Tom Gayner's Markel Corp Exits Activision Blizzard, Reveals Q4 Portfolio Moves

Insight into the Investment Strategy of Tom Gayner (Trades, Portfolio) and His Latest 13F Filing

Tom Gayner (Trades, Portfolio), the Co-Chief Executive Officer of Markel Corporation, is known for his disciplined investment approach, focusing on companies with strong returns, modest leverage, and capable management. With a background that includes roles at Davenport & Co of Virginia and PriceWaterhouseCoopers LLP, Gayner brings a wealth of experience to his investment decisions. His strategy, as outlined in Markel's 2019 Letter to Shareholders, emphasizes the importance of reinvestment opportunities, capital discipline, and fair pricing in pursuit of long-term value growth.

Summary of New Buys

Tom Gayner (Trades, Portfolio)'s portfolio saw the addition of 2 new stocks in the fourth quarter of 2023:

Graphic Packaging Holding Co (NYSE:GPK) was the most significant new addition with 121,601 shares, accounting for 0.03% of the portfolio and a total value of $2,997,470.

Comfort Systems USA Inc (NYSE:FIX) was also added with 1,000 shares, representing a total value of $205,670.

Key Position Increases

Gayner increased his stakes in a total of 43 stocks, with notable increases in:

LPL Financial Holdings Inc (NASDAQ:LPLA) saw an additional 125,122 shares, bringing the total to 426,386 shares. This represents a 41.53% increase in share count and a 0.31% impact on the current portfolio, with a total value of $97,053,980.

Deere & Co (NYSE:DE) had an additional 39,000 shares, bringing the total to 797,800. This adjustment represents a 5.14% increase in share count, with a total value of $319,016,290.

Summary of Sold Out Positions

During the fourth quarter of 2023, Tom Gayner (Trades, Portfolio) exited 7 holdings, including:

Activision Blizzard Inc (ATVI), where all 650,600 shares were sold, resulting in a -0.74% impact on the portfolio.

Liberty Broadband Corp (NASDAQ:LBRDA), with all 196,750 shares liquidated, causing a -0.22% impact on the portfolio.

Key Position Reductions

Gayner also reduced his positions in 2 stocks, with significant changes in:

Bank of New York Mellon Corp (NYSE:BK) was reduced by 243,750 shares, resulting in a -66.74% decrease in shares and a -0.13% impact on the portfolio. The stock traded at an average price of $46.06 during the quarter.

Intercontinental Exchange Inc (NYSE:ICE) saw a reduction of 27,957 shares, a -84.52% decrease, and a -0.03% impact on the portfolio. The stock traded at an average price of $113.38 during the quarter.

Portfolio Overview

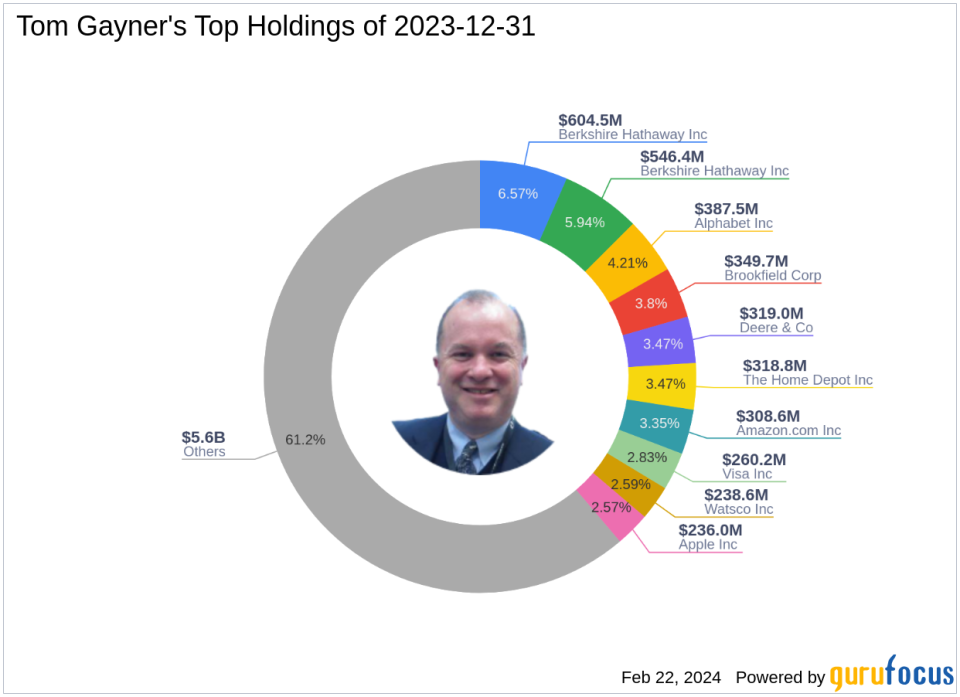

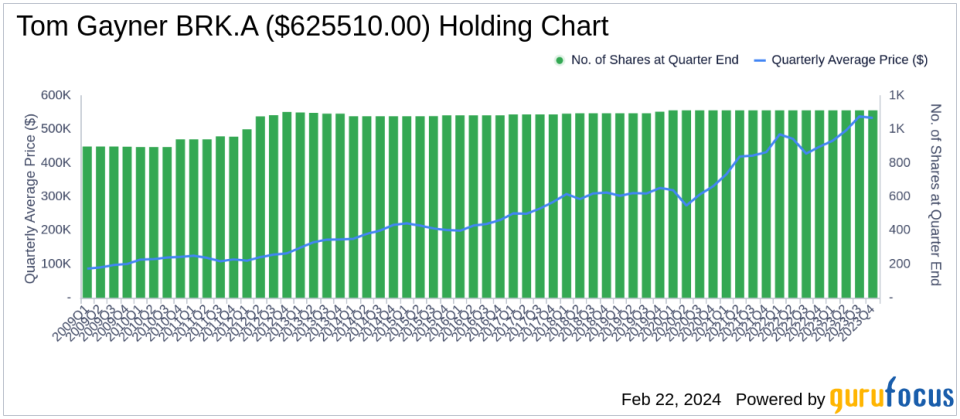

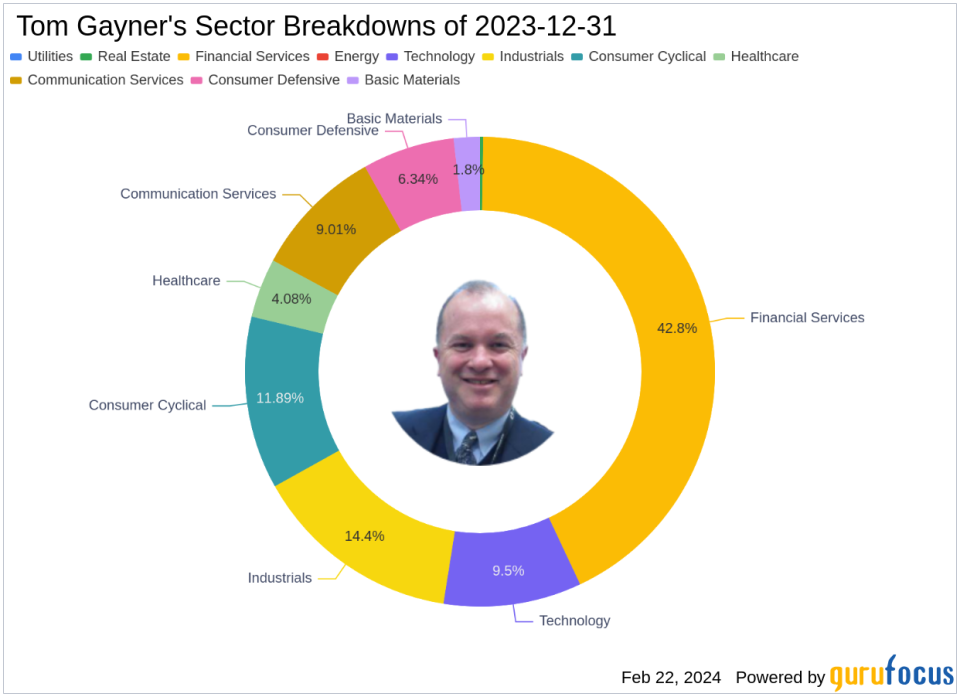

As of the fourth quarter of 2023, Tom Gayner (Trades, Portfolio)'s portfolio included 128 stocks. The top holdings were 6.57% in Berkshire Hathaway Inc (NYSE:BRK.A), 5.94% in Berkshire Hathaway Inc (NYSE:BRK.B), 4.21% in Alphabet Inc (NASDAQ:GOOG), 3.8% in Brookfield Corp (NYSE:BN), and 3.47% in Deere & Co (NYSE:DE). The holdings are mainly concentrated in 9 of the 11 industries, with significant investments in Financial Services, Industrials, Consumer Cyclical, and Technology sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.