Thryv Holdings Inc (THRY) Reports Mixed Results Amid SaaS Growth and Goodwill Impairment Charge

SaaS Revenue: Q4 SaaS revenue increased by 25% year-over-year to $74.0 million.

Marketing Services Revenue: Q4 Marketing Services revenue decreased by 26% year-over-year to $162.2 million.

Net Loss: Q4 consolidated net loss was $257.5 million due to a non-cash goodwill impairment charge.

Adjusted EBITDA: Q4 consolidated Adjusted EBITDA was $52.3 million, with a margin of 22%.

Operating Cash Flow: Strong FY operating cash flow of $148.2 million, with free cash flow at $114.8 million.

Debt Reduction: Paid down $120 million towards term loan, exceeding expectations.

Outlook: Thryv provides positive guidance for Q1 and full year 2024, with expected SaaS revenue growth.

On February 22, 2024, Thryv Holdings Inc (NASDAQ:THRY), a leading provider of software as a service (SaaS) management tools and marketing solutions for small to mid-sized businesses, released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company operates in four segments, with the majority of revenue generated from its U.S. Marketing Services segment.

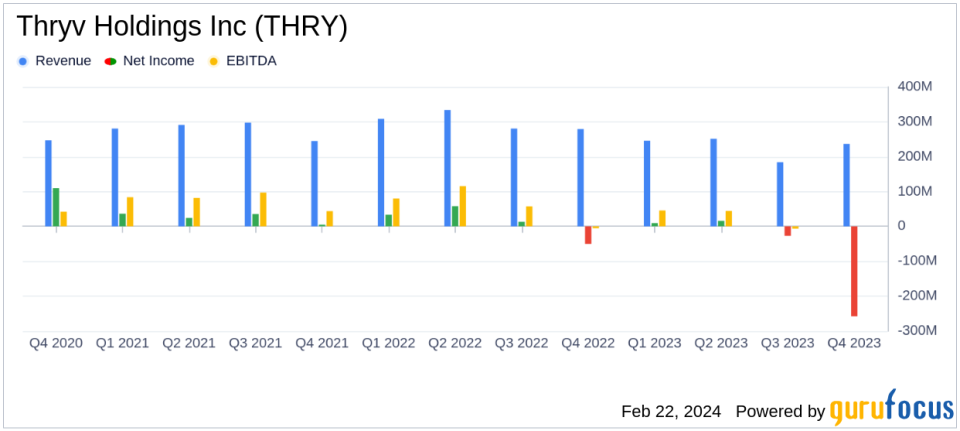

Thryv reported a significant 25% year-over-year increase in SaaS revenue for Q4, reaching $74.0 million. This growth was attributed to the increasing adoption of the Thryv SaaS platform by legacy clients. Despite this, total Marketing Services revenue saw a 26% decrease to $162.2 million. The consolidated total revenue for the quarter was $236.2 million, marking a 15% decrease year-over-year. A substantial net loss of $257.5 million was reported, primarily due to a non-cash goodwill impairment charge of $268.8 million. This compares to a net loss of $50.4 million in the fourth quarter of 2022.

Adjusted EBITDA for the quarter stood at $52.3 million, with a margin of 22%. The SaaS segment's Adjusted EBITDA was $6.5 million, while the Marketing Services Adjusted EBITDA was $45.8 million. The company also reported a strong operating cash flow of $44.6 million and free cash flow of $34.1 million for the quarter.

For the full year 2023, Thryv's SaaS revenue increased by 21.9% to $263.7 million, while Marketing Services revenue decreased by 33.8% to $653.2 million. The consolidated net loss for the year was $259.3 million, including the same goodwill impairment charge. Adjusted EBITDA for the year was $187.5 million, with a margin of 20.4%. The operating cash flow for the year was slightly down at $148.2 million, and free cash flow was $114.8 million.

Thryv's SaaS metrics showed a 27% year-over-year increase in total SaaS clients, with Seasoned Net Dollar Retention at 96%. However, SaaS monthly Average Revenue per Unit (ARPU) decreased to $370. ThryvPay, the company's payment solution, saw a 54% increase in total payment volume year-over-year.

Looking ahead, Thryv provided positive guidance for the first quarter and full year of 2024, with expected SaaS revenue growth and continued focus on profitable growth and maintaining a strong balance sheet.

Financial Analysis and Outlook

Thryv's performance in the fourth quarter of 2023 reflects a company in transition, with significant growth in its SaaS offerings being offset by declines in its traditional Marketing Services revenue. The large goodwill impairment charge, while a non-cash item, indicates adjustments to the company's valuation of acquired assets and may raise concerns about future profitability. However, the strong operating cash flow and proactive debt reduction demonstrate Thryv's commitment to financial stability.

The company's focus on transitioning legacy digital clients to the Thryv SaaS platform is expected to drive future revenue growth and margin expansion. The guidance for 2024 suggests confidence in the continued adoption and expansion of Thryv's SaaS solutions.

Investors and potential GuruFocus.com members should monitor Thryv's ability to manage the balance between growing its SaaS business and navigating the challenges within its Marketing Services segment. The company's strategic decisions in the coming quarters will be critical in determining its long-term financial health and market position.

For a more detailed analysis of Thryv Holdings Inc's financial results and outlook, readers are encouraged to review the full earnings release and financial statements.

Explore the complete 8-K earnings release (here) from Thryv Holdings Inc for further details.

This article first appeared on GuruFocus.