‘Time to Hit Buy,’ Says Bank of America About These 3 Stocks

Building on the momentum from last year, this year’s market performance follows a similar pattern. Year-to-date, both the S&P 500 and the tech-oriented NASDAQ are up, by nearly 8% and 8.5%, respectively. But will this momentum continue?

Watching the situation from Bank of America, equity strategist Savita Subramanian keeps a bullish stance, albeit tempered by reading the current market dynamics. Still, Subramanian thinks stocks remain on track for further growth. “We raise our S&P 500 year-end target to 5400 from 5000 primarily on tweaks to our fair value assumptions. But our bullish conviction has cooled since publishing our 2024 Outlook amid improving sentiment across Wall Street. The Sell Side Indicator, our key sentiment gauge, has seen increasing equity allocations and is now firmly neutral and we lower its weight in our framework. But a neutral call is rarely correct, and the net message of our market timing framework is still, in one word, UP,” Subramanian said.

That overall outlook suggests a year-end gain for the S&P of 5.5% from current levels, and the broader base should give investors more choices for buying in. The stock analysts at Bank of America would definitely agree – they’ve picked out several stocks as potential winners for this year, believing it’s ‘time to hit buy.” Moreover, it’s not only BofA that’s bullish on these particular names; according to the TipRanks database, the analyst consensus rates all 3 as Strong Buys.

Catalyst Pharmaceuticals (CPRX)

We’ll start in the world of biotech, with Catalyst Pharmaceuticals. This biotech research firm focuses its work on new treatments for rare diseases. These are difficult conditions to treat, with small patient bases, life-threatening effects, and a relative paucity of published research on treatment options. Catalyst Pharma has met the challenges, however, and has several approved products on the market for several conditions.

Catalyst has built up a portfolio of three approved drugs, through the acquisition of commercialization licenses. These are the corticosteroid Agamree, developed to treat patients with Duchenne muscular dystrophy (DMD); Firdapse, which is the only medication currently approved by the FDA for the treatment of Lamber-Easton myasthenic syndrome (LEMS) in patients ages 6 and up; and Fycompa, used in the treatment of epilepsy, which has shown efficacy against multiple types of seizures and is used in patients from age 4 and up.

The first of these drugs, Agamree, is the branded form of vamorolone, which received FDA approval in the treatment of DMD in October 2023. In the US, the drug has been approved for patients from the age of 2; in Europe, the EU has approved it from age 4. Agamree was developed by Santhera Pharmaceuticals, and Catalyst obtained exclusive rights for North American commercialization rights in July 2023. The company is on track for a US commercial launch of Agamree during this 1Q24, and its license for the drug includes permissions to expand that commercialization to ‘other potential indications.’

Catalyst also has license rights for Fycompa, which it acquired in January of last year. Fycompa was acquired from Eisai Company, and is currently the only AMPA receptor antagonist epilepsy treatment on the market. Catalyst owns the US rights for the drug, which is an established, first-in-class asset in in the treatment of seizure disorders.

The company’s third portfolio product is Firdapse, to which it has long held the rights. In 2018 the company received FDA approval for a 10mg tablet, and Firdapse is currently available in the US as a treatment for LEMS, a serious neuromuscular junction disorder, and is approved for use in adult patients and in children from 6 years of age. Firdapse has approval in Canada for the treatment of adults only. In December 2023, Catalyst announced that its collaboration partner, DyDo Pharma, has submitted the New Drug Application for Firdapse in Japan, and earlier, in November, the company announced two new US patent allowances for the drug. On a note of importance to investors, the company is currently engaged in patent lawsuits over Firdapse, seeking to block three unauthorized copies of the drug.

Having approved drugs on the market is always a boon for biopharma companies, and for Catalyst it translated into revenue of $110.6 million in 4Q23. This was a quarterly record for the company; revenues were up 82% year-over-year, and beat the forecast by $4.65 million. At the bottom line, Catalyst saw non-GAAP EPS of 53 cents per share, or some 7 cents per share better than had been anticipated.

For BofA’s analyst Jason Gerberry, the key here is Catalyst’s commercial portfolio, and proven record of acquiring solid portfolio products. He writes, in his initiation of coverage note, “We think Catalyst Pharma is a unique aggregator of innovative therapies in the premium-multiple rare disease space. CPRX has a track-record of highly capital efficient license/ acquisition deals that have generated favorable ROI. We see the upcoming launch of muscular dystrophy drug Agamree as the next phase of strategy validation. We believe Agamree will be successful given its competitive profile. Further, CPRX’s largest revenue-generating product, Firdapse, has room to grow. Ultimately, we think the shares are undervalued. On a P/E basis, the stock trades at a discount relative to comparable small- to mid-cap biopharma cos. Current valuation also implies a conservative outcome of Firdapse patent litigation.”

These comments back up the analyst’s Buy rating on the stock, and his $23 price target suggests a one-year upside of 43%. (To watch Gerberry’s track record, click here)

The Strong Buy consensus rating on Catalyst stock is unanimous, based on a total of 6 Buys, showing that Gerberry’s colleagues agree with the bullish outlook here. The shares are selling for $16.10 and the $25.09 average target price implies an upside of 56% in the next 12 months. (See CPRX stock forecast)

SBA Communications (SBAC)

Next up is SBA Communications, a real estate investment trust (REIT) with a unique twist. These companies typically acquire, own, manage, and lease out various forms of real properties; SBA Communications focuses this activity on cellular infrastructure, the physical locations and structures that support our wireless telecom networks. The company owns a variety of small cells, traditional cell sites, and distributed antenna systems at locations in North and South America, as well as in the Philippines, South Africa, and Tanzania.

SBA was founded in 1989, and is based in Boca Raton, Florida. The company works through both site leasing and site development. On the first, it owns multi-tenant cell towers and leases antenna space to cellular operators and wireless service providers, typically on a long-term lease structure. On the second track, SBA works with wireless companies in the processes of site acquisition, zoning approval, construction, and final hardware installation. SBA will also enter agreements with property owners for the development of cellular and wireless infrastructure.

The persistently high inflation – and consequently high interest rates – of the last few years put pressure on the real estate market, and SBA could not avoid that headwind. The company’s most recent quarterly report, from 4Q23, showed a miss at the top line – but bottom line strength. Quarterly revenues fell by 1.6%, to just over $675 million, and missed the forecast by $7.24 million, or a shade over 1%. At the bottom line, SBA reported an adjusted funds from operations (AFFO) of $3.37 per share, or some 15 cents per share better than expected.

The AFFO is important, as it provides support for the company’s dividend. SBA recently raised its common share dividend payment to 98 cents per share, up more than 15% from the previous 85-cent payment. The annualized rate of $3.92 gives a yield of 1.75%. The new dividend is set for payment on March 28.

Covering SBAC shares for BofA, analyst Dave Barden is upbeat, noting, among other factors, the underlying strength of cellular demand and the prospect of lower interest rates later this year. He says of the stock, “We upgrade SBAC to Buy from Neutral. We believe the following: 1. There is inevitable upside to domestic carrier macro tower activity to meet growing customer demand despite decade low valuations; 2. There is a rising chance of accelerating buybacks with leverage well below the company’s target range, sitting at its lowest level in decades; 3. The downside impact of upcoming 2025/26 Sprint churn is well understood by the market; 4. Interest expense headwind concerns will diminish as the potential for rate cuts in 2024+ grows.”

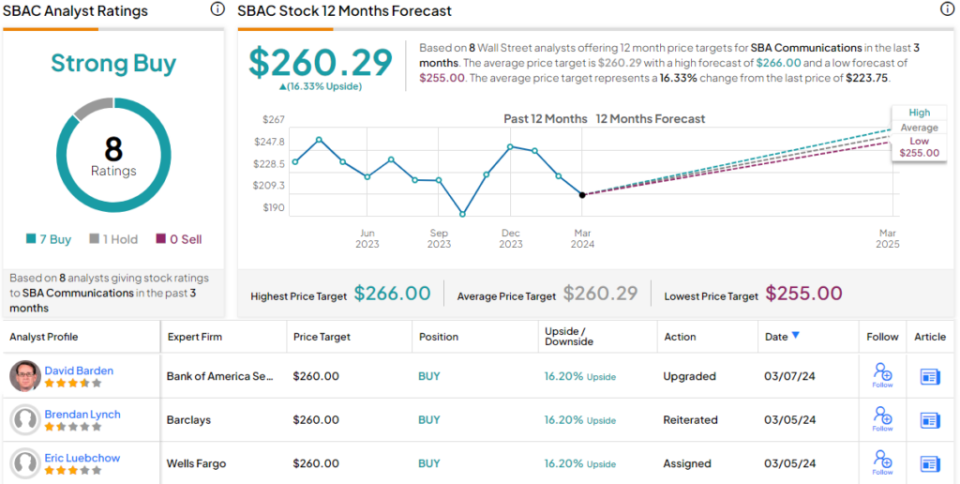

Along with his upgraded Buy rating, Barden sets a price target of $260, implying that the stock will appreciate by 16% over the coming year. (To watch Barden’s track record, click here)

There are 8 recent analyst reviews on record for SBA Communications, and they include 7 Buys to just 1 Hold – for a Strong Buy consensus rating. These shares have a current trading price of $223.75, and their average target price of $260.29 nearly matches the BofA view. (See SBAC stock forecast)

BBB Foods (TBBB)

Last on our list is a company new to the public markets – but not to the food business. BBB Foods is the parent company of Tiendas 3B, a well-known Mexican discount grocery chain. The ‘3B’ name refers to the Spanish words bueno, bonito, and barato, or ‘good, nice, and affordable,’ in English, and covers the company’s mission to its customers – providing quality products at bargain prices to budget-conscious shoppers.

While Tiendas 3B is the company’s largest subsidiary, with operations across Mexico, the BBB Foods parent company also has operations in Central America, the Dominican Republic, and the US. The company has several in-house brands of food products, including Hugo Pork and Hugo Chick.

The TBBB ticker was taken onto the New York stock exchange just last month, in an IPO that saw TBBB open for trading on February 9. The initial offering price was expected at $17.50, but the shares opened at $19.50. The IPO gave the company a valuation of $2.2 billion, and after additional share appreciation in the stock’s first month of trading, the company now has a market cap of $2.35 billion.

The strong IPO caught the attention of analyst Robert Ford, who opened coverage of the shares for Bank of America. Ford sees the company’s breadth of product offerings, including private labels, as a net plus, along with its solid marketing: “Tiendas 3B offers about 800 SKUs at prices comparable to or below big box rivals in a convenience, warehouse-like format. Its private labels are aggressively priced vs peers (10-15% cheaper) and in our view often higher quality, and today make up nearly half of sales. TBBB’s mix covers about half of its target market spending and includes a treasure hunt component that further differentiates its value proposition.”

“Tiendas 3B generates high store-level pre-tax returns (~60%), which should further improve as scale, private label and consumer awareness continue to evolve,” Ford adds, and goes on to outline the firm’s prospects: “Hard discount represents <3% of Mexican food retail, suggesting the potential to grow rapidly. An effective incumbent competitive response, in our view, would likely entail costly cannibalization.”

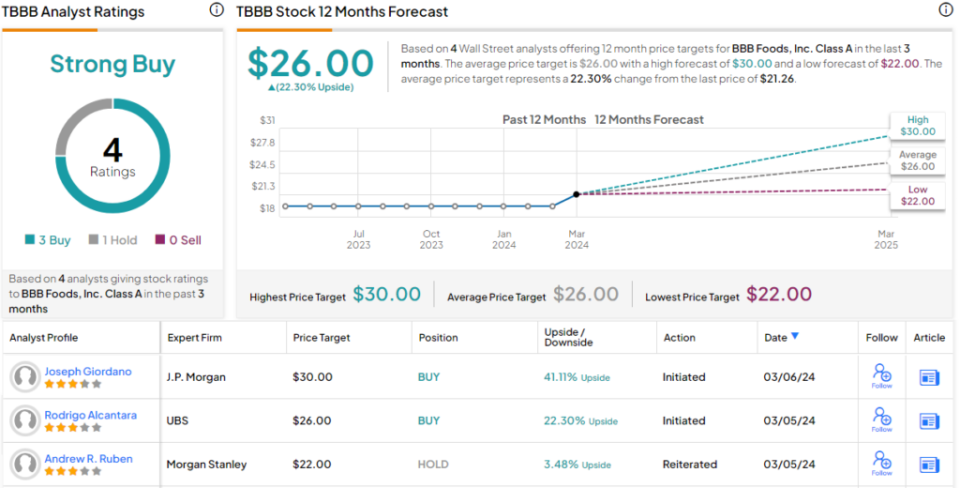

In the analyst’s view, this adds up to a Buy rating, and his price target, opened at $26, suggests that a one-year upside of 22% is waiting in the wings. (To watch Ford’s track record, click here)

With 4 analyst reviews on record, including 3 to Buy against a single Hold, this new stock has earned a Strong Buy rating from the analysts’ consensus. The shares are trading for $21.26 and have an average price target of $26, matching BofA’s objective. (See TBBB stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.