Too Much Optimism Is Baked Into Intuitive Surgical

Intuitive Surgical Inc. (NASDAQ:ISRG) is an absolute monster of a health care stock. The company has returned over 600% over the past 10 years, easily dwarfing the 160% returns of the S&P 500 Index. Over the same period, the Health Care Select Sector ETF (XLV) returned 148%. Most of the growth in Intuitive Surgical was seen as hospitals, large medical institutions and integrated delivery networks such as Kaiser Permanente jumped onto the trend of using its robotic surgery systems at their health care facilities.

With the scope for innovation in the health care space and the accompanying optimism in seeing medical institutions gradually adopt robotic surgeries, market participants have attached higher premiums to Intuitive Surgical over time. While I believe the company is well-positioned for the long term, the stock is richly valued at the moment after having benefited from an overly exuberant market.

Business model review

Headquartered in Sunnyvale, California, Intuitive Surgical is a dominant force in the field of robotic surgeries. Most patients at hospitals are, to date, generally operated on via open surgical procedures or laparoscopic surgical procedures, where surgeons are present in person to physically operate on the patient. However, the use of robots and robotic systems to manage surgical procedures has increased in the last 25 years, as per the American College of Surgeons. Intuitive Surgical is a dominant force in the field of robotic surgery and is the maker of the Da Vinci robotic surgery system, with over 7,500 systems already deployed around the world.

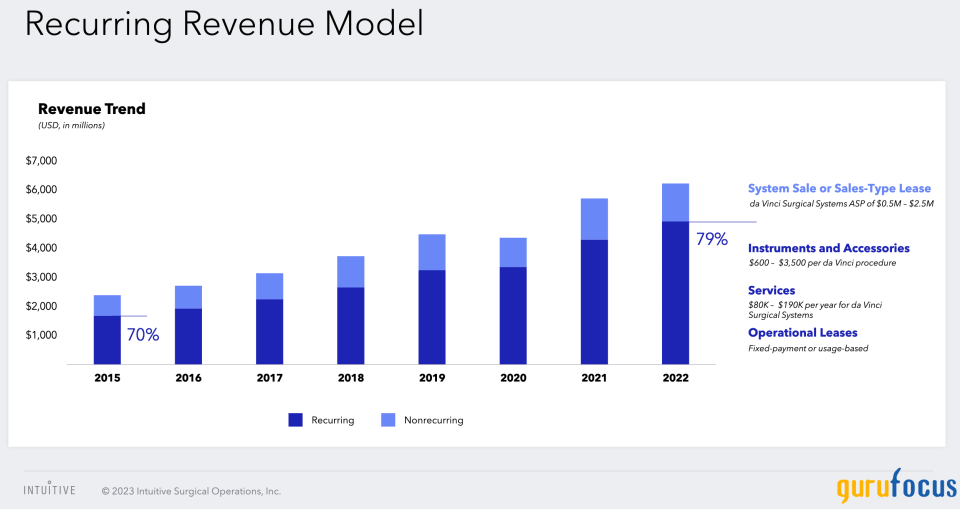

The company generates revenue by installing its robotic systems products either via full sales models, where revenue is recognized upfront, or sales-type lease arrangements, where revenue is recognized over time via operating leases and usage-based revenue models. The Da Vinci robotic systems are the mainstay of its robotic surgery products, which form the core revenue generators for Intuitive Surgical. The company also sells the Ion endoluminal systems as part of its robotic system product line, but they generate less revenue as compared to the Da Vinci products.

According to its most recent 10-Q, product revenue makes up approximately 83% of sales, primarily from a mix of system sales and recurring sales from the Da Vinci product platform. Intuitive Surgical also estimates it earns between $600 $3,500 of revenue per robotic surgical procedure from the sale and usage of system instruments and surgical procedure accessories, depending on the type and complexity of the procedure.

At this point, I can conclude the more procedures there are, the more revenue Intuitive Surgical earns from each system placed in hospitals. Moreover, the company would also increase the chance of growing revenue if existing robotic system products placed in hospitals are utilized more often, leading to more opportunities for incremental orders placed for newer robotic systems or for more system instruments.

Robotic surgery market leadership and a strong moat

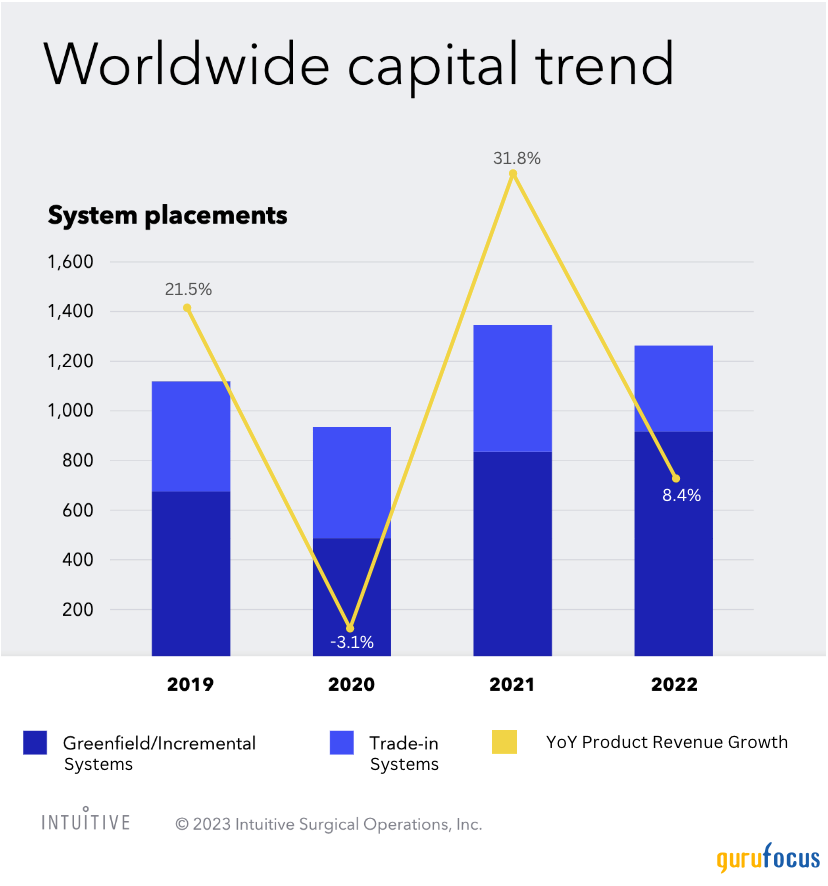

I noted earlier that procedure volume is an important metric that shows the health of the overall robotic procedures. More procedures lead to more hospitals placing and utilizing more robotic systems, as can be seen below, per the third-quarter investor slides.

I can observe how strong procedure growth of 18% year-over-year on the left has led to relatively higher robotic systems placed in hospitals operated by IDNs. But the growth in hospitals seen in the number of robotic systems placed in hospitals is much higher at 45%. Such strength in the macroenvironment portends solid interest in purchasing and deploying Intuitive Surgical's robotic systems.

The company also understands the costs of its systems are high. Therefore, it enters into operating lease agreements with medical institutions and spread the recurring revenue realized from the sales of those systems over time. In addition to financial obligations, these leases generally also contain commercially competitive clauses that are structured to favor Intuitive Surgical over its competitors. I think these moves create a secular moat that works very well for the company, in addition to the growing surgical volume trend that we observed earlier. This can be seen in the chart below, taken from Intuitive Surgical's investor presentation, which shows how these industry trends and sales agreements have worked well to grow the company's recurring revenue to 79% of its overall revenue as of 2022.

I shall note, however, that hospitals and medical institutions will always evaluate the budget requirements for purchasing robotic systems given the high cost of system acquisition, deployment and skill upgrades for surgeons who will operate using these robotic surgery systems. As per its latest 10-K, each of the Da Vinci systems costs between $0.5 million and $2 million. Hence, the purchase and deployment of these systems will hugely depend on the general trend in capital expenses in medical institutions and the overall strength of the macroeconomy. These trends can sometimes be a double-edged sword for Intuitive Surgical, in my opinion.

Superior financial discipline, but still overvalued

Intuitive Surgical has an impressive balance sheet, to say the least. With a solid cash position of $7.5 billion, which has grown approximately 12% year over year, the company carries no long-term debt. This has resulted in improving the quality of shareholder equity.

While the company missed revenue expectations in the third quarter by 1.7%, it exceeded its earnings expectations by a solid 22.7%. Meanwhile, its overall revenue grew 12% to $1.74 billion, of which 66.9% was recognized as gross profits. This was the second consecutive quarter the company was able to arrest the decline in its profit and operating income margins. I will note that Intuitive Surgical does have superior operating income margins as compared to competitors such as Stryker (NYSE:SYK) and Medtronic (NYSE:MDT), mainly due to its dominant market share and innovation pipeline.

But as I look forward, I see severe optimism baked into the stock's valuation. One of the primary reasons the company's stock has seen appreciation in its market cap is due to the fact that the company soft-launched its fourth-quarter earnings last week, which shows full-year revenue of $7.12 billion coming in ahead of consensus expectations of $7.08 billion. The release also mentioned that full-year Da Vinci procedures came in much stronger at 22%, which I can assume is the key reason for excitement.

Still, I do not see sufficient reasons for investors to be optimistic about continued growth in global procedures heading into 2024. One of the reasons Intuitive Surgical's management themselves mentioned is they still see macroeconomic conditions remaining uncertain in 2024. During the J.P. Morgan Healthcare Conference 2024 held last week, Chief Financial Officer Jamie Samath noted:

So our procedure guidance is 13% to 16% for 2024. I guess, one thing before I get into the low end and the high end of the range, I really want to emphasize that in '23, we had 22% procedure growth for the year. You saw just elevated level of patients in the healthcare system or essentially backlog throughout 2023. So as you're thinking about 2024, it's really hard to predict what's going to happen with the backlog. So I'm not sure, I don't know what's really going to happen with that if that actually even carries overs into 2024. But at the low end of the range, we're assuming that bariatrics growth, I'd say, continues to decline modestly.

Management is currently projecting procedures to grow modestly by 13% to 16% in fiscal 2024 as per their provincial fourth-quarter earnings release.

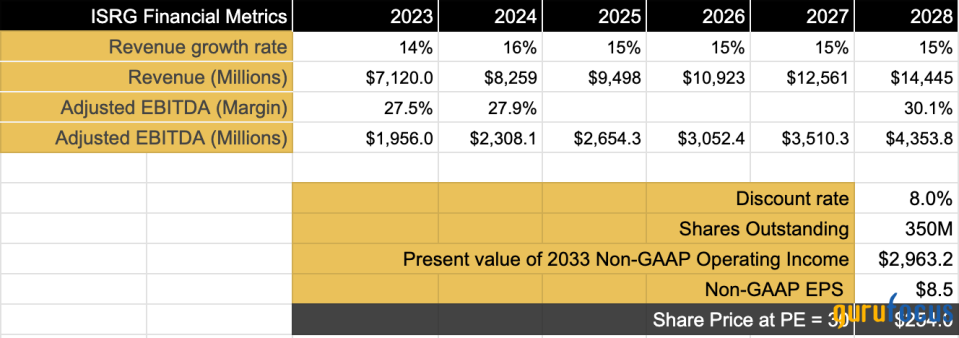

For the purpose of valuing Intuitive Surgical, I have assumed the company grows its revenue in line with its procedure growth, although in reality it will be lower. Moreover, since the company has the characteristics of a late-stage growth company, I have assumed revenue will continue to grow at an average rate of 15%. I have also assumed the company's adjusted Ebitda margin will only improve to 30% from its current margin of 27.5%.

Given that this is a growth company with a strong balance sheet, growing margins and dominant market share, I would be willing to pay a forward price-earnings ratio of 30. Applying a discount rate of 8%, I estimate the value of Intuitive Surgical's shares at $255.

Uncertain macroeconomic environment and growing competition

I had earlier touched upon how macro forces in the economy had helped higher purchase agreements for Intuitive Surgical's robotic systems. However, in cases of downturns in the economy, medical institutions will curtail spending and reallocate budget resources toward critical investments rather than capital expenses toward system upgrades such as those by Intuitive Surgical. In such cases, the company would see fewer sales agreements and, subsequently, fewer systems being placed in medical institutions.

As can be seen in the chart above, fewer Intuitive Surgical systems were placed in years where there were downturns and recessions, such as in 2020 and 2022. This also impacted revenue growth, which would then impact premium multiples.

Also, so far, Intuitive Surgical has held a dominant market share in the robotic surgery space. However, its competition has moved to launch cheaper systems to make it easier for medical institutions to purchase and place robotic systems. Medtronic, for instance, launched the Hugo Robotic Surgery systems to address the historic cost and utilization barriers of Intuitive Surgical's products. Similarly, Johnson & Johnson (NYSE:JNJ) acquired Verb Surgical in 2019 to compete with Intuitive Surgical. These competitors may pose significant threats moving forward.

Conclusions

While I am optimistic about the secular growth prospects of the company, I believe Intuitive Surgical's market value today far exceeds the estimates that my valuation models suggest, indicating superior premiums. But with health care costs rising and pharmaceutical budgets under pressure, I cannot justify the premium attached to this company's stock and find it overvalued.

This article first appeared on GuruFocus.