Timken (TKR) Stock Scales 52-Week High: More Room to Run?

Shares of The Timken Company TKR scaled a new 52-week high of $89.79 on Jun 28, before closing the session a tad lower at $89.44.

TKR has a market capitalization of $6.48 billion and a Zacks Rank #3 (Hold) currently.

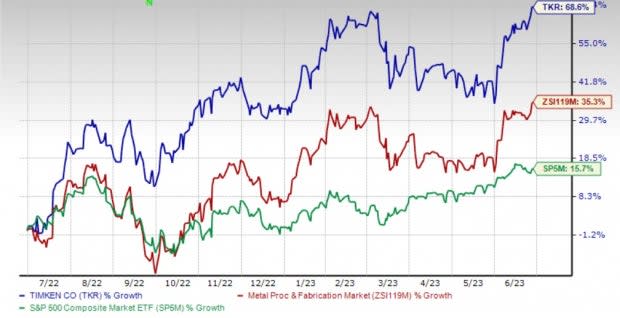

In the past year, Timken’s shares have gained 68.6%, compared with the industry’s 35.3% growth. The S&P 500 has gained 15.7% in the same timeframe.

Image Source: Zacks Investment Research

Solid Q1 Results

Underlying customer demand and end-market momentum remain strong across most of Timken’s sectors. TKR continues to witness business wins in new markets and regions. The company has been reporting double-digit organic growth for eight consecutive quarters. It reported record earnings per share of $2.09 in the first quarter of 2023, which reflected sales growth, margin expansion, contributions from acquisitions and share buybacks.

Upbeat 2023 Expectations

Backed by this record performance in the first quarter of 2023 as well as the impact of the Nadella acquisition along with improved backlog and demand levels, Timken expects 2023’s total revenues to be up 9.5% at the midpoint from the 2022 reported levels. Apart from strong demand, earnings growth continues to be supported by benefits from price realization and growth initiatives. The company has managed to offset the impacts of inflationary cost pressure through pricing actions and operational excellence initiatives.

Solid Prospects in Food & Beverage

The company recently stated that it is experiencing strong demand for the broad range of products and services it offers to the food and beverage industry. Timken achieved a sales CAGR of more than 30% in the market over the last five years. This has been aided by the company’s solid portfolio of organic and inorganic food and beverage products that it has built through the years.

Timken’s expanding global footprint, new and innovative products and growing demand for food are expected to fuel growth in the coming years.

The market for food and beverage processing equipment is estimated to increase from $64.6 billion in 2023 to $84.9 billion by 2028. The company is also building its aftermarket business. Most industrial motion and bearing positions in a food-processing plant have short replacement cycles, which translates into further opportunities for Timken.

Earnings estimates for Timken have also moved up over the past 60 days. The Zacks Consensus Estimate for 2023 bottom line has increased 4% and the same for 2024 has moved up 3%. The favorable estimate revisions instill investors’ confidence in the stock.

Key Picks

Some better-ranked stocks from the Industrial Products sector are Hubbell Incorporated HUBB, The Manitowoc Company, Inc. MTW and W.W. Grainger, Inc. (GWW). HUBB and MTW sport a Zacks Rank #1 (Strong Buy) at present, and GWW has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hubbell has an average trailing four-quarter earnings surprise of 21%. The Zacks Consensus Estimate for HUBB’s fiscal 2023 earnings is pegged at $13.81 per share. The consensus estimate for 2023 earnings has moved 22.5% north in the past 60 days. Its shares have gained 70.3% in the past year.

Manitowoc has an average trailing four-quarter earnings surprise of 38.8%. The Zacks Consensus Estimate for MTW’s 2023 earnings is pegged at 85 cents per share. The consensus estimate for 2023 earnings has moved 63.5% north in the past 60 days. MTW’s shares have gained 61.1% in the past year.

The consensus estimate for Grainger’s 2023 earnings per share is pegged at $35.83, up 7.6% in the past 60 days. It has a trailing four-quarter average earnings surprise of 9.1%. GWW has gained 59% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Timken Company (The) (TKR) : Free Stock Analysis Report

Hubbell Inc (HUBB) : Free Stock Analysis Report