Titan Machinery (TITN) Q3 Earnings & Revenues Lag Estimates

Titan Machinery Inc. TITN reported earnings per share (EPS) of $1.32 in third-quarter fiscal 2024 (ended Oct 31, 2023), missing the Zacks Consensus Estimate of EPS of $1.51. The bottom line declined 27% from the EPS of $1.82 reported in the year-ago quarter.

Total revenues in the reported quarter were a record $694 million, up 4% from the year-ago quarter. The top line however fell short of the consensus mark of $723 million.

Equipment revenues rose 2.5% year over year to $522 million and parts revenues were up 6% to $115 million. Revenues generated from service were $45 million in the reported quarter, up 15% from the year-ago quarter. Meanwhile, rental revenues were up 4% year over year to $12.6 million.

Titan Machinery Inc. Price, Consensus and EPS Surprise

Titan Machinery Inc. price-consensus-eps-surprise-chart | Titan Machinery Inc. Quote

Costs and Margins

Cost of sales was up 5% year over year to $556 million in the quarter under review. Gross profit dipped 0.9% year over year to $138 million. The gross margin was 19.9% compared with 20.9% in the year-ago fiscal quarter. The contraction was due to lower equipment and parts margins, partially offset by higher service and rental margins.

Operating expenses increased 8.5% from the year-ago quarter to $92 million due to acquisitions and an increase in variable expenses. Adjusted EBITDA decreased 21% year over year to $50 million. The adjusted EBITDA margin in the fiscal third quarter was 7.2% compared with 9.5% in the year-ago quarter.

Segment Performance

Agriculture revenues rose 7.7% to $531 million from the last fiscal year’s comparable quarter. The upside was driven by benefits from the recent acquisition of Pioneer Farm Equipment and same-store growth of 3.5%. The segment’s income before taxes declined 16.4% year over year to $35 million.

Construction revenues were $77.5 million in the fiscal third quarter, down 10% from the comparable quarter in the prior fiscal year. The timing of equipment deliveries has shifted some revenues into the fourth quarter of this year, leading to the decline. The segment reported income before taxes of $4.1 million, down 33% from the year-ago quarter’s $6.1 million.

Europe revenues were $85 million, down from the year-ago quarter’s $89 million owing to weak demand. The segment reported income before taxes of $5.1 million, which marked a 39% plunge year over year.

Financial Position

Cash used for operating activities was $82 million in the first nine months of fiscal 2024 compared with $7.1 million used in the prior-year period. Titan Machinery ended the reported quarter with a cash balance of around $70 million.

Other Updates

In October 2023, Titan Machinery completed the acquisition of O'Connors, Australia's leading Case IH dealership group. O'Connors has a record of delivering strong financial performance through a combination of organic and acquisitive growth.

With this acquisition, Titan Machinery intends to build its presence in Southeastern Australia and capitalize on operational synergies across its global footprint.

FY24 Guidance

The company expects EPS of $4.60-$5.25 for fiscal 2024. The Agriculture segment’s revenues are projected to grow 20-23%, down from 20-25% stated earlier. The Construction segment’s revenues are expected to grow 4-7% for fiscal 2024, updated from the previously mentioned 5-10% growth. Europe revenues are expected to increase 4-7%, updated from growth of 5-10% mentioned earlier.

TITN will report its Australia segment starting in the fourth quarter. Revenues for the year are expected to be $70-$80 million for fiscal 2024.

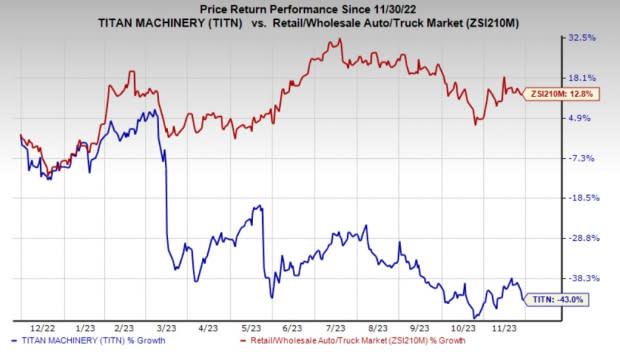

Share Price Performance

In the past year, shares of Titan Machinery have fallen 40% against the industry’s 14.5% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Titan Machinery currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the Retail - Wholesale sector are Target TGT, Abercrombie & Fitch ANF and American Eagle Outfitters AEO.

Target, which provides an array of goods ranging from household essentials and electronics to toys and apparel for men, women and kids, currently has a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for TGT’s fiscal 2023 sales indicates 1.4% growth from the year-ago reported level. The company has a trailing four-quarter earnings surprise of 24.2%, on average.

Abercrombie, a specialty retailer of premium, high-quality casual apparel for men, women, and kids, presently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for Abercrombie’s current fiscal-year sales suggests growth of 12.3% from the year-ago reported number. ANF has a trailing four-quarter earnings surprise of 713%, on average.

American Eagle, a specialty retailer of casual apparel, accessories and footwear for men and women, currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for American Eagle’s current financial-year sales and earnings suggests growth of 3.7% and 37.1%, respectively, from the year-ago period’s actuals. AEO has a trailing four-quarter earnings surprise of 23%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Titan Machinery Inc. (TITN) : Free Stock Analysis Report