Titan Machinery (TITN) Tops Q2 Earnings Estimates, Rises Y/Y

Titan Machinery Inc. TITN reported adjusted earnings per share (EPS) of $1.38 in second-quarter fiscal 2024 (ended Jul 31, 2023), beating the Zacks Consensus Estimate of $1.15. The bottom line increased 25% from the EPS of $1.10 reported in the year-ago quarter.

Total revenues in the reported quarter were $643 million, up 29.4% from the year-ago quarter’s levels. The top line surpassed the consensus mark of $600 million. The upside is driven by solid performance across its segments.

Equipment revenues rose 28% year over year to $480 million, whereas parts revenues were up 39.6% to $109 million. Revenues generated from service were $42.5 million in the reported quarter, up 27.2% from the year-ago quarter. Meanwhile, rental revenues were up 11.7% year over year to $11.5 million.

Titan Machinery Inc. Price, Consensus and EPS Surprise

Titan Machinery Inc. price-consensus-eps-surprise-chart | Titan Machinery Inc. Quote

Costs and Margins

Cost of sales was up 29.3% to $509 million from the prior fiscal year’s quarterly reading. Gross profit increased 29.9% year over year to $133 million. The gross margin was 20.8%, up from 20.6% in the last fiscal year’s quarter.

Operating expenses increased 28.9% from the earlier fiscal year to $89 million. Adjusted EBITDA increased 25.4% year over year to $50 million. The adjusted EBITDA margin in the fiscal second quarter was 7.8% compared with 8.1% in the prior-year quarter.

Segmental Performance

Agriculture revenues rose 34.4% to $469 million from the last fiscal year’s comparable quarter. The upside was driven by benefits from recent acquisitions. The segment’s income before taxes rose 32.5% year over year to $33 million.

Construction revenues were $83 million in the fiscal second quarter, up 18.4% from the comparable quarter in the prior fiscal year. The segment reported income before taxes of $5.2 million, up from the prior-year quarter’s $3.9 million.

International revenues were $91 million compared with the year-ago quarter’s $78 million. The segment reported income before taxes of $5.6 million compared with the $5.9 million reported in the previous-year quarter.

Financial Position

Cash used for operating activities was $51 million in the first half of fiscal 2024 compared with $21 million in the prior-year period. Titan Machinery ended the reported quarter with a cash balance of around $53 million.

Business Updates

On Aug 30, 2023, Titan Machinery announced that it inked a deal to acquire O'Connors — Australia's leading Case IH dealership group. O'Connors has a record of delivering strong financial performance through a combination of organic and acquisitive growth.

With this acquisition, Titan Machinery intends to build its presence in Southeastern Australia and capitalize on operational synergies across its global footprint.

FY24 Guidance

The company expects earnings per share of $4.60-$5.25 for fiscal 2024. The Agriculture segment’s revenues are projected to grow 20-25%. The Construction segment’s revenues are pegged at growth of 5-10% for fiscal 2024, updated from the previously mentioned flat to 5% growth. International revenues are expected to increase 5-10%, updated from growth of 8-13% mentioned earlier.

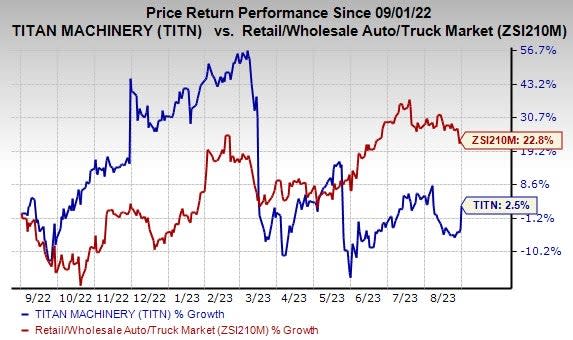

Share Price Performance

In the past year, shares of Titan Machinery have gained 2.5% compared with the industry’s growth of 22.8%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Titan Machinery currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Retail - Wholesale sector are Amazon.com, Inc. AMZN, Yum China, Inc. YUMC and Chuy's Holdings, Inc. CHUY. AMZN flaunts a Zacks Rank #1 (Strong Buy) at present, and YUMC and CHUY have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Amazon's 2023 earnings per share is pegged at $2.23, suggesting an increase of 214% from that reported in the last year. The consensus estimate for 2023 earnings moved 43% upward in the last 60 days. AMZN has a trailing four-quarter average earnings surprise of 40.6%. Its shares gained 8% in the last year.

Yum China has an average trailing four-quarter earnings surprise of 31.7%. The Zacks Consensus Estimate for YUMC’s 2023 earnings is pegged at $2.06 per share. This indicates a 96.2% increase from the prior-year reported figure. The consensus estimate for 2023 earnings has moved north by 4% in the past 60 days. Its shares gained 10.4% in the last year.

Chuy’s has an average trailing four-quarter earnings surprise of 26.5%. The Zacks Consensus Estimate for CHUY’s 2023 earnings is pegged at $1.82 per share. This indicates a 32.9% increase from the prior-year reported figure. The consensus estimate for 2023 earnings has moved 5% north in the past 60 days. CHUY’s shares gained 71.3% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Titan Machinery Inc. (TITN) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Yum China (YUMC) : Free Stock Analysis Report