Tom Gayner Picks Up 4 Stocks in the 4th Quarter

- By Sydnee Gatewood

Tom Gayner (Trades, Portfolio), the co-CEO of Markel Corp., disclosed four new positions in his fourth-quarter 2018 portfolio, which was released last week.

Warning! GuruFocus has detected 5 Warning Signs with SHW. Click here to check it out.

The intrinsic value of SHW

Concentrating on promising areas where Markel has good understanding and knowledge, the guru's Virginia-based firm uses a value-oriented approach to stock picking. Gayner also maintains a margin of safety within the investment portfolio and believes that since a stock is part of a business, it is worth what the present value of future cash flows are.

Based on these guidelines, the guru established positions in Sherwin-Williams Co. (SHW), NVR Inc. (NVR), Equifax Inc. (EFX) and TransUnion (TRU) during the quarter.

Sherwin-Williams

Gayner invested in 11,000 shares of Sherwin-Williams for an average price of $403.44 per share, dedicating 0.08% of the equity portfolio to the holding.

The Cleveland-based manufacturer of paint and coatings has a $39.67 billion market cap; its shares were trading around $428.29 on Tuesday with a price-earnings ratio of 36.34, a price-book ratio of 9.98 and a price-sales ratio of 2.31.

The Peter Lynch chart shows the stock is trading higher than its fair value, suggesting it is overpriced.

GuruFocus rated Sherwin-Williams' financial strength 5 out of 10. Although the company has issued approximately $5.8 billion in new long-term debt over the last three years, it is at a manageable level due to adequate interest coverage. In addition, the Altman Z-Score of 3.11 indicates the company is in good financial standing.

The company's profitability and growth scored an 8 out of 10 rating, boosted by operating margin expansion, good returns, consistent earnings and revenue growth, a moderate Piotroski F-Score of 5, which indicates conditions are stable, and a business predictability rank of 3.5 out of five stars. According to GuruFocus, companies with this rank typically see their stocks gain an average of 9.3% per year.

Of the gurus invested in Sherwin-Williams, Steven Cohen (Trades, Portfolio) has the largest position with 0.09% of outstanding shares. Pioneer Investments (Trades, Portfolio), Ron Baron (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Ray Dalio (Trades, Portfolio), David Einhorn (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio) are also shareholders.

NVR

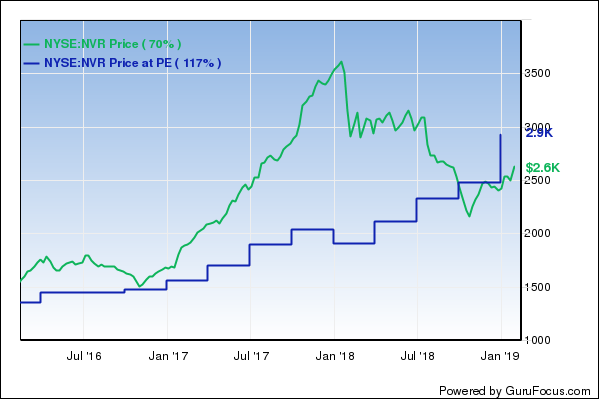

The investor picked up 770 shares of NVR for an average price of $2,365.38 per share, allocating 0.04% of the equity portfolio to the position.

The homebuilding and mortgage company, which is headquartered in Reston, Virginia, has a market cap of $9.31 billion; its shares were trading around $2,650.01 on Tuesday with a price-earnings ratio of 13.35, a price-book ratio of 5.16 and a price-sales ratio of 1.58.

According to the Peter Lynch chart, the stock is undervalued.

NVR's financial strength was rated 8 out of 10 by GuruFocus, driven by high interest coverage and robust Altman Z-Score of 11.23. The company's profitability and growth scored a 9 out of 10 rating, supported by an expanding operating margin, strong returns and a high Piotroski F-Score of 8, which suggests business conditions are healthy. The company also has a one-star business predictability rank. According to GuruFocus, companies with this rank typically see their stocks gain an average of 1.1% per year.

With 0.76% of outstanding shares, the Smead Value Fund (Trades, Portfolio) is the company's largest guru shareholder. Jim Simons' (Trades, Portfolio) Renaissance Technologies, Pioneer, Jeremy Grantham (Trades, Portfolio), Jones and Dalio also have positions in the stock.

Equifax

The guru purchased 2,500 shares of Equifax for an average price of $105.61 per share.

The Atlanta-based consumer credit reporting agency has a $12.93 billion market cap; its shares were trading around $107.56 on Tuesday with a price-earnings ratio of 29.14, a price-book ratio of 4.06 and a price-sales ratio of 3.81.

Based on the Peter Lynch chart, the stock appears to be overvalued.

Bolstered by sufficient interest coverage and a high Altman Z-Score of 3.7, GuruFocus rated Equifax's financial strength 6 out of 10. The company's profitability and growth scored an 8 out of 10 rating. In addition to operating margin expansion, the company has good returns and a moderate Piotroski F-Score of 4. The company's 2.5-star business predictability rank, however, is on watch as a result of a slowdown in revenue per share growth over the last 12 months. GuruFocus says companies with this rank typically see their stocks gain an average of 7.3% per year.

Pioneer is the company's largest guru shareholder with 0.17% of outstanding shares. Other guru investors are First Eagle Investment (Trades, Portfolio), Robert Olstein (Trades, Portfolio) and Greenblatt.

TransUnion

Gayner bought a 4,000-share holding of TransUnion for an average price of $63.55 per share.

Based in Chicago, the consumer credit company has a market cap of $11.44 billion; its shares were trading around $62.33 on Tuesday with a price-earnings ratio of 28.06, a price-book ratio of 6.13 and a price-sales ratio of 5.30.

The Peter Lynch chart suggests the stock is overvalued.

Weighed down by approximately $1.9 billion in new long-term debt and poor interest coverage, TransUnion's financial strength was rated 4 out of 10 by GuruFocus. In addition, the Altman Z-Score of 1.94 indicates the company is under some financial pressure. The company's profitability and growth fared a bit better, scoring a 6 out of 10 rating as a result of good margins and returns and a moderate Piotroski F-Score of 5.

Steve Mandel (Trades, Portfolio) is the company's largest guru shareholder with 5.3% of outstanding shares. Ron Baron (Trades, Portfolio), Pioneer, Simons' firm and Cohen also have positions in the stock.

Additional trades

During the quarter, Gayner also boosted his holdings of several other stocks, including Rollins Inc. (ROL), Whirlpool Corp. (WHR), Activision Blizzard Inc. (ATVI), Electronic Arts Inc. (EA), Analog Devices Inc. (ADI) and Microchip Technology Inc. (MCHP).

The guru's $5.23 billion equity portfolio, which is composed of 132 stocks, is largely invested in the financial services and consumer cyclical sectors.

Disclosure: No positions.

Read more here:

Robert Olstein's Top 5 Buys in 4th Quarter

Dan Loeb Buys Cigna and Sells Alibaba, Microsoft, Netflix

Chuck Royce on 5 Quality Premier Companies

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Signs with SHW. Click here to check it out.

The intrinsic value of SHW