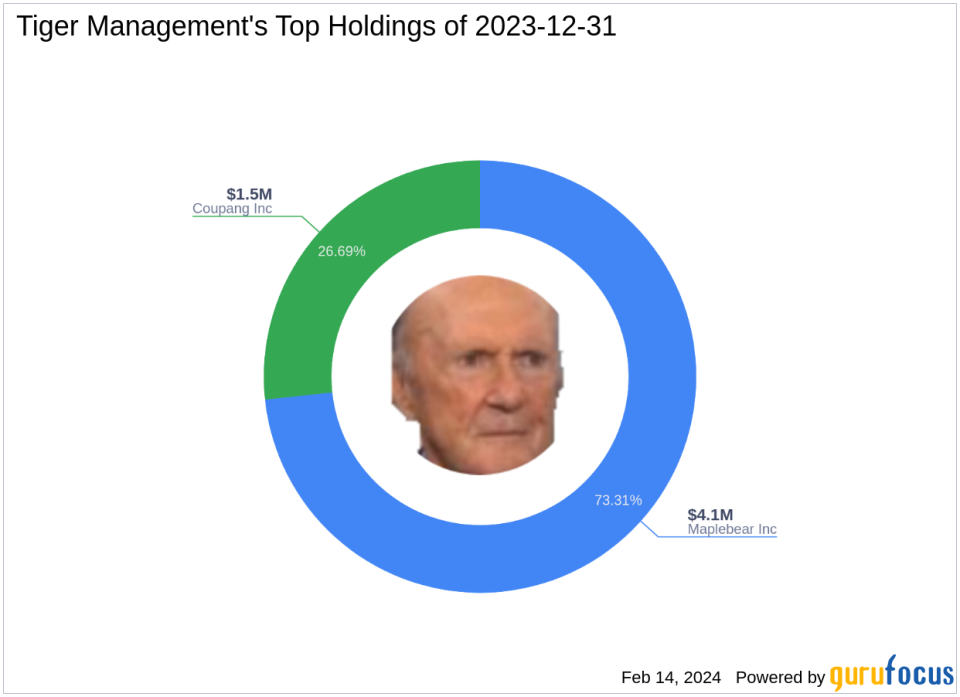

Tiger Management's Bet on Coupang Inc. Dominates Q4 Portfolio with a 26.69% Stake

Julian Robertson's Investment Firm Reveals Latest Moves in 13F Filing

Legendary Investment Firm's Profile

Renowned for his investment prowess, Julian Robertson stands as a towering figure in the world of finance. His firm, Tiger Management (Trades, Portfolio), was founded in 1980 with a modest $8 million and rapidly grew to a staggering $22 billion by the late 1990s. Robertson, often hailed as the "Wizard of Wall Street," has delivered a compound rate of return of 32% to his investors. Despite closing his fund following losses in the late '90s, Tiger Management (Trades, Portfolio) continues to thrive, managing funds primarily from Robertson's personal wealth. His legacy also includes mentoring a cadre of successful 'Tiger Cubs,' many of whom are now prominent hedge fund managers.

Summary of New Buy

In the fourth quarter of 2023, Tiger Management (Trades, Portfolio) made a notable new addition to its portfolio:

The standout new buy was Coupang Inc (NYSE:CPNG), with 91,645 shares, representing 26.69% of the portfolio and a total value of $1.48 billion.

Portfolio Overview

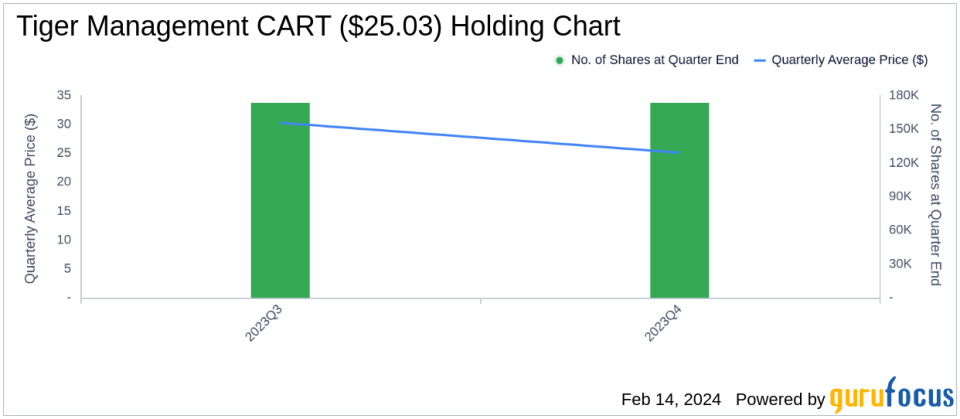

As of the fourth quarter of 2023, Tiger Management (Trades, Portfolio)'s portfolio comprised 2 stocks, with top holdings being 73.31% in Maplebear Inc (NASDAQ:CART) and 26.69% in Coupang Inc (NYSE:CPNG). The investments are heavily weighted in the Consumer Cyclical sector, showcasing a focused approach to industry allocation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.