Time to Buy These Highly Ranked Finance Stocks

There is starting to be ample opportunity in the Zacks Finance sector with many financial stocks still trading at what looks like sound discounts after the collapse of Silicon Valley Bank earlier in the year.

Pulled down by SVB fears, many financials continue to look poised for a rebound and now may be a good time to buy.

Regional & Foreign Banks

Hit the hardest amid banking fears, regional bank stocks may start to attract investors attention and one company that is worthy of consideration is Financial Institutions FISI.

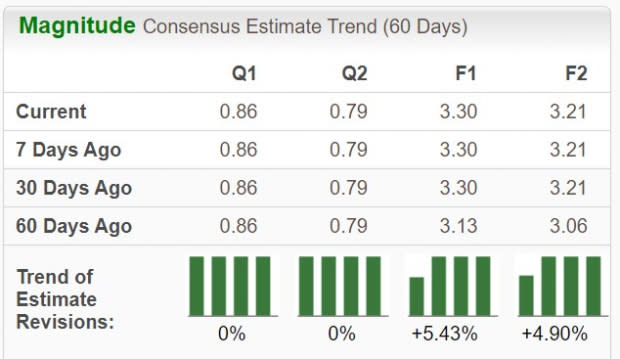

Trading at just 5.1X forward earnings, Financial Institutions' stock especially stands out with the bank holding company located in New York and providing consumer and commercial banking services in the Northeast. Most enticing is that Financial Institutions' fiscal 2023 and FY24 earnings estimates are nicely up over the last 60 days offering support to its “cheap” P/E valuation.

Image Source: Zacks Investment Research

Among foreign banks, HSBC’s HSBC stock is very attractive. Headquartered in London, HSBC’s bottom line expansion has become more intriguing with the company having global operations in Europe, Asia, and the Middle East along with Africa and Latin America.

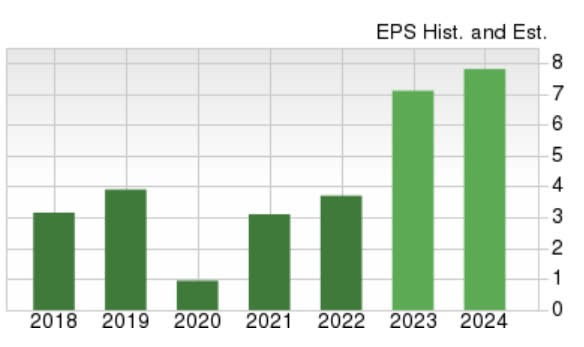

HSBC's annual earnings are now forecasted to soar to $7.10 per share in FY23 compared to EPS of $3.70 last year. Plus, FY24 earnings are expected to leap another 10% with HSBC starting to look undervalued considering its 5.6X forward earnings multiple.

Image Source: Zacks Investment Research

Investment Management

There is international opportunity in the financial investment management space as well with Patria Investments Limited PAX stock making a strong case for consideration.

Patria went public in 2021, offering asset management services in Latin America which are focused on private equity funds, infrastructure development funds, along with real estate and credit funds among others.

Considering Patria was founded in 1994 its top and bottom lines may not be staggering but earnings are anticipated to jump 25% this year and climb another 21% in FY24 to $1.52 per share. Plus, Partria’s stock trades at a reasonable 11.5X forward earnings multiple. On the top line, sales are expected to climb 24% in FY23 to $321.97 million compared to $258.90 million in 2022. Furthermore, FY24 sales are forecasted to expand another 21% to $390.34 million.

Image Source: Zacks Investment Research

Bottom Line

While investors may still be understandably cautious of the broader financial sector there is opportunity brewing as banks and other financial holding companies can be more profitable amid higher interest rates. Notably, Financial Institutions, HSBC, and Patria Investments Limited stock all land a Zacks Rank #1 (Strong Buy) at the moment and offer dividends well over 3% that may be rewarding to longer-term investors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Financial Institutions, Inc. (FISI) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

Patria Investments Limited (PAX) : Free Stock Analysis Report