Is tinyBuild, Inc.'s (LON:TBLD) Stock's Recent Performance Being Led By Its Attractive Financial Prospects?

tinyBuild (LON:TBLD) has had a great run on the share market with its stock up by a significant 7.9% over the last month. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. Particularly, we will be paying attention to tinyBuild's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for tinyBuild

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for tinyBuild is:

13% = US$13m ÷ US$103m (Based on the trailing twelve months to June 2022).

The 'return' refers to a company's earnings over the last year. So, this means that for every £1 of its shareholder's investments, the company generates a profit of £0.13.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of tinyBuild's Earnings Growth And 13% ROE

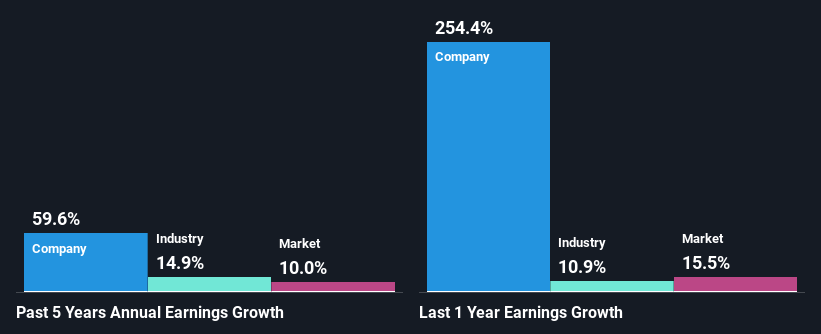

To begin with, tinyBuild seems to have a respectable ROE. Further, the company's ROE compares quite favorably to the industry average of 9.1%. Probably as a result of this, tinyBuild was able to see an impressive net income growth of 60% over the last five years. We reckon that there could also be other factors at play here. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

As a next step, we compared tinyBuild's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 15%.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. What is TBLD worth today? The intrinsic value infographic in our free research report helps visualize whether TBLD is currently mispriced by the market.

Is tinyBuild Making Efficient Use Of Its Profits?

Given that tinyBuild doesn't pay any dividend to its shareholders, we infer that the company has been reinvesting all of its profits to grow its business.

Summary

Overall, we are quite pleased with tinyBuild's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here