Titan International Inc (TWI) Navigates Market Headwinds with Strong Free Cash Flow in FY 2023

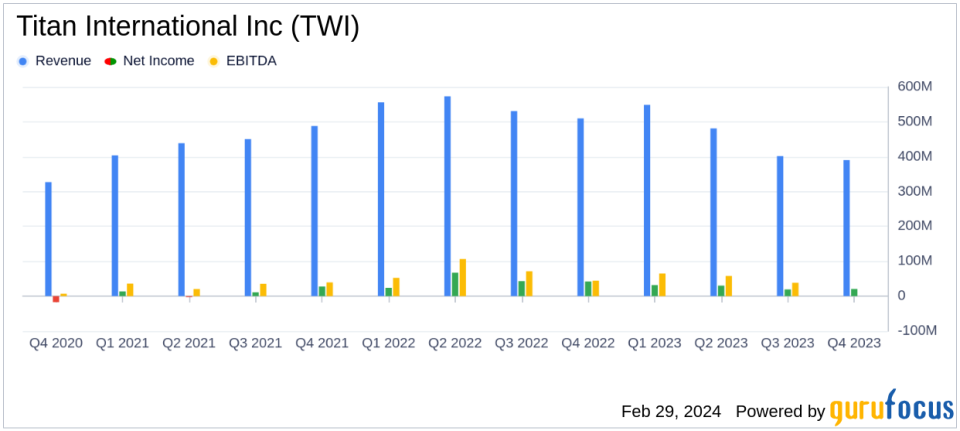

Net Sales: $390.2 million in Q4 2023, a decrease from $509.8 million in Q4 2022.

Gross Profit: Maintained at 14.9% in Q4 2023, consistent with 15.0% in the prior year period.

Free Cash Flow: Record $119 million, highlighting effective working capital management.

Net Debt: Reduced to $205.8 million at the end of 2023, from $286.0 million at the end of 2022.

Acquisition: Completed the acquisition of Carlstar Group LLC, expected to diversify and strengthen the company's market position.

Adjusted EBITDA: $38.1 million in Q4 2023, compared to $52.8 million in the same period last year.

Capital Expenditures: Increased to $60.8 million in 2023, up from $47.0 million in 2022.

On February 29, 2024, Titan International Inc (NYSE:TWI) released its 8-K filing, detailing the financial results for the fourth quarter and fiscal year 2023. The company, a leading manufacturer of off-highway wheels, tires, assemblies, and undercarriage products, faced a challenging year with reduced demand and sales volume, particularly in the Americas. Despite these challenges, Titan International Inc managed to maintain its gross margin and reported a record free cash flow, underscoring its resilience and operational efficiency.

Company Overview

Titan International Inc operates through three segments: Agricultural, Earthmoving/Construction, and Consumer. The company's primary revenue comes from the Agricultural segment, which manufactures equipment such as tractors, combines, and plows. Titan International Inc serves a global market, with a significant presence in the United States, Europe/CIS, Latin America, and other international regions.

Financial Performance and Challenges

The company's net sales for Q4 2023 were $390.2 million, a significant decrease from $509.8 million in the same quarter of the previous year. This decline was attributed to a decrease in sales volume due to elevated inventory levels at OEM customers, lower demand for small agricultural equipment, and economic softness in Brazil. Despite these headwinds, Titan International Inc managed to maintain a gross margin of 14.9% for the quarter, consistent with the prior year, thanks to lower production input costs and continued productivity initiatives.

Strategic Acquisition and Market Conditions

The acquisition of Carlstar Group LLC is a strategic move for Titan International Inc, expected to diversify the customer base and product portfolio while adding key manufacturing and distribution assets. The company refrained from providing financial guidance due to the scope of integration work and the addition of new end markets.

Segment Performance

The Agricultural segment saw a 29.9% decrease in net sales for Q4 2023 compared to the same period in 2022, while the Earthmoving/Construction segment experienced an 18.7% decrease. The Consumer segment had a slight decrease of 1.6% in net sales. However, the Consumer segment's gross profit increased by 42.2%, indicating a potential area of growth for the company.

Financial Condition and Outlook

At the end of 2023, Titan International Inc had a strong cash position with $220.3 million in cash and cash equivalents. The company's long-term debt stood at $409.2 million, with a notable reduction in net debt from the previous year. Capital expenditures increased as the company invested in enhancing its facilities and manufacturing capabilities.

While the company faces soft demand in the agricultural sector and a challenging economic environment, the normalization of inventories and the strategic acquisition of Carlstar Group LLC position Titan International Inc for potential growth and expansion in the upcoming years.

For detailed financial tables and further information, please refer to the full 8-K filing.

Investors and interested parties can access the teleconference and webcast discussing the Q4 financial results on February 29, 2024, at 9 a.m. Eastern Time through the links provided in the earnings release.

This summary provides a snapshot of Titan International Inc's financial performance, highlighting the company's ability to navigate market challenges while maintaining profitability and executing strategic initiatives. For more in-depth analysis and updates, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Titan International Inc for further details.

This article first appeared on GuruFocus.