Tilly's (NYSE:TLYS) Reports Sales Below Analyst Estimates In Q3 Earnings

Young adult apparel retailer Tilly’s (NYSE:TLYS) missed analysts' expectations in Q3 FY2023, with revenue down 6.4% year on year to $166.5 million. On the other hand, next quarter's revenue guidance of $175 million came in slightly above analysts' estimates. It made a GAAP loss of $0.03 per share, down from its profit of $0.17 per share in the same quarter last year.

Is now the time to buy Tilly's? Find out by accessing our full research report, it's free.

Tilly's (TLYS) Q3 FY2023 Highlights:

Revenue: $166.5 million vs analyst estimates of $168.2 million (1% miss)

Same-Store Sales were down 9% year on year (miss vs. expectations of down 6% year on year)

EPS: -$0.03 vs analyst estimates of -$0.09 ($0.06 beat)

Revenue Guidance for Q4 2023 is $175 million at the midpoint, above analyst estimates of $174.1 million (although EPS guidance of ($0.16) missed expectations of ($0.11))

Free Cash Flow was -$10.79 million compared to -$8.97 million in the same quarter last year

Gross Margin (GAAP): 29.3%, down from 42.7% in the same quarter last year

Same-Store Sales were down 9% year on year

"Our third quarter results represent a sequential improvement over the first and second quarters of the fiscal year. We continue to work towards protecting product margins, managing inventories and controlling operating expenses amid a continuing difficult economic environment, particularly for our young customer demographic," commented Ed Thomas, President and Chief Executive Officer.

With an emphasis on skate and surf culture, Tilly’s (NYSE:TLYS) is a specialty retailer that sells clothing, footwear, and accessories geared towards fashion-forward teens and young adults.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

Tilly's is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

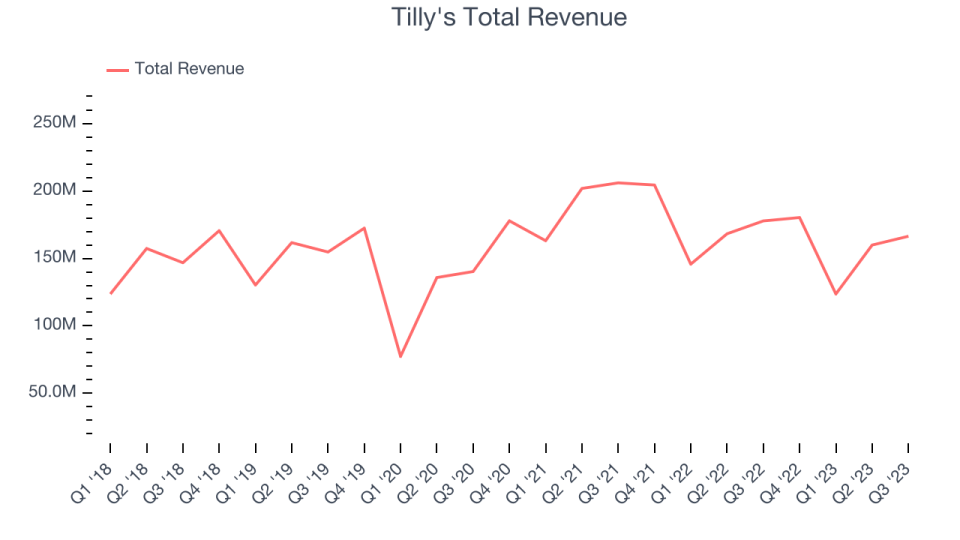

As you can see below, the company's revenue was flat over the last four years (we compare to 2019 to normalize for COVID-19 impacts) as its store footprint remained relatively unchanged.

This quarter, Tilly's reported a rather uninspiring 6.4% year-on-year revenue decline, missing Wall Street's expectations. The company is guiding for revenue to rise 3.1% year on year to $175 million next quarter, improving from the 11.8% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts expect sales to grow 1.5% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Number of Stores

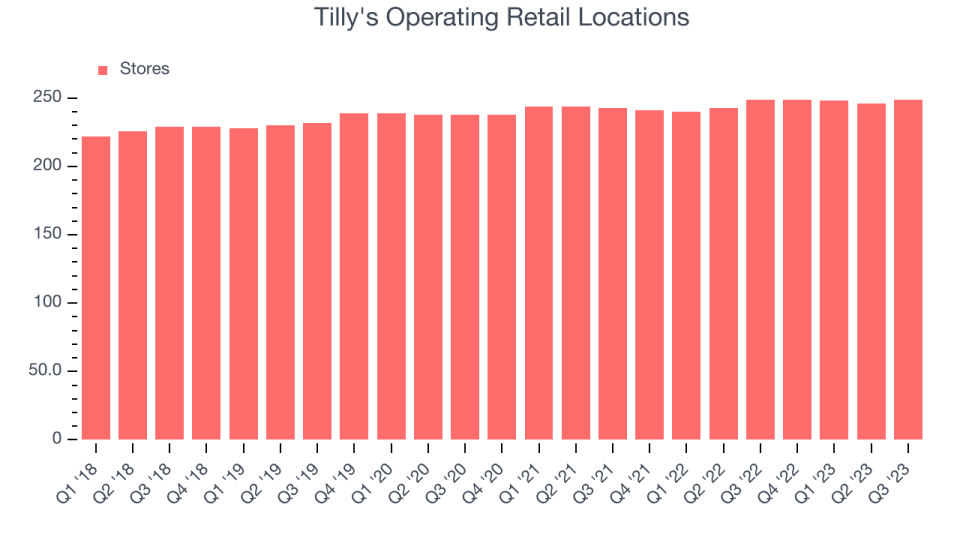

The number of stores a retailer operates is a major determinant of how much it can sell, and its growth is a critical driver of how quickly company-level sales can grow.

When a retailer like Tilly's keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. At the end of this quarter, Tilly's operated 249 total retail locations, in line with its store count 12 months ago.

Taking a step back, the company has kept its physical footprint more or less flat over the last two years while other consumer retail businesses have opted for growth. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Same-Store Sales

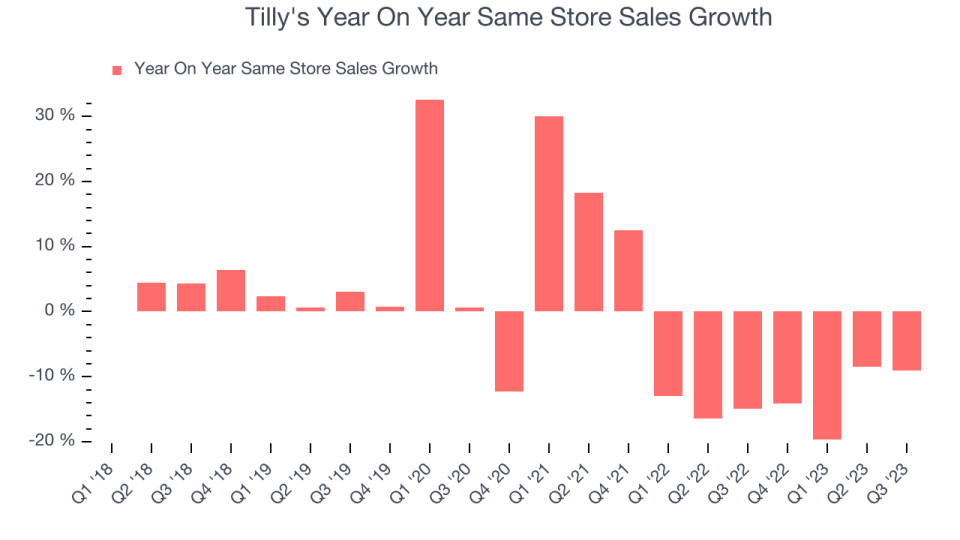

Tilly's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 10.4% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Tilly's same-store sales fell 9% year on year. This decrease was a further deceleration from the 14.9% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Tilly's Q3 Results

With a market capitalization of $259.2 million, Tilly's is among smaller companies, but its more than $44.43 million in cash on hand and near break-even free cash flow margins puts it in a stable financial position.

It was a tough quarter for Tilly's. Same-store sales missed, leading to a revenue miss. Looking ahead, while next quarter's revenue guidance was fine, EPS guidance came in below expectations, suggesting weaker margins. Finally, management called out a "difficult economic environment, particularly for our young customer demographic" as well as more promotional activity than historically, which tends to hurt gross margins. Overall, this quarter's results were weak. The stock is down 2.1% after reporting, trading at $8.09 per share.

So should you invest in Tilly's right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.