‘You're out, you're done’: Dave Ramsey tells a frustrated Michigan landlord to ditch his duplex and move on — 3 ways to invest in real estate without the headaches of having tenants

If you ask Dave Ramsey, there’s no room for dilly-dallying when it comes to real estate investments.

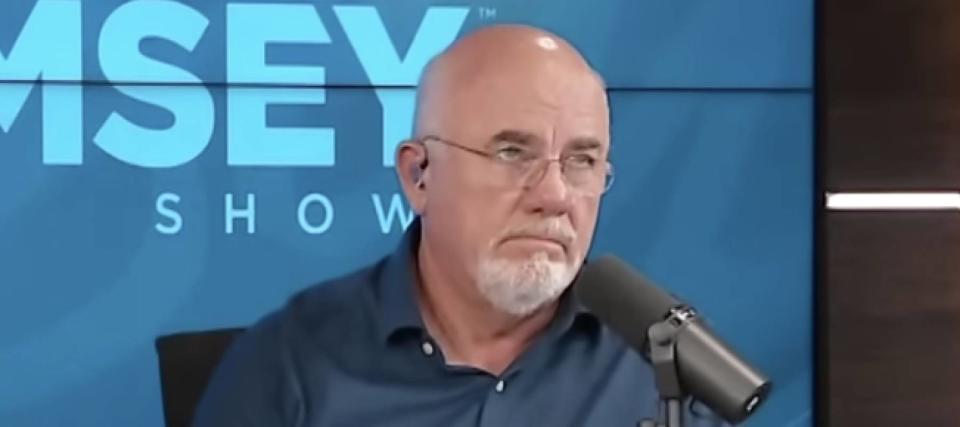

When a young Michigan landlord named Joe called into The Ramsey Show for advice about what to do with a duplex he no longer cares for, Dave Ramsey gave it to him straight.

“You’re out, you’re done,” the personal finance expert said.

Don’t miss

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Joe admitted he was tired of having tenants — and of living underneath them — but he remained uncertain about how to handle his investment. He asked Ramsey whether it made sense to keep the duplex as a rental property and use the income to live elsewhere.

‘I would sell the crap out of this thing,” Ramsey responded during the September episode.

“Someday later, you may want to be a landlord again, but right now, you’ve had your trip on the crazy train and you’re tired of the crazy train. That’s ok. Take a break from crazy. Go get you a house,” he added.

Many Americans are still priced out of the housing market by high home prices and mortgage rates that are still hovering well above 7%.

But if you’re keen to invest in a rental property, but like Joe, you’re not sure if you’re cut out for the landlord life, here are three other ways you can invest in the real estate market.

Real estate investment trusts

Investing in a real estate investment trust (REIT) is a way to profit from the real estate market without having to buy a physical property or deal with any landlord duties.

Like giant landlords, REITs are publicly traded companies that own income-producing real estate like apartment buildings, shopping centers and office towers. They collect rent from tenants and pass that rent to shareholders in the form of regular dividend payments.

Generally, they’re described as high-return investments that provide solid dividends and the potential for moderate, long-term capital appreciation.

Also, as REITs are publicly traded, you can buy or sell shares any time and your investment can be as little or as large as you want — unlike buying a house, which usually requires a hefty down payment followed by a mortgage.

Real estate ETFs

Another easy way to invest in real estate without having to pick and choose which stocks to buy and sell, is through exchange-traded funds (ETFs). You can think of an ETF as a diversified portfolio of stocks.

As ETFs trade on major exchanges, they’re convenient to buy and sell. Some ETFs passively track an index, while others are actively managed. One thing to note is that they all charge a fee — referred to as the management expense ratio (MER) — in exchange for managing the fund.

The iShares U.S. Real Estate ETF (IYR), for example, gives investors targeted access to domestic real estate stocks and REITs. The fund is managed by BlackRock and currently holds 78 stocks with total net assets of $2.85 billion. Since the fund’s inception in June 2000, IYR’s net asset value (NAV) has grown 8.47%. Its MER is 0.39%.

Read more: Save big on your holiday shopping with an app that’s already saved users $800 million

You can also check out the iShares Cohen & Steers REIT ETF (ICF), which tracks an index of U.S. REITs, with its top sectors being telecom towers, retail, data centers and multi-family residential. With 30 holdings and total net assets of $2.24 billion, this is another giant ETF that has produced total returns of 8.66% since its inception in January 2001.

Two other giants to consider are the Vanguard Real Estate ETF (VNQ) and the Real Estate Select Sector SPDR Fund (XLRE). Like all things investing, there are many options and it’s important to consider what best meets your needs and your financial goals.

Crowdfunding platforms

Crowdfunding refers to the practice of funding a project by raising small amounts of money from a large number of people. This can include real estate.

Through a crowdfunding platform, you can buy a percentage of physical real estate — from rental properties to commercial properties.

Some options are targeted at accredited investors, sometimes with higher minimum investments that can reach tens of thousands of dollars.

These platforms can also make real estate investing more accessible to the general public by simplifying the process and lowering the barrier to entry. Many platforms let you invest small sums, even as low as $100.

Sponsors of crowdfunded real estate deals usually charge fees to investors — typically in the range of 0.5% to 2.5% of whatever you’ve invested.

What to read next

Worried about the economy? Here are the best shock-proof assets for your portfolio. (They’re all outside of the stock market.)

Finish 2023 stronger than you started: 5 money moves you should make before the end of the year

The US dollar has lost 87% of its purchasing power since 1971 — invest in this stable asset before you lose your retirement fund

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.