Timken (TKR) Misses Earnings Estimates in Q3, Lowers Guidance

The Timken Company TKR reported adjusted earnings per share of $1.55 in third-quarter 2023, missing the Zacks Consensus Estimate of $1.66. The bottom line fell 4.9% year over year.

On a reported basis, the company delivered earnings of $1.23 per share in the quarter under review compared with $1.18 in the prior-year quarter.

Total revenues in the quarter were $1,143 million, up 0.6% from the year-ago quarter. The upside can be attributed to higher pricing and favorable foreign currency translation, as well as the favorable impacts of acquisitions, partly offset by lower volume. However, the top line missed the Zacks Consensus Estimate of $1,197 million.

Timken Company (The) Price, Consensus and EPS Surprise

Timken Company (The) price-consensus-eps-surprise-chart | Timken Company (The) Quote

Costs and Margins

The cost of sales fell 2% to $787 million from the prior-year quarter. The gross profit increased 6.6% year over year to $356 million. The gross margin was 31.1% compared with 29.3% in the year-ago quarter.

Selling, general and administrative expenses were up 12.4% year over year to $180 million. Operating income increased 13.6% year over year to $150 million. Adjusted EBITDA improved 1% year over year to $216 million in the quarter under review. The adjusted EBITDA margin in the quarter was 18.9% compared with 18.8% in the prior-year quarter.

Segmental Performances

The Engineered Bearings segment’s revenues declined 0.5% year over year to $776 million. The decrease was mainly due to lower volumes. These were somewhat offset by higher pricing and the benefits of acquisitions. We expected the segment’s sales to be $827 million in the quarter.

The Engineered Bearings segment’s adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) were $156.7 million compared with the year-ago quarter’s figure of $153.8 million. Our prediction for the segment’s adjusted EBITDA was $166 million. The impacts of lower volume, higher manufacturing costs, unfavorable foreign currency, and higher impairment & restructuring charges were partially offset by lower material & logistics costs, and a favorable price/mix.

The Industrial Motion segment’s revenues rose 2.9% year over year to $367 million in third-quarter 2023. The upside was led by higher pricing, the benefits of acquisitions and a favorable currency translation, partially offset by lower volume. The reported figure missed our estimate of $372 million. The segment’s adjusted EBITDA was $75.2 million in the third quarter of 2023 compared with $68 million in the third quarter of 2022. We projected an adjusted EBITDA of $72.5 million for the third quarter of 2023.

Financial Position

Timken had cash and cash equivalents of $368 million at the end of the third quarter of 2023 compared with $332 million at the end of 2022. Cash flow from operating activities was $194 million in the third quarter of 2023 compared with $145 million in the prior-year quarter. In the quarter, Timken returned $87.3 million of cash to shareholders through dividends and share repurchases.

The long-term debt as of Sep 30, 2023, was $1.6 billion, down from $1.91 billion as of Dec 31, 2022. The net debt to adjusted EBITDA ratio was 2.0 as of Sep 30, 2023, up from the 1.9 reported as of Dec 31, 2022.

2023 Guidance

To reflect softer end-market demand conditions, Timken anticipates adjusted earnings per share between $6.85 and $6.95 for 2023, lower than the previously provided $6.90-$7.30. Revenue growth is projected at 5-5.5%.

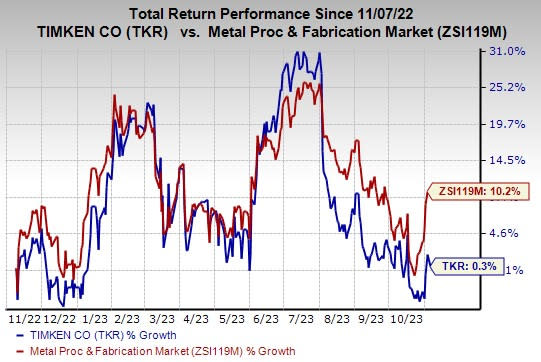

Price Performance

In the past year, Timken’s shares have gained 0.3% compared with the industry’s 10.2% growth.

Image Source: Zacks Investment Research

Zacks Rank and Key Picks

Timken currently carries a Zacks #3 Rank (Hold).

Some better-ranked stocks from the Industrial Products sector are Brady BRC, Applied Industrial Technologies AIT and Emerson Electric Co. EMR. BRC currently sports a Zacks Rank #1 (Strong Buy), and AIT and EMR have a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Brady’s 2023 earnings per share is pegged at $3.62. The consensus estimate for 2023

earnings has moved 13% north in the past 60 days and suggests year-over-year growth of 9.9%. The company has a trailing four-quarter average earnings surprise of 7.2%. Shares of BRC rallied 17.7% in the last year.

Applied Industrial has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pegged at $9.13 per share, which indicates year-over-year growth of 2%. Estimates have moved up 2% in the past 60 days. The company’s shares gained 27% in the last year.

Emerson has an average trailing four-quarter earnings surprise of 7.4%. The Zacks Consensus Estimate for EMR’s 2023 earnings is pegged at $4.45 per share. The consensus estimate for 2023 earnings has moved 1% north in the past 60 days. EMR shares gained 5.9% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Timken Company (The) (TKR) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report