TJX's (NYSE:TJX) Q4: Beats On Revenue

Off-price retail company TJX (NYSE:TJX) beat analysts' expectations in Q4 FY2024, with revenue up 13% year on year to $16.41 billion. It made a GAAP profit of $1.22 per share, improving from its profit of $0.89 per share in the same quarter last year.

Is now the time to buy TJX? Find out by accessing our full research report, it's free.

TJX (TJX) Q4 FY2024 Highlights:

Revenue: $16.41 billion vs analyst estimates of $16.19 billion (1.4% beat)

EPS: $1.22 vs analyst estimates of $1.13 (8.3% beat)

EPS guidance for 2024 of $3.97 at the midpoint, below expectations of $4.12 (3.6% miss)

Free Cash Flow of $2.36 billion, down 11.6% from the same quarter last year

Gross Margin (GAAP): 29.8%, down from 48.7% in the same quarter last year

Same-Store Sales were up 5% year on year (beat vs. expectations of up 4.0% year on year)

Store Locations: 4,954 at quarter end, increasing by 119 over the last 12 months

Market Capitalization: $114.6 billion

Ernie Herrman, Chief Executive Officer and President of The TJX Companies, Inc., stated, “I am extremely proud of the performance of our teams again in 2023. Thanks to their excellent execution of our great business model, we delivered outstanding results on both the top and bottom lines that exceeded our expectations. We surpassed $50 billion in annual sales, a milestone for our Company. We brought our customers exciting values on great brands and fashions and a treasure-hunt shopping experience, every day. Throughout the holiday season, we shipped a fresh assortment of gift giving selections to our stores and online which clearly resonated with consumers. Comparable store sales for the Company increased 5% both for the fourth quarter and full year, well above our original plans for 2023. We saw comp sales growth at every division driven by customer transactions, which underscores our confidence in our ability to gain market share across all of our geographies. We had a very strong finish to 2023 and start the new year in a position of strength with the first quarter off to a good start. We are energized and laser focused on capitalizing on our opportunities for the year ahead and, as always, we’ll strive to beat our plans. Longer term, we are excited about the potential we see to strategically grow our business, capture additional market share, and increase the profitability of our Company.”

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE:TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

Off-Price Apparel and Home Goods Retailer

Off-price retailers, which sell name-brand goods at major discounts because of their unique purchasing and procurement strategies, understand that everyone loves a good deal. Specifically, these companies buy excess inventory and overstocks from manufacturers and other retailers so they can turn around and offer these products at super competitive prices. Despite the unique draw lure of discounts, these off-price retailers must also contend with the secular headwinds of online penetration and stalling retail foot traffic in places like suburban shopping centers.

Sales Growth

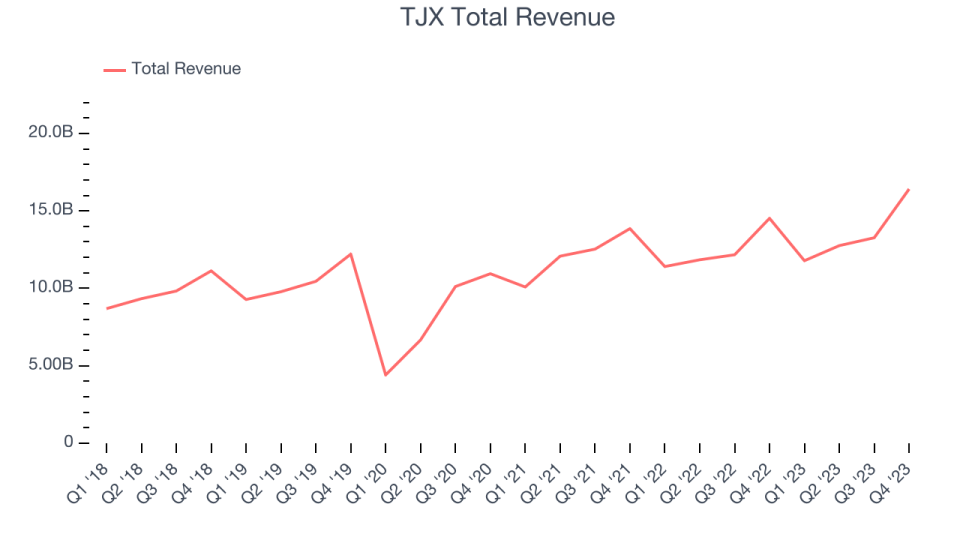

TJX is a behemoth in the consumer retail sector and benefits from economies of scale, an important advantage giving the business an edge in distribution and more negotiating power with suppliers.

As you can see below, the company's annualized revenue growth rate of 6.8% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new stores and grew sales at existing, established stores.

This quarter, TJX reported robust year-on-year revenue growth of 13%, and its $16.41 billion in revenue exceeded Wall Street's estimates by 1.4%. Looking ahead, Wall Street expects sales to grow 4% over the next 12 months, a deceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

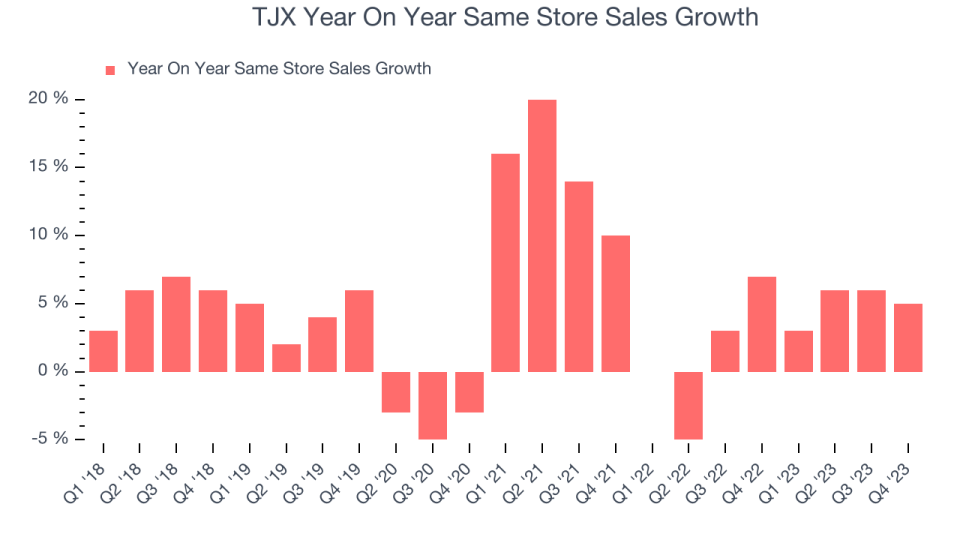

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

TJX's demand within its existing stores has been relatively stable over the last eight quarters but fallen behind the broader consumer retail sector. On average, the company's same-store sales have grown by 2.1% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, TJX is reaching more customers and growing sales.

In the latest quarter, TJX's same-store sales rose 5% year on year. This growth was an acceleration from the 4% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Key Takeaways from TJX's Q4 Results

We were impressed by how significantly TJX blew past analysts' gross margin expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates. On the other hand, its full-year earnings forecast missed analysts' expectations and its earnings guidance for next quarter missed Wall Street's estimates. The company is, on the other hand, increasing its dividend by 13% and committed to buying back $2.0 to $2.5 billion of shares in the coming year, a testament to its strong and dependable free cash generation. As reference, the company bought back $2.5 billion in the latest year. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is flat after reporting and currently trades at $100.99 per share.

So should you invest in TJX right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.