TOM LEE: Bitcoin is an important asset for investors to own

Bitcoin is the hottest topic in markets right now.

And while some big-name investors have called Bitcoin a “fraud” and a bubble, Fundstrat’s Tom Lee made the case at Yahoo Finance’s All Markets Summit on Wednesday that the cryptocurrency is an important asset for investors to own.

“I think cryptocurrencies are a very important technology,” Lee said.

“It’s a huge revolution in terms of decentralized control. It’s biomimicry, finally, in the technology industry. A proper structure for maintaining encryption and security. But because of the nature of blockchain it’s also an asset class.

“And I think this year has proven that Bitcoin is uncorrelated to equities, gold, interest rates, commodities. It’s an important security, I think, for investors to own.”

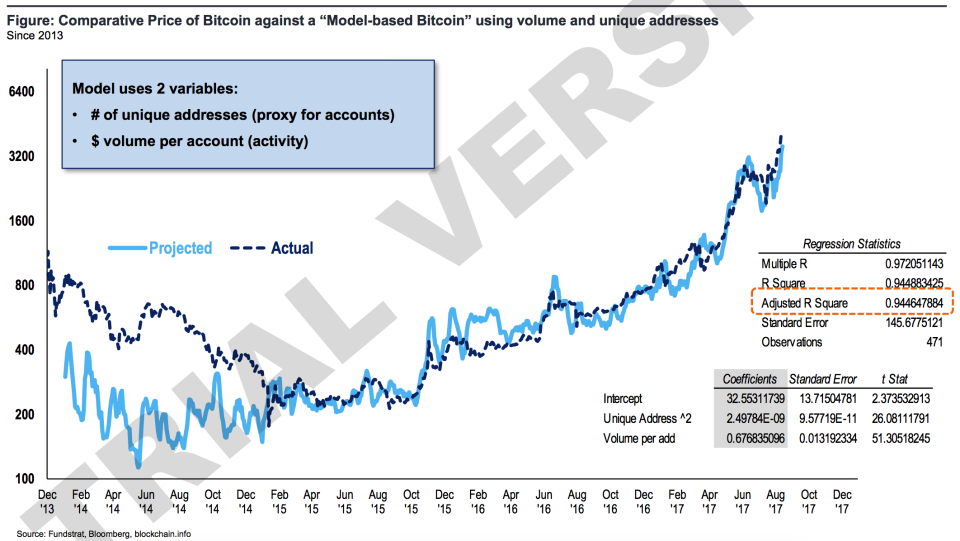

Lee also outlined how Bitcoin is following Metcalfe’s Law, which essentially sketches out the value of a network based on how many users it has.

“If you modeled something as simple as square the number of users plus transaction value, it’s explained 94% of [Bitcoin’s price appreciation] this year,” Lee said.

And this chart from an earlier research note published by Fundstrat outlines this dynamic of the Bitcoin network’s usage and the increase in its price.

Lee put a $25,000 price target for Bitcoin by 2022 in a note to clients published earlier this year. This view is predicated on cryptocurrencies displacing gold in portfolios with Bitcoin serving a “digital store of value.”

After starting 2017 near $1,000, Bitcoin prices have surged to nearly $6,000 as the cryptocurrency has become the most talked-about asset right now. This meteoric rise has of course brought out skeptics.

But to Lee, Bitcoin and the blockchain technology that underwrites it “represents an enhancement of digital trust.” And even a flattening of Bitcoin’s popularity, or a waning in support for Bitcoin among investors, will see the cryptocurrency’s value hold up.

“Using a 90% deceleration of both factors [in Metcalfe’s Law] next year gets you to $6,000 by mid-2018,” Lee said Wednesday.

“So basically we’re saying Bitcoin is going to hit a wall and Bitcoin is still going to be at $6,000.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: