Tom Gayner's Q2 2023 13F Filing Update: Key Trades and Portfolio Overview

Thomas Gayner, Co-Chief Executive Officer of Markel Corporation, recently filed the firm's 13F report for the second quarter of 2023. Gayner, who oversees the investing activities for Markel Corporation and its diverse industrial and service businesses, has a rich history in the investment sector. Prior to joining Markel in 1990, he served as vice president of Davenport & Co of Virginia and as a Certified Public Accountant with PriceWaterhouseCoopers LLP. He is also a trustee of The Community Foundation of Richmond, Bon Secours Health System, and a member of the Investment Advisory Committee of the Virginia Retirement System.

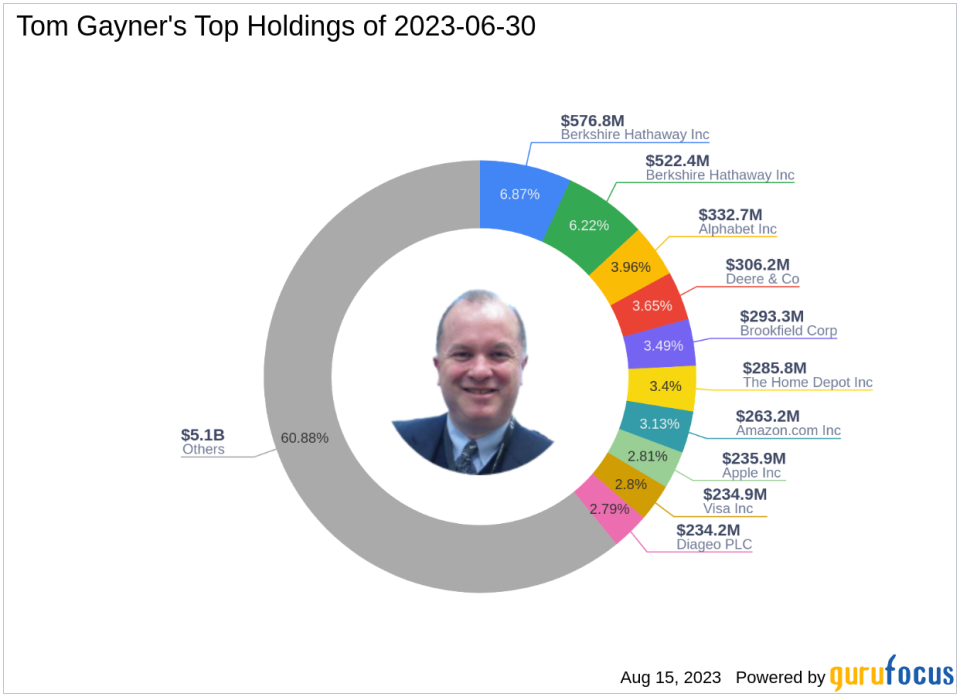

Portfolio Overview

As of the end of Q2 2023, the firm's portfolio contained 131 stocks with a total value of $8.4 billion. The top holdings were BRK.A (6.87%), BRK.B (6.22%), and GOOG (3.96%).

Key Trades of the Quarter

Among the notable trades of the quarter, Gayner's firm made significant moves in Dollar General Corp (NYSE:DG), SEI Investments Co (NASDAQ:SEIC), and LPL Financial Holdings Inc (NASDAQ:LPLA).

Dollar General Corp (NYSE:DG)

The firm purchased 230,000 shares of Dollar General Corp (NYSE:DG), increasing its total holding to 509,250 shares. This trade had a 0.47% impact on the equity portfolio. During the quarter, the stock traded for an average price of $197.94. As of August 15, 2023, DG's price was $161.95 with a market cap of $35.52 billion. Despite a -35.23% return over the past year, GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 9 out of 10. DG's valuation ratios include a price-earnings ratio of 15.26, a price-book ratio of 5.98, a PEG ratio of 0.89, a EV-to-Ebitda ratio of 13.15, and a price-sales ratio of 0.96.

SEI Investments Co (NASDAQ:SEIC)

Gayner's firm reduced its investment in SEI Investments Co (NASDAQ:SEIC) by 416,000 shares, impacting the equity portfolio by 0.3%. The stock traded for an average price of $58.18 during the quarter. As of August 15, 2023, SEIC's price was $60.94 with a market cap of $8.07 billion. The stock has returned 5.98% over the past year. GuruFocus gives the company a financial strength rating of 10 out of 10 and a profitability rating of 10 out of 10. SEIC's valuation ratios include a price-earnings ratio of 20.59, a price-book ratio of 3.98, a PEG ratio of 3.49, a EV-to-Ebitda ratio of 12.63, and a price-sales ratio of 4.39.

LPL Financial Holdings Inc (NASDAQ:LPLA)

During the quarter, the firm bought 107,389 shares of LPL Financial Holdings Inc (NASDAQ:LPLA), bringing its total holding to 127,059 shares. This trade had a 0.28% impact on the equity portfolio. The stock traded for an average price of $200.28 during the quarter. As of August 15, 2023, LPLA's price was $222.09 with a market cap of $16.94 billion. Despite a -1.36% return over the past year, GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rating of 6 out of 10. LPLA's valuation ratios include a price-earnings ratio of 15.11, a price-book ratio of 8.13, a PEG ratio of 0.71, and a price-sales ratio of 4.85.

In conclusion, Tom Gayner (Trades, Portfolio)'s Q2 2023 13F filing reveals a dynamic investment strategy with significant moves in various sectors. These trades reflect the firm's commitment to value investing and its ability to navigate the complex financial landscape.

This article first appeared on GuruFocus.