Time to Buy the Opportunity in These Undervalued Stocks

Searching for stocks that appear to be undervalued and should have more upside may become harder to find with the S&P 500 now up +13% this year and the Nasdaq rising 28%.

Still, there is opportunity among a variety of sectors, and here are a few stocks to consider at the moment.

Business Services

Starting with the Zacks Business Services sector, there is opportunity brewing in Capgemini (CGEMY) and Green Dot (GDOT) stock with both landing a Zacks Rank #2 (Buy).

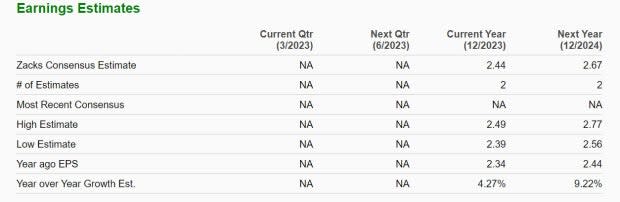

Engaged in providing consulting, technology, and outsourcing services it appears to be a good time to consider Capgemini stock with earrings forecasted to be up 4% this year and jump another 9% in fiscal 2024 at $2.67 per share.

Image Source: Zacks Investment Research

Annual earnings estimates have remained higher over the last 60 days and Capgemini stock still trades near the industry average P/E at 14.8X forward earnings and nicely beneath the S&P 500’s 19.9X.

Pivoting to Green Dot, the pro-consumer bank holding company and personal banking provider is very attractive in terms of valuation. Green Dot stands out amongst its industry when looking at the company’s enterprise value and price to earnings. Green Dot’s EV/EBITDA of 1.56 is attractively beneath its industry average of 5.32.

At $19 a share and just 10.4X forward earnings, Green Dot’s stock trades at a 26% discount to its industry average of 14.2X and nicely beneath the benchmark.

Image Source: Zacks Investment Research

Transportation

Among the Transportation sector, GasLog Partners (GLOP) is starting to offer nice value to investors and sports a Zacks Rank #2 (Buy).

GasLog owns, operates, and acquires LNG carriers with multi-year charters and the company is starting to look vastly undervalued from a price-to-earnings perspective. Trading under $10 a share and just 3.2X forward earnings GasLog stock offers a 38% discount to the industry average of 6.1X.

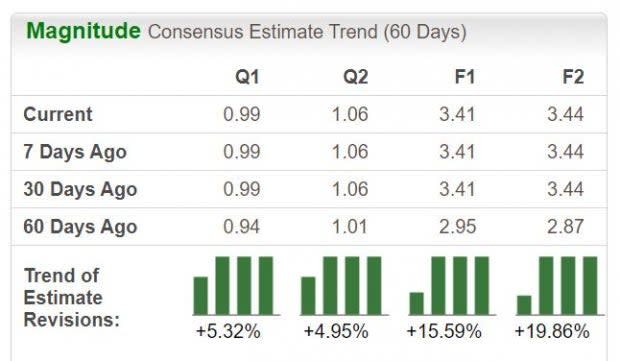

More importantly, annual earnings estimates have remained higher and are starting to reconfirm that GasLog’s stock is cheap considering its P/E valuation.

Image Source: Zacks Investment Research

Oils & Energy

Rounding out this list is Global Partners (GLP) which is sporting a Zacks Rank #1 (Strong Buy). Global Partners stock is sticking out among the Zacks Oils and Energy sector as volatility among crude oil prices has attributed to the company being undervalued at the moment.

Still, Global Partners has access to one of New England's largest terminal networks of refined petroleum products. This has solidified the company as one of the largest wholesale distributors of distillates such as home heating oil, diesel and kerosene, gasoline, residual oil, and bunker fuels.

Making the case for value is that Global Partners stock trades at $30 a share and 9.1X forward earnings which is attractively beneath the industry average of 11.9X. Earnings estimates are noticeably higher over the last 60 days, offering further support.

Image Source: Zacks Investment Research

Global Partners stock also checks valuation boxes in other areas such enterprise value and price to cash flow. Notably, Global Partners financial health looks strong with its price to cash flow (P/CF) intriguingly below the optimum level of less than 20 at 2.41 with the industry at 5.10 and the S&P 500’s average at 17.02.

Image Source: Zacks Investment Research

Bottom Line

Investors searching for value might want to consider these stocks as rising earnings estimate revisions are supportive of their attractive valuation metrics. There should be more upside from their current levels and now appears to be an opportunistic time to buy.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Global Partners LP (GLP) : Free Stock Analysis Report

Cap Gemini SA (CGEMY) : Free Stock Analysis Report

GasLog Partners LP (GLOP) : Free Stock Analysis Report