Tilly's (TLYS) to Report Q4 Earnings: What's in the Cards?

Tilly's, Inc. TLYS is likely to witness a decline in the top line when it reports fourth-quarter fiscal 2022 numbers on Mar 9, after market close. The Zacks Consensus Estimate for revenues is pegged at $179 million, suggesting a decline of 12.5% from the prior-year reported figure.

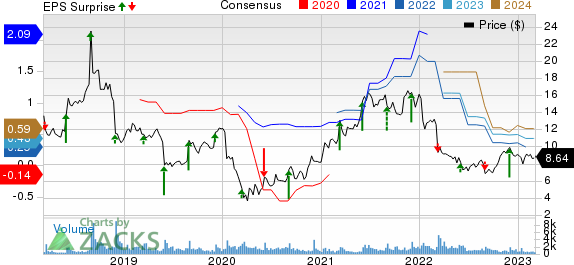

The Zacks Consensus Estimate for quarterly loss per share has been stable at 3 cents over the past 30 days. It suggests a sharp decline from the earnings of 38 cents reported in the year-ago period. This specialty retailer of casual apparel, footwear, accessories and hard goods has a trailing four-quarter earnings surprise of 29.2%, on average.

Key Factors to Note

The soaring inflation continues to impact consumers’ discretionary spending. The impact of the same can be seen on the company’s holiday sales. During the holiday season, company’s total comparable net sales, including physical stores and e-commerce fell 14.4% for the 2022 holiday period against an increase of 14.1% in the year-ago period. In the same period, company’s holiday period net sales declined 12.9% to $150.9 million from the year-ago period.

Tilly's, Inc. Price, Consensus and EPS Surprise

Tilly's, Inc. price-consensus-eps-surprise-chart | Tilly's, Inc. Quote

Based on the company’s net sales results for the 2022 holiday period and recent historical trends, the company decreased its guidance for the upcoming quarter. The company projected fourth-quarter net sales between $178 million and $180 million, down from the previous guidance of $183 million to $188 million.

The aforementioned factors have also weighed on the company’s bottom line. Tilly’s guided a loss per share in the range of 1-4 cents against the prior projection of earning per share of 2-6 cents in the fourth quarter.

Despite these headwinds, we cannot ignore Tilly's efforts to mitigate challenges. The company’s consumer-centric approach, product initiatives, prudent inventory management and focus on improving distribution efficiencies might have provided some cushion.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Tilly's this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here.

Tilly's has an Earnings ESP of 0.00% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

3 Stocks With the Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Ulta Beauty ULTA currently has an Earnings ESP of +8.53% and a Zacks Rank #2. The company is likely to register an increase in the bottom line when it reports fourth-quarter fiscal 2022 results. The Zacks Consensus Estimate for the quarterly earnings per share of $5.53 suggests an increase of 2.2% from the year-ago quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ulta Beauty’s top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $3.01 billion, which suggests a rise of 10.3% from the figure reported in the prior-year quarter. ULTA delivered an earnings beat of 26.2%, on average, in the trailing four quarters.

Casey's General Stores CASY currently has an Earnings ESP of +8.25% and a Zacks Rank #3. The company is expected to register a fall in bottom line when it reports third-quarter fiscal 2023 results. The Zacks Consensus Estimate for quarterly earnings per share of $1.67 suggests a decrease of 2.3% from the year-ago quarter.

Casey's General’s top line is anticipated to have risen year over year. The consensus mark for CASY’s revenues is pegged at $3.37 billion, indicating an increase of 10.6% from the figure reported in the year-ago quarter. Casey's General has a trailing four-quarter earnings surprise of 7.2%, on average.

Five Below FIVE currently has an Earnings ESP of +0.30% and a Zacks Rank #3. The company is likely to register an increase in the bottom line when it reports fourth-quarter fiscal 2022 results. The Zacks Consensus Estimate for quarterly earnings per share of $3.06 suggests an increase of 22.9% from the year-ago quarter.

Five Below’s top line is expected to have increased marginally year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $1.11 billion, which suggests a rise of 10.9% from the figure reported in the prior-year quarter. In the trailing four quarters, FIVE delivered an earnings beat of 26.3%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

Five Below, Inc. (FIVE) : Free Stock Analysis Report

Tilly's, Inc. (TLYS) : Free Stock Analysis Report