Time To Shop For Online Retail ETFs?

Key Takeaways

This winter holiday season, nearly 60% of shoppers plan to purchase items online despite the ability to shop in person, according to a key retail survey.

While internet and direct marketing retail companies lagged in 2021, they have stronger earnings prospects for 2022, making the subindustry worthy of consideration.

The Amplify Online Retail ETF (IBUY), Global X E-Commerce ETF (EBIZ) and ProShares Online Retail ETF (ONLN) all earn CFRA five-star ratings but are constructed differently with unique ETF holdings.

Fundamental Context

Heading into the holiday shopping season, e-commerce is likely to continue to gain share. U.S. consumers plan to spend approximately $1,000 on gifts, holiday items and other nongift purchases for themselves and their families this year, consistent with 2020, according to the annual survey released in October by the National Retail Federation and Prosper Insights & Analytics.

Despite broad availability of COVID-19 vaccines—which might entice consumers to return to in-person stores—57% of respondents plan to purchase items online, consistent with prepandemic norms.

Online retail has been gaining ground in recent years, including outside of the winter holidays, yet there is room for further growth. E-commerce grew to 13.3% of total retail sales in the second quarter of 2021, according to the U.S. Census Bureau, up from 10.5% two years earlier, though it dipped from 15.7% a year ago as the pandemic-induced lockdown has begun to ease.

Furniture, apparel and accessories, and food and beverage are some of the areas that were expected to show the strongest growth in 2021. E-commerce penetration is forecast by eMarketer to more than double to 23.6% in 2025, creating a significant investment opportunity.

The internet and direct marketing retail (IDMR) subindustry is expected to grow stronger than the broader consumer discretionary sector in 2022. The S&P 1500 Consumer Discretionary sector is projected to generate 85% earnings growth in 2021, climbing faster than the 50% for the broader market. Triple-digit growth is expected for certain subindustries, such as apparel, accessories, and luxury goods and apparel retail, while earnings within IDMR are expected to rise only 13%.

Yet looking to 2022, earnings for the DMR subindustry are projected to climb 30%, faster than the 25% for the consumer discretionary sector and low-teens growth for apparel retail (10%) and apparel, accessories and luxury goods (13%).

While IDM retailers have historically traded at a premium P/E multiple to the broader consumer discretionary sector, the premium was recently below the historic average, creating a potential buying opportunity using ETFs.

Physical Vs. Digital Economy

Meanwhile, according to Simeon Hyman, global investment strategist at ProShares, the Solactive-ProShares Bricks and Mortar Retail Store Index returned 33% year-to-date through September, which was about double the return of the S&P 500. To Hyman, the performance reflects a deserved rebound initiated by the partial reopening of the physical economy.

However, Hyman thinks the valuation advantage might now shift to e-commerce. The Solactive-ProShares Bricks and Mortar Retail Store Index was trading at more than double the prepandemic relative price-to-book of the ProShares Online Retail Index, which is tracked by ONLN, as of the end of September 2021.

Source: S&P Dow Jones. As of November 5, 2021.

(For a larger view, click on the image above)

ETFs provide diversification benefits, particularly thematic ones. In recent years, investors have embraced ETFs tied to a long-term theme, such as cloud computing, clean energy, infrastructure or online retail, because even if an industry’s growth accelerates, there will be some leaders and some laggards.

Each of the three popular e-commerce ETFs we will discuss further hold at least 40 companies, though they are constructed differently, as ETF.com’s Jessica Ferringer discussed with CFRA recently in an ETF battle.

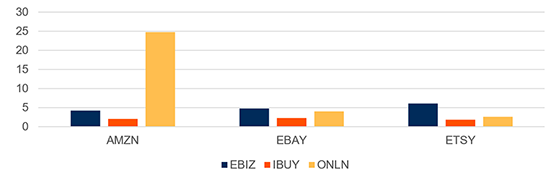

Exposure to Amazon.com (AMZN) and Etsy (ETSY) is different within online retail thematic ETFs. CFRA provides qualitative analytical STARS coverage of 11 global companies within the IDMR subindustry, spread across four Buys, six Holds and one Strong Sell.

AMZN and eBay (EBAY), which are the two Buy recommended companies domiciled in the U.S, are the first and third largest positions in the $883 million ONLN, representing a combined 29% of assets. In contrast, these stocks were recently 8.9% and 4.3%, respectively, of peer ETFs EBIZ and IBUY.

CFRA’s Buy opinion on AMZN reflects expectations for further e-commerce market share gains and potentially sizable upside for the AWS (Amazon Web Services) business on the heels of accelerated secular shifts through the pandemic. We forecast net sales for AMZN of 22% and 16% in 2021 and 2022, which, coupled with gross margin expansion, should result in strong earnings. AMZN’s size and scale give it an advantage over other retailers.

Meanwhile, CFRA thinks eBay has been written off by some as an e-commerce also-ran, and we see a place for multiple major third-party seller platforms. We view eBay’s strong position in unique and secondhand goods, along with its iconic brand, as a foundation for a potentially greater, longer-duration return to growth.

Meanwhile, the $201 million EBIZ and the $934 million IBUY have larger stakes than ONLN in Etsy, which CFRA expects to generate 20% revenue growth in 2022, following a forecasted 33% in 2021. While CFRA has a Hold recommendation on the shares, we believe the company is executing well on its marketing strategy.

Figure 2: Key Holdings In Online Retail ETFs (% of assets)

Source: CFRA’s ETF database. As of November 8, 2021.

(For a larger view, click on the image above)

Conclusion

We think e-commerce is likely to return to investor focus heading into and after the holiday shopping season. EBIZ, IBUY and ONLN are three distinct ETFs to consider while tapping into the long-term trend, but all are positioned to outperform the broader global equity category over the next nine months, according to CFRA ratings.

All of the views expressed in this research report accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. For more information and disclosures, please refer to CFRA’s Legal Notice at https://www.cfraresearch.com/legal/.

Copyright © 2021 CFRA. All rights reserved. All trademarks mentioned herein belong to their respective owners.

Recommended Stories