Three Solid Canadian Dividend Stocks With Yields Starting At 3.4%

In recent times, the Canadian market has shown a resilient performance, navigating through economic uncertainties with a level of stability that investors find reassuring. Amidst this backdrop, dividend stocks stand out for their potential to offer steady income and long-term value growth, particularly those with yields starting at 3.4%.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Richards Packaging Income Fund (TSX:RPI.UN) | 3.85% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 4.97% | ★★★★★☆ |

First National Financial (TSX:FN) | 6.25% | ★★★★★☆ |

Manulife Financial (TSX:MFC) | 4.85% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.34% | ★★★★★☆ |

Savaria (TSX:SIS) | 3.17% | ★★★★★☆ |

IGM Financial (TSX:IGM) | 6.37% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.44% | ★★★★★☆ |

Imperial Oil (TSX:IMO) | 3.02% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.82% | ★★★★★☆ |

Click here to see the full list results from our Top Dividend Stocks screener.

We're going to check out 3 of the 22 best picks from our screener tool.

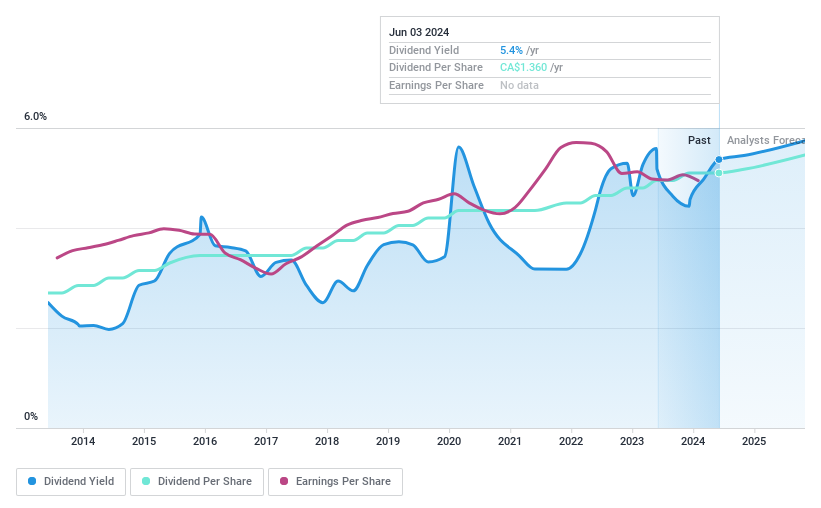

Canadian Western Bank (TSX:CWB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Western Bank is a financial institution offering personal and business banking services, mainly in Western Canada, with a market capitalization of approximately CA$2.64 billion.

Operations: Canadian Western Bank generates its revenues primarily through banking services, amounting to CA$1.09 billion.

Dividend Yield: 5%

Canadian Western Bank (CWB) presents a mixed picture for dividend-focused investors. While its allowance for bad loans is low at 65%, and the Loans to Assets ratio is healthy at 88%, CWB's earnings growth has slowed, currently below its five-year average. Nevertheless, dividends seem sustainable with a modest payout ratio of 38.5% and are projected to remain well-covered over the next three years. Despite this prudence in dividend coverage, CWB's yield isn't top-tier within Canada's market, indicating that while reliable and stable over the past decade, it may not appeal to those seeking the highest yields available. Click to explore a detailed breakdown of our findings in Canadian Western Bank's dividend report.

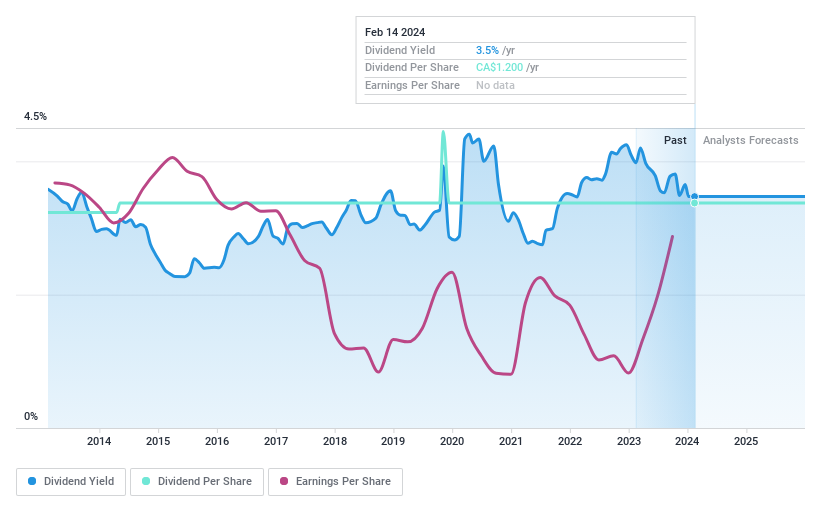

K-Bro Linen (TSX:KBL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: K-Bro Linen Inc. is a Canadian company specializing in laundry and linen services for healthcare facilities, hotels, and commercial entities across Canada and the UK, with a market capitalization of approximately CA$364 million.

Operations: K-Bro Linen Inc. generates its revenue primarily from providing laundry and linen services, which amounted to CA$309.1 million, serving sectors that include healthcare and hospitality.

Dividend Yield: 3.5%

K-Bro Linen (TSX:KBL) exhibits a prudent financial posture, with debt becoming more manageable over time, as evidenced by a declining debt to equity ratio. The company's earnings have consistently grown, outpacing its five-year average significantly in the last year. Although KBL's dividend yield isn't among the highest in Canada, it has shown reliability and stability over a decade. However, investors should note that while dividends are supported by cash flows, their coverage by earnings is tight due to a high payout ratio. This situation warrants attention to future earnings performance to sustain such dividend commitments. Get an in-depth perspective on K-Bro Linen's performance by reading our dividend report here.

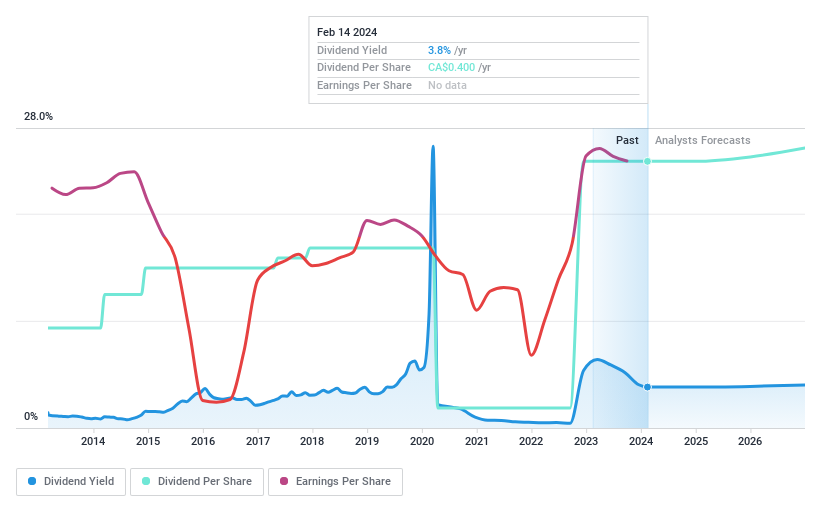

Secure Energy Services (TSX:SES)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Secure Energy Services Inc. is an energy services company offering a range of solutions to upstream oil and natural gas companies in Canada and the United States, with a market capitalization of approximately CA$2.96 billion.

Operations: Secure Energy Services Inc. generates its revenues by providing a suite of services tailored for the upstream oil and natural gas sector in North America, with reported segment adjustments totaling CA$7.93 billion.

Dividend Yield: 3.8%

Secure Energy Services presents a nuanced case for dividend investors. Its debt levels have risen, with the net debt to equity ratio crossing the threshold of caution. Yet, SES has transitioned into profitability and maintains dividends well-supported by both earnings and cash flows, indicating a sustainable payout scenario. The company's operating cash flow robustly covers its debt obligations, providing some financial flexibility. Dividend growth over the past decade adds to its appeal; however, the yield is modest relative to Canada's top dividend payers and future revenue projections suggest potential challenges ahead. Delve into the full analysis dividend report here for a deeper understanding of Secure Energy Services.

Next Steps

Discovering top dividend-paying stocks in Canada is made effortless with the analytical prowess of the Simply Wall St screener. Investigate our full lineup of 22 Top Dividend Stocks right here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com