Toast Is Poised to Gain on Strong Customer Adoption as Profitability Improves

Toast Inc. (NYSE:TOST) is an all-in-one software-as-a-service offering for the restaurant industry. With the stock up 12% year to date, the company has managed to grow its number of locations 34% year over year to 106,000 as it continues to gain market share in a large total addressable market. While revenue growth has slowed from its prior levels and macroeconomic uncertainties remain a concern, I believe the company is driving targeted efforts to acquire new customers and drive deeper adoption, which has allowed it to improve its operating margins at the same time.

As such, I believe the company is currently undervalued and should drive sizable returns over a five-year investment horizon as it gains deeper market share both in the U.S. and internationally while further expanding its margins.

About Toast

Toast provides an all-in-one cloud-based technology platform for the restaurant industry. As of the fourth quarter of 2023, the company has processed over $126.20 billion in gross payment volume over the trailing 12 months across 106,000 restaurant locations.

The core of the platform is its Toast POS system, which integrates point-of-sale functions and payment processing for restaurants. In the fourth quarter, 82% of its revenue came from processing transactions. At the same time, Toast also offers a number of restaurant-specific modules, such as payroll, marketing and loyalty, digital ordering and delivery, invoicing, supply chain management and accounting, through a subscription-based pricing model.

For the three months ended Dec. 31, its subscription revenue jumped 49% to $142 million, growing faster than its overall revenue growth. Moving forward, I believe Toast's subscription-based products will help accelerate its revenue growth, as the emphasis on building an integrated platform for the restaurant industry will foster deeper customer loyalty and adoption across existing and new restaurant locations.

Building the bull case

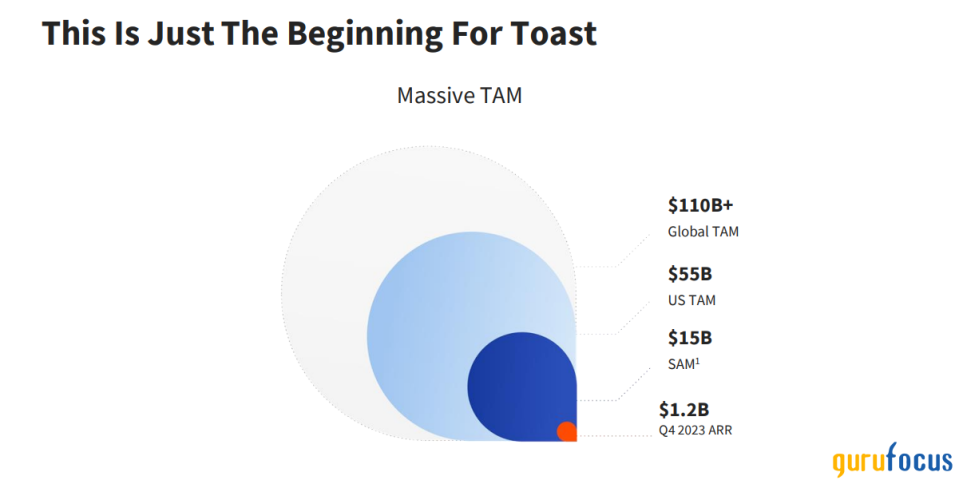

Toast operates in a large total addressable market, with plenty of room ahead for growth as customer adoption deepens.

In its latest earnings report, the company announced it added 6,500 net locations, increasing its total locations 34% year over year to 106,000. The company estimates there are approximately 860,000 restaurant locations in the U.S., contributing $1 trillion, or 4%, of total U.S. gross domestic product. Given Toast has onboarded 106,000 restaurant locations, that would mean that it has penetrated 12.30% of all restaurants in the U.S., up from 11.50% in the third quarter of the year.

At the same time, the company estimates a total addressable market of $55 billion in the U.S. and $110 billion globally. While the company has already started expanding internationally to 1,000 locations in Canada, the U.K. and Ireland as of the fourth quarter, it is still in the early stages. In 2023, the company generated $3.9 billion in revenue, which would translate to a U.S. market share of 7%.

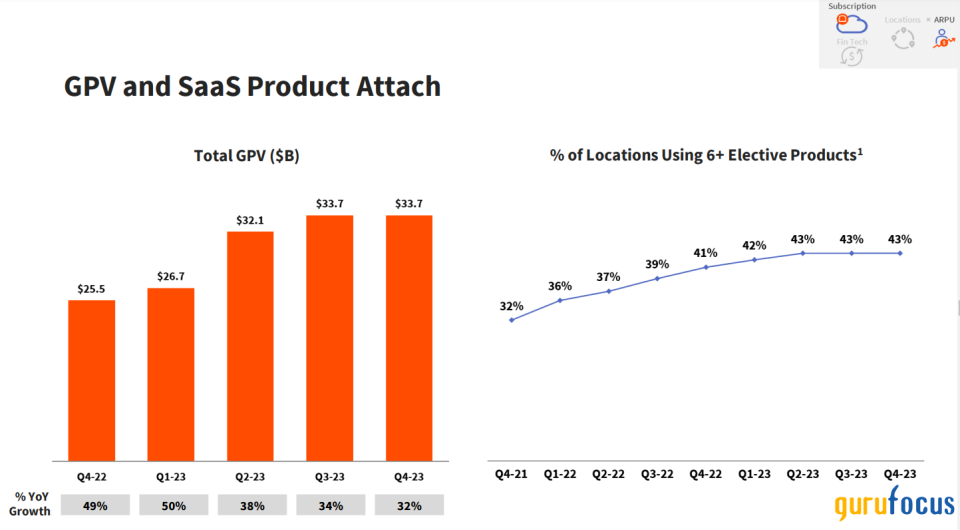

Apart from successfully scaling its presence in new locations, the company is seeing tremendous success in its product adoption, as it has 43% of its customers that are using six or more Toast product modules on its platform, up from 41% a year ago. Meanwhile, the company management remains firmly committed to investing in building its upsell team, as part of the sales organization, as it is an important driver to deepen product adoption across its customer base across locations. I believe that this approach will help the company efficiently grow its average revenue per user while expanding its economies of scale.

This is what Toast CEO Aman Narang said during the earnings call, which further illustrates how management is thinking about scaling revenue growth in the future to drive deeper market share. He said:

In 2023, we grew total ARR 35% year over year. We believe there is runway in our existing markets to continue to scale locations while also increasing both SaaS and fintech ARR to product innovation, pricing and our continued investment in upselling existing customers through our growth sales team.

Revenue growth also exceeded expectations, while expanding margins should bode well for investor optimism. In its latest quarter, Toast grew its revenue by 35% to $1.04 billion, which exceeded expectations by 2%. Meanwhile, for the full year, the company produced total revenue of $3.90 billion, up 42% year over year. Subscription revenue grew 49% to $142 million. This is the fastest-growing segment with the highest gross margin, although it contributes just 13.70% of total revenue. Meanwhile, financial technology solutions revenue grew 33% to $851 million and hardware and professional services revenue grew 26% to $43 million.

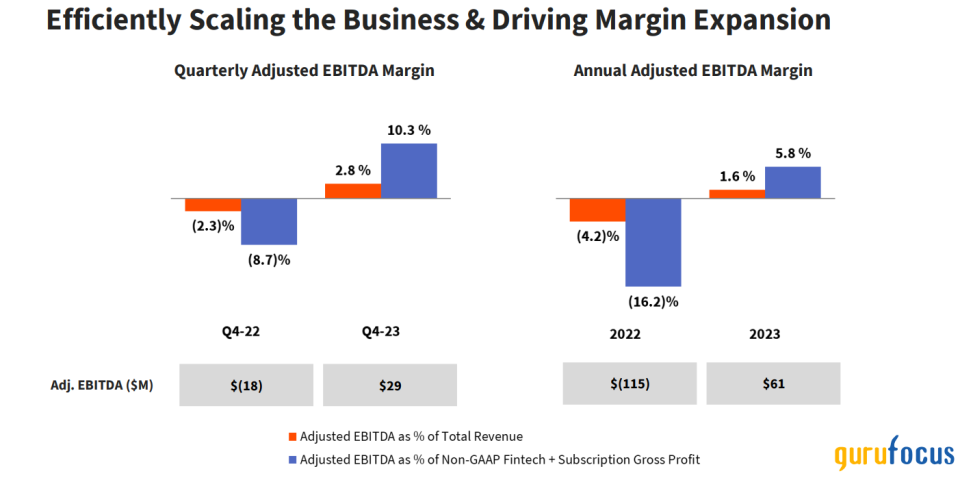

At the same time, 2023 adjusted Ebitda came in at $61 million, representing a margin of 1.60%. This is a huge improvement from 2022, when adjusted Ebitda was a $115 million loss. This was accomplished by streamlining total operating expenses, which grew at a much slower pace of 9.70% year over year compared to the overall revenue growth of 35% in the fourth quarter. In my opinion, this is demonstrating management's commitment to drive growth profitably as it improves its overall efficiency while building out targeted strategies to expand its market share.

Shifting gears to 2024 guidance, Toast management believes the company should be able to grow its gross profit by 23% to 25% to $1.30 billion to $1.32 billion. At the same time, management guided for adjusted Ebitda to grow 244% year over year to $210 million (taking the midpoint). The company is also targeting profitability on a GAAP basis in the first half of 2025. Plus, prior to the earnings call, the company announced it would reduce its headcount by 550 employees, or about 10% of its workforce, which would allow it to realize $100 million in annualized savings.

While the company has not provided guidance on revenue growth expectations forthe year, I believe it would be fair to assume it will grow in line with the gross profit of 23% to 25%. While this marks a slowdown in growth from prior levels, I believe the company is well positioned to drive innovation that allows it to gain market share as it expands into new locations (in the U.S. and internationally) and drives deeper adoption, allowing it to grow more efficiently while expanding its margins.

Building the bear case

While the U.S. economy has so far successfully navigated a difficult macroeconomic environment of high inflation and interest rates, as consumers continue to spend on eating out at restaurants, with spending in restaurants up 11.60% year over year, there is a growing fear that inflation may again be on the rise. With the latest inflation print exceeding expectations, the Federal Reserve may need to hold interest rates at current levels for longer than anticipated, or worse, raise them further. As the prospects of the Fed interest rate cuts are pushed out, it will start to hurt both the U.S. consumer and businesses. The longer interest rates remain high, the more consumers will be squeezed by higher interest payments on their credit cards, which stand at a record $1.08 trillion. This will most certainly start to weigh down on consumer discretionary spending, with restaurants being one of them.

Furthermore, higher interest rates are going to increasingly make it more difficult for small and medium-sized businesses as their revenues are directly impacted by a slowdown in consumer spending. Restaurants mostly fall into the SMB target market, and a slowdown or a minor recession in the U.S. economy is bound to have adverse effects on their revenue, leading them to cut back on spending, especially on their technology stack, in order to protect their margins and to stay in business. I believe this in turn will hurt Toast's revenue, as customers will use fewer product modules, or worse, not renew at all.

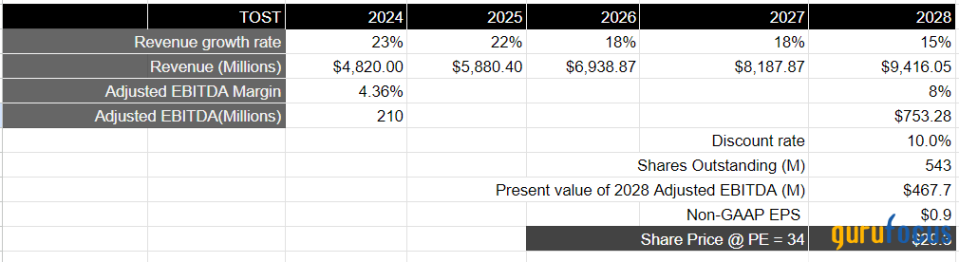

Tying it together: Toast is poised to gain 38% from its current levels

Toast severely underperformed the indexes in 2023. However, the stock is up 12% year to date. Moving forward, I believe it is fair to assume the company will continue to grow in the low 20s range over the next two years as it focuses on growing its presence into new locations while deepening its customer loyalty by upselling a higher number of product modules, thus growing its ARPU. Following fiscal year 2025, I will assume the company maintains its growth rate in the high teens into 2028. At the same time, given the management's focus on driving operating efficiency, I believe the company should be able to grow its adjusted Ebitda margins from an estimated 4.30% to 8% by 2028. This would mean the company produces close to $750 million in adjusted Ebitda, which translates to a present value of $467 million when discounted at 10%.

Taking the S&P 500 as a proxy, where it has grown its earnings by 8% on average over the last 10 years, with a price-earnings multiple in the range of 15 to 18, I believe it is fair to assume Toast should trade at twice the multiple of the S&P 500 in 2028 as I expect the company to continue to grow its adjusted Ebitda in line with revenue growth rates in the mid-to-high teens. This would translate to a forward price-earnings multiple of 34, which would mean the stock is currently undervalued with a potential upside of 38% to a price target of $29.

Conclusion

While revenue growth is expected to slow down from its prior levels and uncertainties remain on the overall macroeconomic front, I believe the company is moving in all the right directions to drive deeper adoption by investing in its sales team and expanding into new locations to gain market share. Plus, management has demonstrated its commitment to expand its margins and grow profitably. As a result, I believe the stock is positioned to drive sizable returns of 38% from its current levels over a five-year investment horizon.

This article first appeared on GuruFocus.