Tilly's Inc (TLYS) Faces Headwinds: A Look at Q4 and Full Year Fiscal 2023 Results

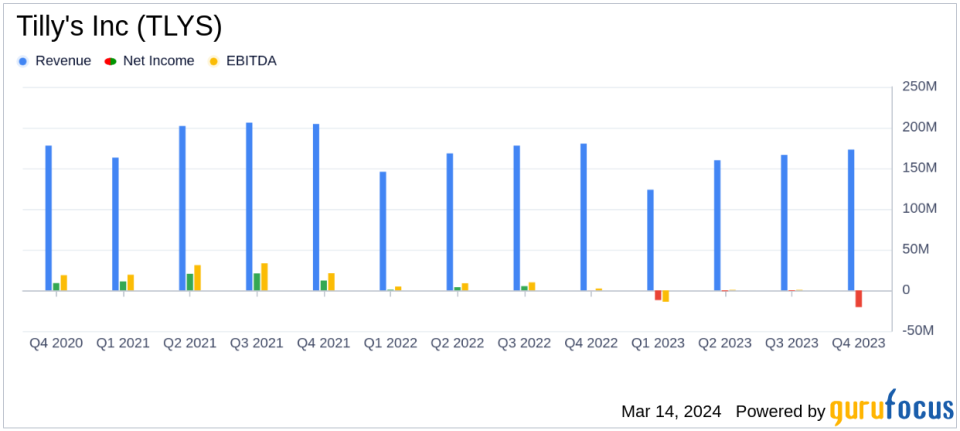

Net Sales: Q4 net sales decreased by 4.1% to $173.0 million; full year net sales down 7.3% to $623.1 million.

Net Loss: Q4 GAAP net loss of $(20.6) million; non-GAAP net loss of $(5.2) million. Full year GAAP net loss of $(34.5) million; non-GAAP net loss of $(19.1) million.

Gross Profit: Q4 gross profit margin decreased to 27.0% from 29.0% in the prior year; full year gross profit margin declined to 26.6%.

Operating Loss: Q4 operating loss widened to $(8.5) million; full year operating loss of $(31.0) million.

Inventory Levels: Inventory per square foot increased by 2.6% at the end of Q4 compared to the prior year.

Liquidity: $95.0 million in cash, cash equivalents, and marketable securities with no debt as of February 3, 2024.

Store Count: Ended Q4 with 248 stores, a decrease from 249 stores at the end of the prior year.

On March 14, 2024, Tilly's Inc (NYSE:TLYS) released its 8-K filing, detailing the financial outcomes for the fourth quarter and full fiscal year of 2023. As a specialty retailer of casual apparel, footwear, and accessories, Tilly's operates in a highly competitive and cyclical retail environment. The company's product offerings are aimed at young men, women, and children, featuring a mix of branded and proprietary merchandise.

Financial Performance and Challenges

Tilly's reported a decrease in net sales for both the fourth quarter and the full year, attributing the decline to a challenging macro environment. The company's gross profit margins were impacted by increased markdowns, and operating losses grew due to a combination of lower sales and higher SG&A expenses, which included non-cash store asset impairment charges and the impact of an extra week in the fiscal year.

Despite these challenges, Tilly's e-commerce segment showed resilience with a 4.7% increase in net sales for the quarter. However, this was not enough to offset the 7.0% decrease in net sales from physical stores. The company's management is actively seeking opportunities for improvement, although they anticipate that it may take time to realize the benefits of these efforts.

Financial Achievements and Importance

One of Tilly's financial achievements in a difficult year was its ability to maintain a strong liquidity position with $95.0 million in cash, cash equivalents, and marketable securities, and no debt. This financial stability is crucial for weathering the current economic headwinds and investing in future growth initiatives.

Key Financial Metrics

Key metrics such as gross profit margin and SG&A expenses as a percentage of net sales are critical for understanding Tilly's operational efficiency and cost management. The company's gross profit margin decreased, indicating pressure on product margins, while SG&A expenses increased, reflecting the added costs of an extra fiscal week and impairment charges. These metrics are important as they directly affect the company's profitability and ability to generate positive cash flows.

"Our business currently faces many headwinds from the macro environment. Despite these headwinds, we are challenging ourselves to improve our business performance by carefully reconsidering everything we do," commented Hezy Shaked, Co-Founder and Interim President and Chief Executive Officer.

Analysis of Tilly's Performance

While Tilly's has demonstrated some areas of growth, particularly in its e-commerce channel, the overall decline in sales and profitability is a concern. The retail industry is highly sensitive to economic cycles and consumer sentiment, and Tilly's is not immune to these factors. The company's focus on cost management and strategic initiatives to improve business performance will be key to navigating the current retail landscape.

As Tilly's looks ahead to fiscal 2024, it faces a challenging start with a significant decrease in comparable net sales through March 12, 2024. The company's outlook for the first quarter includes an anticipated decrease in net sales and a projected loss per share. Tilly's capital expenditure plans for fiscal 2024 are conservative, with a focus on new store openings and upgrades to distribution and information technology systems.

For value investors and potential GuruFocus.com members, Tilly's current financial position and future outlook provide a mixed picture. The company's strong liquidity position and lack of debt are positive signs, but the declining sales and profitability highlight the need for effective strategic actions to improve performance. As Tilly's navigates these challenges, it will be important for investors to monitor the company's progress and the effectiveness of its initiatives.

For more detailed financial analysis and the latest updates on Tilly's Inc (NYSE:TLYS) and other investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Tilly's Inc for further details.

This article first appeared on GuruFocus.