‘Time to Pull the Trigger,’ Says Morgan Stanley About These 2 Healthcare Stocks

It’s been a bountiful year for the stock market but that doesn’t mean there haven’t been laggards. The biotech industry, for example, has underperformed. While the Nasdaq Biotechnology Index (NBI) shows a 3% year-to-date gain, that is still some distance below the S&P 500’s 24% return.

Therefore, with investor sentiment subdued, and some SMID-cap biotech firms still needing to raise capital against a challenging capital markets backdrop, Morgan Stanley’s Jeffrey Hung says the setup for SMID-cap biotech exiting 2023 seems “daunting.”

That said, there are signs that 2024 could offer an improvement, and as such, Hung is “cautiously optimistic for SMID-cap biotech in 2024.”

“Within healthcare, biotech appears to be more attractive on relative valuation,” the 5-star analyst recently said. “Healthcare tends to outperform in environments of above trend and falling inflation, which our economists expect for the near term. The markets imply rate cuts by the Fed in nearly five full 25bp increments over 2024, starting in May… We still like a core position in mid-cap growth names where there is downside protection from approved products with substantive revenues but meaningful upside opportunity when the biotech market returns to reward investors for revenue growth & positive data.”

With a more favorable outlook in tow, and meeting the above criteria, Hung thinks it’s time to pull the trigger on a couple of promising biotech stocks, having recently upgraded his ratings for them. So, we decided to give the pair a closer look. Turns out it’s not only Hung who has confidence in these names; according to the TipRanks database, both are also rated as Strong Buys by the analyst consensus. Let’s see what makes them so.

Amicus Therapeutics (FOLD)

The first stock on our MS-backed list, Amicus Therapeutics, is a biotech research firm focused on developing new pharmaceuticals for the treatment of ‘rare and orphan diseases.’ This class of disease conditions is characterized by devastating effects on patients – and by small patient bases. For biopharma companies, they present a difficult challenge: there will be a market for a new drug, but it will be difficult to make it offset the high overhead incurred in the development process.

Amicus has taken up this challenge, and is working on a line-up of new drug candidates featuring novel modes of action – and the company has reached the ‘Holy Grail’ of the biopharma industry, achieving approval and commercialization on two new drug therapies. These are galafold, a treatment for adults suffering from Fabry disease, and a combination therapy, pombility-plus-opfolda, designed to treat Pompe disease after late-onset diagnosis.

Having these approved drugs on the market gives Amicus a reliable source of income, and the company’s revenues have been trending upward this year. The bulk of this income comes from continuing sales of galafold, which reached $100.7 million in 3Q23, up 23% year-over-year – and the first time galafold’s total sales exceeded $100 million. Sales of the pombility-plus-opfolda combination therapy came to $2.77 million; this combo brought in just $60K in the prior-year quarter.

At the bottom line for the third quarter, Amicus reported a net loss per share of $0.07, based on a total net loss of $21.6 million. This was the lowest net EPS loss Amicus has reported, and beat the forecast by a penny. The company anticipates showing non-GAAP profitability in the 4Q23 report.

For Morgan Stanley’s Hung, this adds up to a solid choice for investors. He is impressed by Amicus’ ability to shift toward net profits, and writes, “We expect the company to reach non-GAAP profitability by year-end, and the company has achieved each of its major goals (such as approval of Pombiliti + Opfolda) over the last year. Looking ahead, focus remains on the Galafold and Pombiliti + Opfolda launches, for which we think Amicus is well-positioned. We significantly cut our R&D expenses as we believe development expenses for the company’s early stage pipeline will remain fairly limited for the next 12-18 months.”

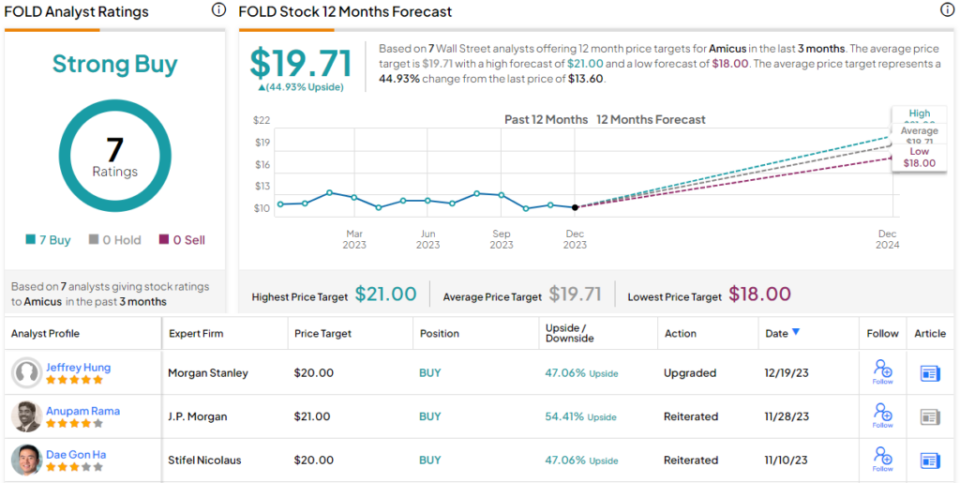

Accordingly, Hung upgraded FOLD shares from Equal-weight (i.e., Neutral) to Overweight (Buy) while his $20 price target points toward a one-year upside potential of 47%. (To watch Hung’s track record, click here.)

Amicus has a Strong Buy rating from the Street’s analyst consensus, based on 7 unanimously positive reviews. The shares are currently trading for $13.60, and the $19.71 average target price suggests that FOLD will appreciate by 45% in the year ahead. (See Amicus’ stock forecast.)

Acadia Pharmaceuticals (ACAD)

The second Morgan Stanley pick we’ll look at is Acadia Pharmaceuticals, a biotech researcher working on treatments for disorders and diseases of the central nervous system. Like Amicus above, Acadia has reached the commercialization stage, with two approved drugs on the market, and is pursuing an active research pipeline, featuring new applications of the approved drugs and several new drug candidates.

The first of Acadia’s approved medications is pimavanserin, branded as nuplazid, an atypical antipsychotic drug currently approved for the treatment of psychosis – delusions and hallucinations – that are associated with Parkinson’s disease. The drug was first approved in 2016, and in the recently reported 3Q23 it generated net product sales of $144.8 million. For the first three quarters of 2023, sales of nuplazid reached $405.3 million, up 6.5% year-over-year.

Acadia is continuing to study pimavanserin in its clinical trial program. The company recently reported positive results from the Phase 2 ADVANCE study, which focused on using this atypical antipsychotic as a treatment for ‘negative symptoms of schizophrenia.’ Currently, pimavanserin is the subject of the ADVANCE-2 study, a Phase 3 trial of the drug in the treatment of schizophrenia. Top line results are expected next year.

In other important news about nuplazid, Acadia earlier this month won a patent lawsuit in the Federal District Court in Delaware. The case was based on two suits which were filed last October, and alleged that copies of nuplazid being put on the market violated Acadia’s copyright. The company won the suit in a summary judgement, and shares in ACAD jumped 32% on the news.

The second approved drug in Acadia’s portfolio is trofinetide, approved earlier this year as a treatment for Rett syndrome. The drug has been branded as daybue and is on the market for the treatment of Rett in adults and in pediatric patients over age 2. Daybue received FDA approval this past March, and launched commercially shortly thereafter. The drug is already generating significant income for Acadia; product sales in 3Q23 came in at $66.9 million.

In his coverage of this stock, top analyst Hung notes several of these factors as supportive for ACAD shares, writing, “We upgrade ACAD shares to Overweight (from Equal-weight) as we believe the Daybue launch is likely to remain strong. While management expects the launch to be more linear going forward, we are encouraged by the market opportunity and think the company will be able to identify more patients and continue to grow the Rett syndrome diagnosed population. In addition, last week’s court ruling in favor of Acadia on the Nuplazid patent challenge removes a significant headwind that had been a focus amongst many investors.”

Our PT goes to $40 (from $31) from raising our market share estimates for Daybue in Rett Syndrome to 50% peak share (from 40%).”

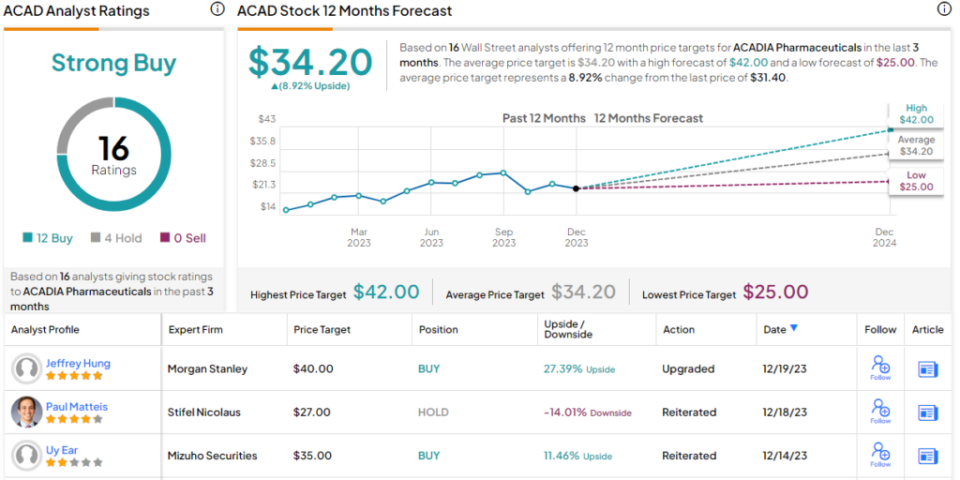

Along with the rating upgrade, Hung’s price target goes from $31 to $40, implying a potential upside here of 27% on the one-year horizon.

This biotech has picked up 16 recent analyst reviews – and these include 12 Buys over 4 Holds, to support the Strong Buy consensus rating. ACAD boasts a $34.20 average target price, which suggests a 9% increase from the current trading price of $31.40. (See Acadia’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.