Time to Buy Disney's (DIS) Stock for Higher Highs?

In a shortened week of trading, Disney’s DIS stock made headlines on Monday after reaching 52-week highs sparked by an upgrade from analysts at Barclays BCS.

Cost-cutting initiatives have paid off with Disney reinstating its dividend at the end of last year after postponing its payout during the pandemic.

Investor sentiment has once again been high for Disney shares with DIS spiking +3% today and now climbing +31% in 2024 to outperform many of its Zacks Media Conglomerate Industry peers which includes the likes of Paramount Global PARAA and Madison Square Garden Entertainment MSGE.

Image Source: Zacks Investment Research

Barclays Upgrade

Disney’s stock was bumped up to overweight from equal weight by Barclays on the premise that the multi-media conglomerate is likely to see positive earnings revisions to support its valuation after outperforming so far this year.

Most recently surpassing its fiscal first quarter earnings expectations in early February, Disney’s Q1 EPS of $1.22 crushed the Zacks Consensus of $0.97 a share by 26% and soared from $0.99 a share in the comparative quarter.

Image Source: Zacks Investment Research

Barclays raised its price target for DIS to $135 from $95 which suggests 13% upside from current levels of $119 a share. While Barclays is not named as one of the 24 brokers covering Disney’s stock and offering proprietary data to Zacks it is noteworthy that DIS had already moved past its Average Zacks Price Target of $112.81.

Image Source: Zacks Investment Research

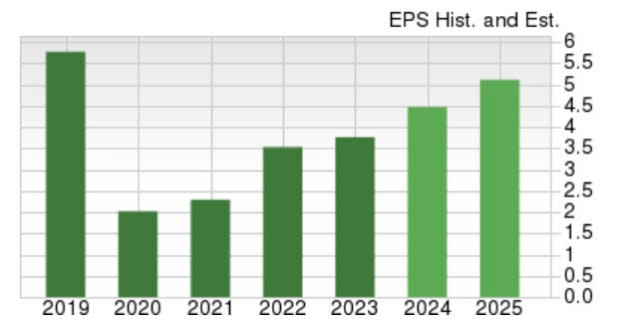

Earnings Estimate Revisions

Notably, the Zacks Media Conglomerates Industry is currently in the top 27% of over 250 Zacks industries with Disney starting to join Paramount Global and Madison Square Garden in receiving positive earnings estimate revisions.

While not as compelling as Paramount Global and Madison Square Garden’s recent upward revisions, Disney’s fiscal 2024 EPS estimates have risen 4% over the last 60 days with FY25 EPS estimates up 2%.

Image Source: Zacks Investment Research

Furthermore, Disney’s bottom line is now projected to expand 21% this year and is expected to jump another 19% in FY25 to $5.47 per share.

Image Source: Zacks Investment Research

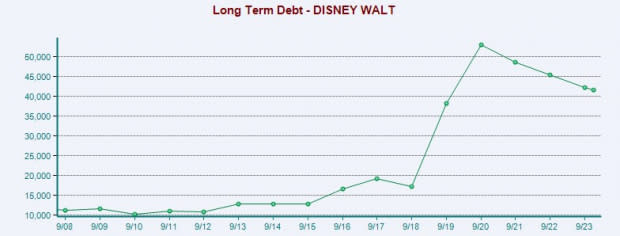

Valuation & Cost Cutting Initiatives

Attributed to its cost savings initiatives since the return of CEO Bob Iger in 2022, Disney’s long-term debt has drifted down to $42.1 billion compared to peaks of $52.91 billion in 2020.

Image Source: Zacks Investment Research

In regards to rising earnings estimates helping Disney’s P/E Valuation, DIS trades at 25.3X forward earnings which is well below its decade-long high of 134.3X and closer to the median of 21X. However, Disney’s stock does trade above its industry average of 22.5X and the S&P 500’s 22X.

Image Source: Zacks Investment Research

Reinstated Dividend

Piggybacking to Disney's reinstated dividend, it will now pay a semi-annual dividend of $0.45 per share following its strong Q1 results which is 50% above its first post-pandemic payout of $0.30 a share in early January. The ex-dividend date is July 5 and is payable on July 25.

Image Source: Zacks Investment Research

Takeaway

The turnaround in Disney’s stock has been very impressive and DIS currenlty lands a Zacks Rank #3 (Hold) after such an extensive YTD rally. With that being said, longer-term investors may continue to be rewarded although there could be better buying opportunities ahead.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Barclays PLC (BCS) : Free Stock Analysis Report

Madison Square Garden Entertainment Corp. (MSGE) : Free Stock Analysis Report

Paramount Global (PARAA) : Free Stock Analysis Report