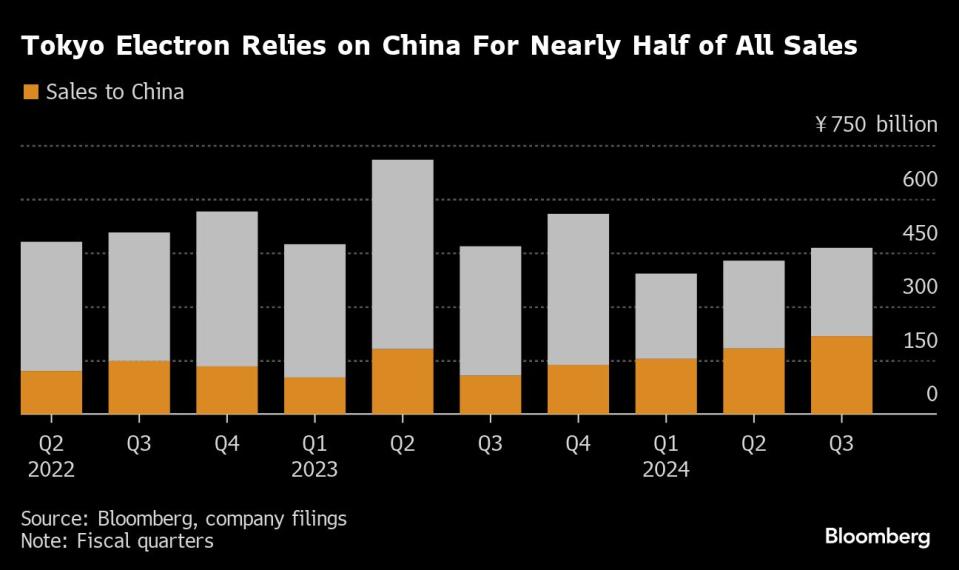

Tokyo Electron Adds $12 Billion in a Day on Strong China Demand

(Bloomberg) -- Tokyo Electron Ltd.’s market capitalization surged by more than $12 billion on Tuesday, hitting a record high after the company hiked guidance for the year on the strength of sales to China.

Most Read from Bloomberg

Japan Loses Its Spot as World's Third-Largest Economy as It Slips Into Recession

Putin Steps Into US Race to Back ‘Old-Style’ Biden Over Trump

The chipmaking gear producer rose 13% in Tokyo Tuesday, hitting a valuation of ¥15.9 trillion ($106 billion) with its highest close on record. It came after the company lifted its operating income forecast for the year to March by 11% to ¥445 billion. That beat analyst estimates and came on the back of a December quarter where China accounted for 46.9% of its sales.

Demand is surging from Chinese semiconductor ventures buying up legacy equipment as US trade curbs prevent them from acquiring the best chips for tasks like artificial intelligence development.

Tokyo Electron also said it expected investment from DRAM makers to rebound this year. The stock prices of two of its customers, South Korea’s Samsung Electronics Co. and SK Hynix Inc., rose on optimism about their prospects given rising AI-driven demand.

“We have entered a frenzy stage of buying anything tech,” Amir Anvarzadeh of Asymmetric Advisors said. Tokyo Electron’s surge followed a near doubling of chip designer Arm Holdings Plc’s market value after better-than-expected earnings, and a related spike in parent SoftBank Group Corp.’s stock. “However, given that China has been the biggest single engine for Tokyo Electron, we see big risks that have been ignored.”

The view from the company itself is more sanguine, with one executive projecting strong sales in China continuing for the next year or two.

“We expect strong demand from China to continue or grow stronger still,” deputy general manager Hiroshi Kawamoto said on an earnings call last week. China only makes a small percentage of the chips it needs, and Kawamoto sees the country investing aggressively to lower its reliance abroad. “We expect momentum to remain intact through 2025.”

--With assistance from Vlad Savov.

(Updates with closing stock price and added market valuation. A previous version corrected attribution of Tokyo Electron executive quote in final paragraph.)

Most Read from Bloomberg Businessweek

‘Playing God’: This Labor Activist’s Relentless Emails Force Companies to Change

The US Will Face Blowback in the Middle East, No Matter What

©2024 Bloomberg L.P.