Time to Buy Marriott (MAR) or Hilton's (HLT) Stock After Earnings?

Two consumer discretionary companies with a dominant presence in regards to hotel operations are of course Marriott International MAR and Hilton Worldwide HLT. Now may be a good time to see if investing in these hotel giants in 2024 is ideal with both reporting their Q4 results for fiscal 2023 within the last week.

Let’s take a look at Marriott and Hilton’s quarterly reviews along with their growth projections to see if it’s time to buy.

Marriott Q4 Review

Reporting its Q4 results on Tuesday, Marriott was able to crush earnings expectations despite quarterly sales of $6.09 billion missing estimates of $6.32 billion by -3%. Still, EPS of $3.57 per share surpassed Q4 estimates of $2.12 a share by a whopping 68%. More impressive, Q4 EPS soared 82% from $1.96 a share in the prior year quarter with sales rising 3% from $5.92 billion a year ago.

Notably, Marriott has beaten earnings expectations for five consecutive quarters posting an average earnings surprise of 21.11% in its last four quarterly reports. Marriott stated its excellent results in 2023 were driven by continued demand for its industry-leading portfolio and offerings around the world which includes roughly 573,000 rooms and 3,400 properties. Overall, Marriott’s total sales rose 14% in FY23 to $23.71 billion with annual EPS soaring 49% to $9.99 per share compared to $6.69 a share in 2022.

Image Source: Zacks Investment Research

Hilton Q4 Review

Hilton reported its Q4 results last Wednesday and comfortably surpassed bottom line expectations as well while also topping sales estimates. Fourth quarter earnings of $1.68 per share came in 7% better than expected and was up 5% YoY. Quarterly sales of $2.6 billion exceeded estimates by 1% and rose 6% from the comparative quarter.

Hilton has topped earnings expectations in three of its last four quarterly reports posting an average earnings surprise of 5.07%. Even better, Hilton has beaten sales estimates for 11 consecutive quarters dating back to July of 2021. Hilton’s total sales jumped 17% in FY23 to $10.24 billion with annual EPS leaping 27% to $6.21 per share versus $4.89 a share in 2022. Driving Hilton’s growth was its nearly 7,500 properties and 1.2 million rooms with the company continuing to build out its luxury brand and announcing a new exclusive partnership with Small Luxury Hotels of the World (SLH) to expand its distribution.

Image Source: Zacks Investment Research

Growth Projections

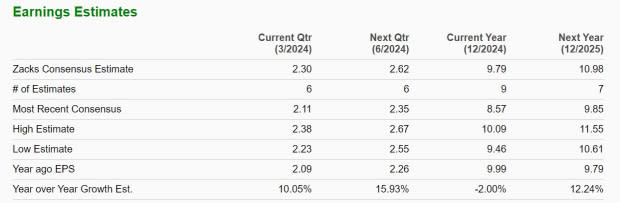

Facing a very tough to compete against year in terms of EPS growth Marriot’s annual earnings are expected to dip -2% in FY24 but rebound and rise 12% in FY25 to $10.98 per share. Total sales are projected to be up 8% this year and climb another 7% in FY25 to $27.44 billion.

Image Source: Zacks Investment Research

As for Hilton, annual earnings are forecasted to rise 13% in FY24 and soar another 17% in FY25 to $8.17 per share. Hilton's total sales are anticipated to be up 9% in FY24 and jump another 8% next year to $12.15 billion.

Image Source: Zacks Investment Research

Takeaway

Marriott and Hilton should certainly remain viable long-term investments with both stocks landing a Zacks Rank #3 (Hold). With that being said, there could be better buying opportunities ahead considering MAR and HLT shares have rallied more than +25% over the last year. However, their lucerative growth and expansion could make them ideal buy the dip canidates down the road.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report