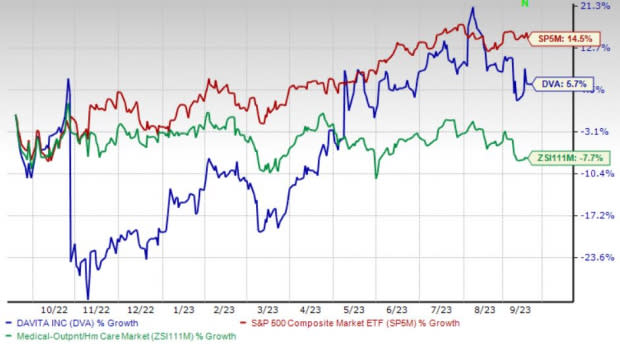

Over the past year, this Zacks Rank #2 (Buy) stock has gained 5.7% against the 7.6% decline of the industry. The S&P 500 has witnessed 14.5% growth in the said time frame.

The renowned global comprehensive kidney care provider has a market capitalization of $8.98 billion. The company projects 12.7% growth for the next five years and expects to maintain its strong performance. DaVita’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 21.4%.

Image Source: Zacks Investment Research

Let’s delve deeper.

DaVita Kidney Care: We are optimistic about DaVita Kidney Care, the major revenue-generating segment of DVA. It specializes in a broad array of dialysis services, significantly contributing to the company's top line. With respect to DaVita’s Integrated Kidney Care, as of Jun 30, 2023, the company had approximately 64,000 patients in risk-based integrated care arrangements, representing approximately $5.2 billion in annualized medical spend. DaVita also had an additional 15,000 patients in other integrated care arrangements.

Acquisition of Dialysis Centers: Acquiring dialysis centers and businesses, which own and operate dialysis centers, as well as other ancillary services, is DaVita’s preferred business strategy. These strategies have boosted the company’s top line to a large extent, raising our optimism.

As of Jun 30, 2023, DaVita provided dialysis services to around 248,000 patients at 3,056 outpatient dialysis centers, of which 2,703 were U.S. centers while 353 were located across 11 other countries. In the second quarter of 2023, the company opened a total of 10 new dialysis centers in the United States. It also acquired two dialysis centers and opened two dialysis centers outside the United States in the same period.

Strong Q2 Results: DaVita’s solid second-quarter 2023 results buoy optimism. The company registered an uptick in its overall top line and dialysis patient service revenues. An increase in total U.S. dialysis treatments was also seen. The gross margin expansion bodes well for the stock.

Downsides

Dependence on Commercial Payers: A significant portion of DaVita’s dialysis and related lab services’ revenues are generated from patients who have commercial payers as the primary payers. The payments received from commercial payers are the primary generators of profit. However, there remains a risk of people shifting from commercial insurance schemes to government schemes due to the wide disparity in payment rates in case of a rise in unemployment.

Integration Risks: DaVita’s business strategy includes growth through acquisitions of dialysis centers and other businesses, as well as entry into joint ventures. The company may engage in acquisitions, mergers, joint ventures or dispositions or expand into new business models, which may affect its operations.

Estimate Trend

DaVita is witnessing a positive estimate revision trend for 2023. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 7.8% north to $7.22.

The Zacks Consensus Estimate for the company’s third-quarter 2023 revenues is pegged at $3 billion, suggesting a 1.9% uptick from the year-ago quarter’s reported number.

Other Key Picks

A few other top-ranked stocks in the broader medical space are McKesson Corporation MCK, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 8.1%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

McKesson has gained 20.4% compared with the industry’s 13.6% rise over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has lost 3.9% compared with the industry’s 10.2% decline over the past year.

Integer Holdings, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has gained 28% against the industry’s 0.5% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report