Three Things You Should Check Before Buying Mitie Group plc (LON:MTO) For Its Dividend

Today we'll take a closer look at Mitie Group plc (LON:MTO) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

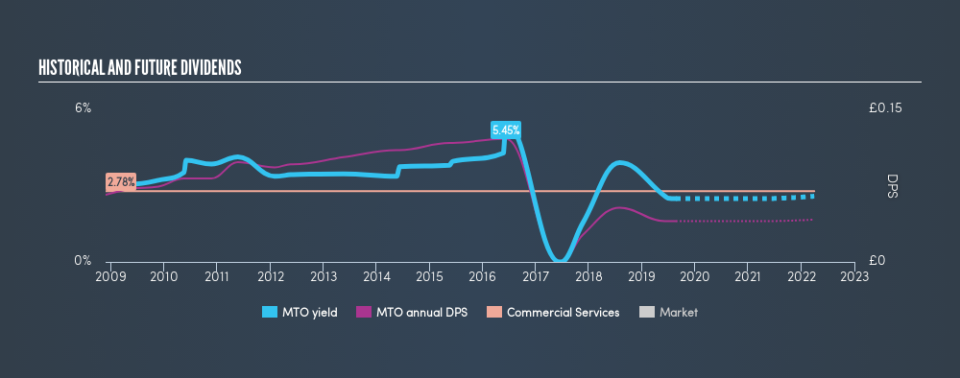

While Mitie Group's 2.5% dividend yield is not the highest, we think its lengthy payment history is quite interesting. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on Mitie Group!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. In the last year, Mitie Group paid out 48% of its profit as dividends. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. Plus, there is room to increase the payout ratio over time.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Mitie Group paid out 87% of its cash flow last year. This may be sustainable but it does not leave much of a buffer for unexpected circumstances. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

We update our data on Mitie Group every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of Mitie Group's dividend payments. The dividend has been cut by more than 20% on at least one occasion historically. During the past ten-year period, the first annual payment was UK£0.066 in 2009, compared to UK£0.04 last year. This works out to be a decline of approximately 4.9% per year over that time. Mitie Group's dividend has been cut sharply at least once, so it hasn't fallen by 4.9% every year, but this is a decent approximation of the long term change.

We struggle to make a case for buying Mitie Group for its dividend, given that payments have shrunk over the past ten years.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. In the last five years, Mitie Group's earnings per share have shrunk at approximately 9.1% per annum. If earnings continue to decline, the dividend may come under pressure. Every investor should make an assessment of whether the company is taking steps to stabilise the situation.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Firstly, we like that Mitie Group pays out a low fraction of earnings. It pays out a higher percentage of its cashflow, although this is within acceptable bounds. Unfortunately, the company has not been able to generate earnings per share growth, and cut its dividend at least once in the past. In sum, we find it hard to get excited about Mitie Group from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Given that earnings are not growing, the dividend does not look nearly so attractive. Very few businesses see earnings consistently shrink year after year in perpetuity though, and so it might be worth seeing what the 5 analysts we track are forecasting for the future.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.