Timken Co Reports Modest Revenue Growth and Record Adjusted EPS for 2023

Revenue: Fourth-quarter sales increased by 0.9% year-over-year to $1.09 billion.

Earnings Per Share (EPS): Fourth-quarter EPS at $0.83; adjusted EPS climbed to $1.37.

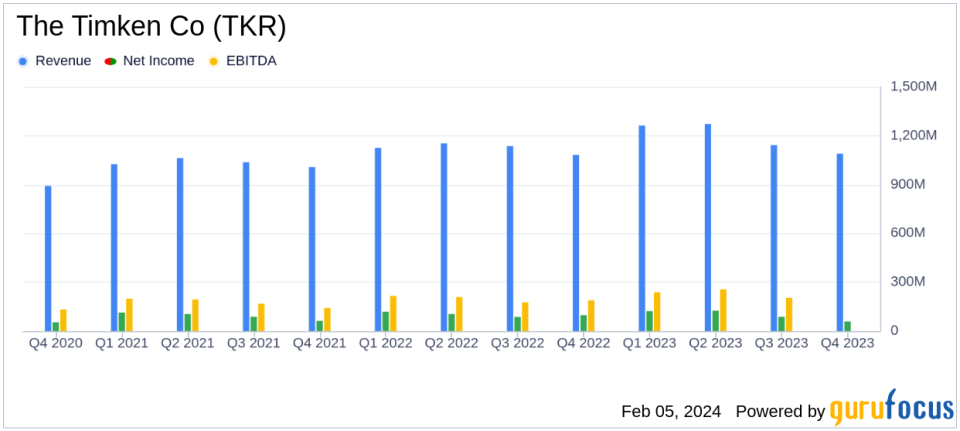

Annual Performance: Record full-year sales of $4.8 billion, a 6.1% increase from the previous year.

Net Income Margin: Full-year net income margin stood at 8.3%, with an adjusted EBITDA margin of 19.7%.

2024 Outlook: Initial EPS estimate for 2024 set between $4.90-$5.30, with adjusted EPS of $5.80-$6.20.

Acquisitions: Strategic acquisitions expected to add approximately $70 million in annual revenue.

The Timken Co (NYSE:TKR) released its 8-K filing on February 5, 2024, revealing a modest increase in fourth-quarter sales and a record-setting year for adjusted earnings per share. The company, a global leader in engineered bearings and industrial motion products, navigated a dynamic market environment to close out 2023 with strong financial results.

The Timken Company operates in two segments: Mobile Industries and Process Industries, serving a diverse range of sectors including automotive, energy, and agriculture. With a strategic network of authorized dealers and direct sales to original equipment manufacturers, Timken has solidified its presence in the industrial products sector, particularly in the United States.

Performance and Challenges

Despite facing lower volume across several industrial sectors, including wind energy and off-highway, Timken's fourth-quarter sales saw a slight uptick, largely due to acquisitions, higher pricing, and favorable foreign currency translation. However, net income for the quarter dropped to $58.7 million, or $0.83 per diluted share, compared to $97.2 million, or $1.32 per diluted share, in the same period last year. Adjusted for special items, net income remained stable at $97.3 million, or $1.37 per diluted share.

The company's full-year performance was marked by record sales of $4.8 billion, a 6.1% increase from the previous year. This growth was primarily driven by strategic acquisitions and higher pricing, despite lower volume and unfavorable foreign currency translation. The full-year net income margin stood at 8.3%, with a record adjusted EBITDA margin of 19.7%.

Financial Achievements and Importance

Timken's financial achievements in 2023, particularly the record adjusted EPS, underscore the company's ability to manage costs and optimize pricing strategies effectively. These results are significant as they demonstrate resilience in a challenging market and the capacity to deliver value to shareholders. The company's strategic acquisitions have also played a crucial role in enhancing its product offerings and expanding its market reach, contributing to the overall financial success.

Key Financial Metrics

Timken's fourth-quarter results showed a robust adjusted EBITDA of $195.4 million, or 17.9% of sales. The company generated a healthy free cash flow of $75.4 million for the quarter, returning $55.7 million to shareholders through dividends and share repurchases. For the full year, net cash from operations was $545.2 million, with free cash flow reaching $357.4 million. These metrics are vital as they reflect the company's operational efficiency and liquidity, which are essential for sustaining growth and shareholder returns.

"We delivered excellent results in the fourth quarter to close out another record year for The Timken Company," said Richard G. Kyle, Timken president and chief executive officer. "In 2023, we grew revenue, expanded margins and set a new all-time record for adjusted earnings per share as our team executed well in this dynamic environment."

2024 Outlook and Analysis

Looking ahead to 2024, Timken anticipates a revenue decline between 2.5% to 4.5%, with lower organic revenue expectations based on current demand. Nevertheless, the company projects earnings per diluted share in the range of $4.90 to $5.30 and adjusted earnings per diluted share between $5.80 to $6.20. These projections reflect Timken's strategic focus on cost management and operational excellence to maintain solid operating margins and improve free cash flow, despite softer industrial markets.

Timken's performance in 2023, coupled with its strategic acquisitions and financial discipline, positions the company to navigate economic volatility and continue delivering value to its shareholders. The company's commitment to innovation and ethical business practices further solidifies its reputation as a responsible and forward-thinking industry leader.

For more detailed insights and analysis, investors and interested parties are encouraged to review the full 8-K filing and join the conference call hosted by Timken.

Explore the complete 8-K earnings release (here) from The Timken Co for further details.

This article first appeared on GuruFocus.