Titan Machinery Inc (TITN) Reports Record Revenue and Earnings for Fiscal 2024

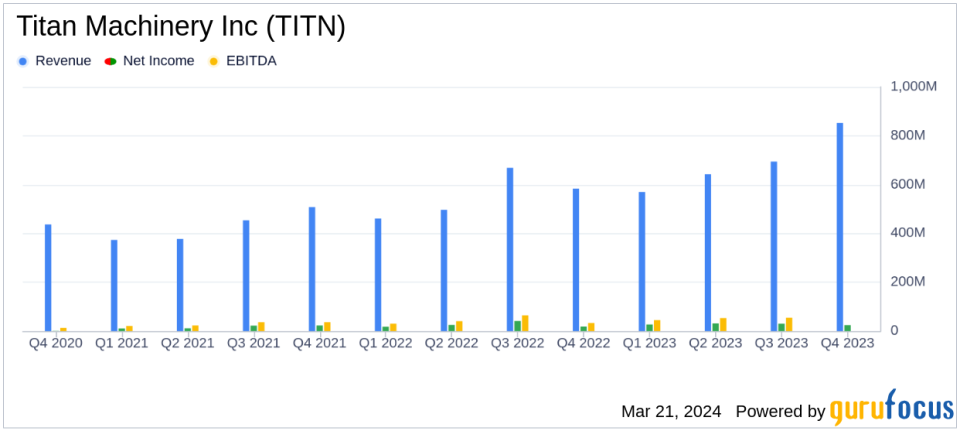

Revenue Growth: Titan Machinery Inc (NASDAQ:TITN) achieved a record $2.8 billion in revenue for fiscal 2024, marking a 24.9% increase year-over-year.

Earnings Per Share (EPS): The company reported a record EPS of $4.93, up 9.8% from the previous fiscal year.

Net Income: Net income for fiscal 2024 stood at $112.4 million, reflecting the company's strong profitability.

EBITDA: EBITDA reached $189.3 million, a 14.6% increase compared to fiscal 2023.

Segment Performance: All segments, including Agriculture, Construction, Europe, and Australia, contributed to the revenue growth, with Agriculture leading at a 40.8% increase.

Balance Sheet Strength: Cash at the end of fiscal 2024 was $38.1 million, with inventories rising to $1.3 billion due to strategic acquisitions and increased equipment availability.

On March 21, 2024, Titan Machinery Inc (NASDAQ:TITN) released its 8-K filing, detailing its financial performance for the fiscal fourth quarter and full year ended January 31, 2024. Titan Machinery Inc, a prominent network of full-service agricultural and construction equipment stores, has reported a record-breaking fiscal year with significant growth across all segments.

Company Overview

Titan Machinery Inc operates through segments that cater to different markets: Agriculture, Construction, Europe, and Australia. Each segment contributes to the company's comprehensive service offerings, which include sales, repairs, and rentals of equipment and machinery for various scales of farming, construction, and industrial use.

Fiscal 2024 Performance Highlights

The company's fiscal 2024 performance was marked by substantial revenue growth, with a 24.9% increase to a record $2.8 billion. This growth was propelled by robust sales across all legacy operating segments, including a significant contribution from the recent O'Connors acquisition. The consolidated pre-tax margin stood at 5.5%, and the company achieved record earnings per share of $4.93, a 9.8% increase from the previous year.

Despite facing challenges such as normalization of equipment gross margin and increased floorplan and other interest expenses due to higher inventory levels and interest rates, Titan Machinery Inc managed to deliver strong financial results. The company's focus on improving customer delivery pace and advancing its customer care strategy led to double-digit same-store growth for its recurring parts and service business.

Financial Achievements and Importance

The company's financial achievements are particularly noteworthy in the context of the Industrial Distribution industry. The record revenue and EPS underscore the company's ability to leverage market opportunities and operational efficiencies. The growth in EBITDA, which increased by 14.6% to $189.3 million, reflects the company's strong profitability and cash flow generation capabilities.

Financial Metrics and Commentary

Key financial metrics from the income statement show net income for fiscal 2024 at $112.4 million, with diluted earnings per share of $4.93. The balance sheet reveals a solid cash position of $38.1 million and a significant increase in inventories to $1.3 billion, reflecting strategic growth initiatives and acquisitions. Cash flow statements indicate a net cash used for operating activities of $32.3 million, primarily driven by an increase in inventories and timing of collections of accounts receivable.

"We finished fiscal year 2024 with a strong performance that was driven by growth across all of our legacy operating segments and resulted in record revenue of $2.8 billion, consolidated pre-tax margin of 5.5%, and record earnings per share of $4.93," stated Bryan Knutson, Titan Machinerys President & Chief Executive Officer.

Analysis of Company's Performance

Titan Machinery Inc's performance in fiscal 2024 reflects a well-executed strategy of growth through both organic means and strategic acquisitions. The company's ability to maintain a strong balance sheet while expanding its operations is indicative of prudent financial management and operational efficiency. The record revenue and EPS demonstrate the company's resilience and adaptability in a dynamic market environment.

For fiscal 2025, Titan Machinery Inc has provided modeling assumptions that forecast consolidated revenue growth, primarily led by the annualization of the O'Connors acquisition and steady growth in the parts and service business. The company expects earnings per share to be between $3.00 and $3.50, reflecting a cautious yet optimistic outlook in the face of shifting agricultural cycle dynamics and anticipated equipment margin compression.

Value investors and potential GuruFocus.com members may find Titan Machinery Inc's fiscal 2024 performance and strategic outlook compelling, as the company continues to demonstrate financial strength and a clear vision for sustained growth.

Explore the complete 8-K earnings release (here) from Titan Machinery Inc for further details.

This article first appeared on GuruFocus.