Tilly's (NYSE:TLYS) Posts Q4 Sales In Line With Estimates But Stock Drops

Young adult apparel retailer Tilly’s (NYSE:TLYS) reported results in line with analysts' expectations in Q4 FY2023, with revenue down 4.1% year on year to $173 million. On the other hand, next quarter's revenue guidance of $114 million was less impressive, coming in 8.1% below analysts' estimates. It made a GAAP loss of $0.69 per share, down from its loss of $0 per share in the same quarter last year.

Is now the time to buy Tilly's? Find out by accessing our full research report, it's free.

Tilly's (TLYS) Q4 FY2023 Highlights:

Revenue: $173 million vs analyst estimates of $171.7 million (small beat)

EPS: -$0.69 vs analyst estimates of -$0.22 (-$0.47 miss)

Revenue Guidance for Q1 2024 is $114 million at the midpoint, below analyst estimates of $124 million

Gross Margin (GAAP): 27.5%, down from 40.8% in the same quarter last year

Free Cash Flow of $310,000, down 95.2% from the same quarter last year

Same-Store Sales were down 8.8% year on year

Store Locations: 248 at quarter end, decreasing by 1 over the last 12 months

Market Capitalization: $219.4 million

With an emphasis on skate and surf culture, Tilly’s (NYSE:TLYS) is a specialty retailer that sells clothing, footwear, and accessories geared towards fashion-forward teens and young adults.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

Tilly's is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

As you can see below, the company's revenue was flat over the last four years (we compare to 2019 to normalize for COVID-19 impacts) as its store footprint remained relatively unchanged.

This quarter, Tilly's reported a rather uninspiring 4.1% year-on-year revenue decline to $173 million in revenue, in line with Wall Street's estimates. The company is guiding for a 7.8% year-on-year revenue decline next quarter to $114 million, an improvement from the 15.2% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

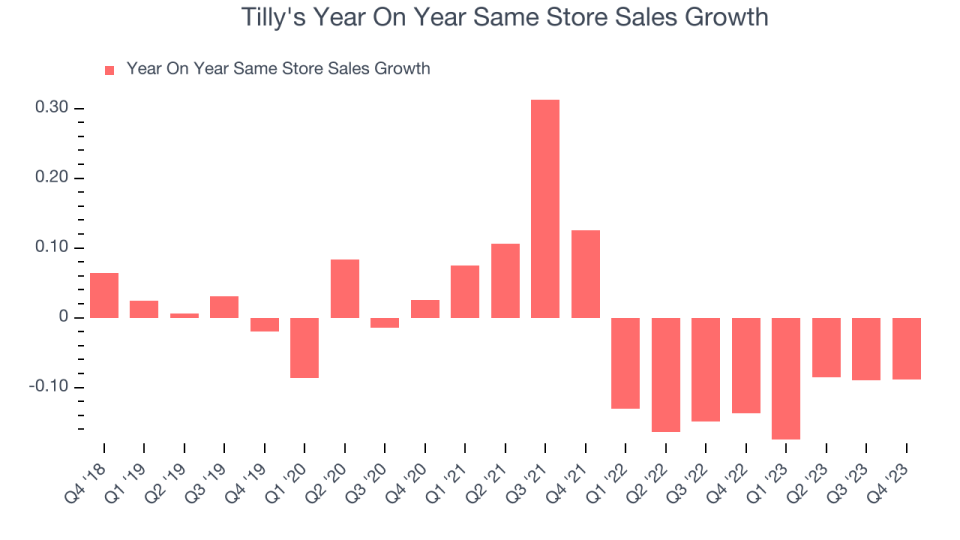

Tilly's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 12.7% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Tilly's same-store sales fell 8.8% year on year. This decrease was a further deceleration from the 13.7% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Tilly's Q4 Results

We enjoyed seeing Tilly's exceed analysts' gross margin expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street's estimates. On the other hand, its EPS fell significantly short, and its revenue and EPS guidance for next quarter missed analysts' expectations as its same-store sales have already declined 13.4% as of March 12, 2024. Overall, the results could have been better. The company is down 6.4% on the results and currently trades at $6.76 per share.

Tilly's may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.