tinyBuild (LON:TBLD) investors are sitting on a loss of 49% if they invested a year ago

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by tinyBuild, Inc. (LON:TBLD) shareholders over the last year, as the share price declined 49%. That's well below the market decline of 27%. tinyBuild may have better days ahead, of course; we've only looked at a one year period.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for tinyBuild

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the tinyBuild share price fell, it actually saw its earnings per share (EPS) improve by 235%. It could be that the share price was previously over-hyped.

It's surprising to see the share price fall so much, despite the improved EPS. So it's easy to justify a look at some other metrics.

tinyBuild managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

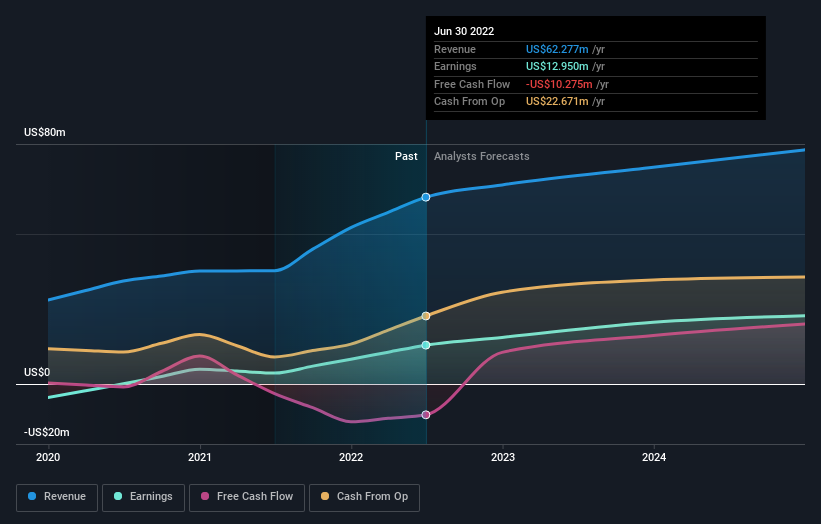

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that tinyBuild has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at tinyBuild's financial health with this free report on its balance sheet.

A Different Perspective

We doubt tinyBuild shareholders are happy with the loss of 49% over twelve months. That falls short of the market, which lost 27%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 3.7%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for tinyBuild you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here