Time to Buy These Dividend Aristocrats Amid Recent Market Volatility

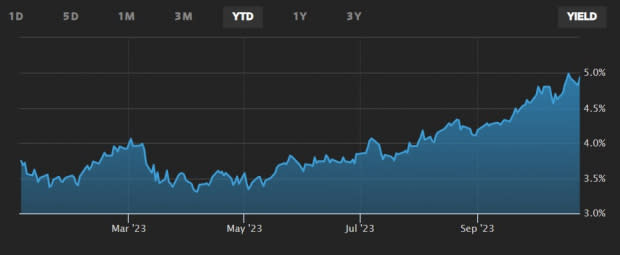

Amid recent market volatility and the 10-year Treasury Yield climbing over the last few weeks, investors may be more cautious of the stocks they are investing in.

That being said, several dividend aristocrats are attractive and are currently top-rated Zacks stocks. More reassuring, stocks considered to be dividend aristocrats have increased their annual dividend payouts in each of the last 25 years providing investors with a steady source of income.

For these top-rated Zacks dividend aristocrats, the combination of a strengthening outlook and reliable dividends is hard to overlook. This is especially true with much uncertainty in the stock market and broader economy at the moment.

However, these dividend aristocrats are benefitting from strong industries that should help them outperform making now an ideal time to buy.

Image Source: Wall Street Journal

Energy Aristocrats

We’ll start with a pair of oil and gas titans in Chevron CVX and Exxon Mobil XOM as both currently sport a Zacks Rank #2 (Buy).

In terms of their dividends, Chevron has raised its payout for 36 consecutive years with Exxon's at 40 years and counting. Even better, Chevron and Exxon both have dividend yields over 3% and well above the S&P 500’s 1.5% average.

Image Source: Zacks Investment Research

Furthermore, their Oil and Gas-Integrated-International Industry is currently in the top 16% of over 250 Zacks industries. As integrated oil giants, Chevron and Exxon can certainly reap steeper profits amid higher oil prices and their strong post-pandemic price performances could resume with CVX soaring +121% over the last three years and XOM skyrocketing +225%.

Image Source: Zacks Investment Research

To that point, WTI crude oil prices have been volatile over the last week but remain over $80 a barrel with earnings estimate revisions nicely up for Chevron and Exxon in the last 60 days.

Plus, recent tensions in the Middle East between Israel and Hamas could mean another spike in oil prices could be right around the corner as Iran has already called for other Muslim nations to curtail oil supplied to the region in support of Palestine.

Image Source: Yahoo Finance

Financial Aristocrats

Financials have attributed to a large sum of the recent volatility in broader markets but several of these equities have made the case for being oversold and happen to be dividend aristocrats.

Making a compelling case for such is casualty insurance provider Cincinnati Financial CINF which currently sports a Zacks Rank #2 (Buy). Cincinnati Financial has raised its dividend for 61 consecutive years classifying the company as a "dividend king" as well with a current annual yield of 3.06%.

Image Source: Zacks Investment Research

Trading more than 20% from its 52-week high of $130 a share seen last February, Cincinnati Financial‘s stock is down -4% YTD but still up +28% over the last three years. Buying the recent dip is very intriguing with Cincinnati Financial’s Insurance-Property and Casualty Industry in Zacks top 34%.

Annual earnings estimates are slightly higher over the last quarter with Cincinnati Financial expecting double-digit percentage growth on its bottom line in fiscal 2023 and FY24.

Image Source: Zacks Investment Research

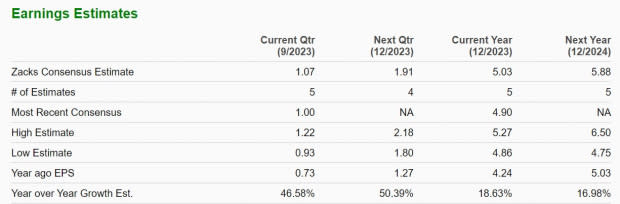

Another viable option among financial aristocrats is Aflac AFL which also sports a Zacks Rank #2 (Buy) and its Zacks Insurance-Accident and Health Industry is in the top 5% of all Zacks industries.

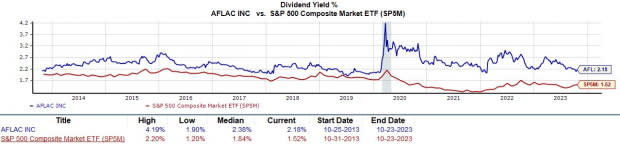

Aflac has raised its dividend for 41 consecutive years with a current yield of 2.18% which slightly trails its industry average but tops the benchmark.

Image Source: Zacks Investment Research

The voluntary supplemental and life insurance behemoth has seen its stock hold up while other financials have cratered. Up a respectable +8% in 2023, Aflac’s stock recently hit 52-week highs of $82 a share last Tuesday before cooling off over the last few trading sessions.

Along with its reliable dividend, annual earnings estimates for FY23 and FY24 are modestly higher in the last 30 days with Aflac’s EPS now projected to jump 13% this year and rise another 3% next year to $6.19 per share.

Image Source: Zacks Investment Research

Bottom Line

The trend of rising earnings estimates correlates with the notion that these top-rated dividend aristocrats are benefitting from their strong business environments. Now appears to be a good time to buy as their reliable dividends and strengthening outlooks are reassuring for investors amid recent market volatility.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report