Tootsie Roll Industries Inc Reports Sweetened Earnings and Sales Growth in 2023

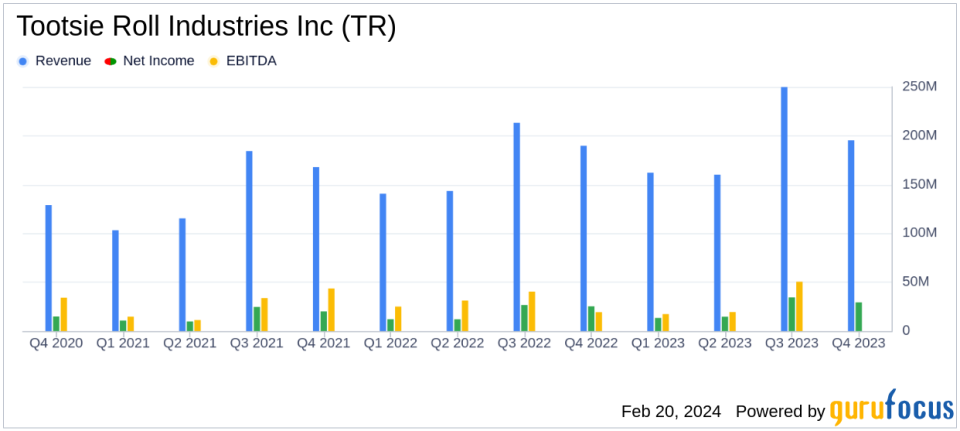

Net Sales: Fourth quarter net sales increased by 4% to $195.4 million, and twelve-month net sales grew by 12% to $763.3 million.

Net Earnings: Fourth quarter net earnings rose by 16% to $29.4 million, with a 23% increase in twelve-month net earnings to $91.9 million.

Earnings Per Share (EPS): EPS for the fourth quarter was $0.42, up from $0.36 in the previous year, and $1.32 for the twelve months, compared to $1.07 year-over-year.

Gross Profit Margins: Despite higher sales, gross profit margins were affected by increased input costs for ingredients, packaging, and manufacturing.

Supply Chain and Labor: The supply chain saw improvements in 2023, but labor challenges persisted at some manufacturing locations.

Investment Income: Favorable investment income helped mitigate some losses from unfavorable foreign exchange.

Effective Income Tax Rates: The company's effective income tax rates were 21.8% for the fourth quarter and 23.4% for the twelve months of 2023.

On February 16, 2024, Tootsie Roll Industries Inc (NYSE:TR) released its 8-K filing, announcing its earnings for the fourth quarter and full year of 2023. The company, known for its iconic candy products such as Tootsie Rolls and Tootsie Pops, has reported a sweet uptick in both net sales and earnings, signaling a robust performance despite facing industry-wide challenges.

Tootsie Roll Industries Inc, a confectionery manufacturer with a diverse portfolio that includes Charms, Blow-Pops, Dots, Junior Mints, and Andes, among others, primarily serves the United States market. The company's latest financial results reflect its ability to navigate the complex consumer packaged goods industry effectively.

Performance Highlights and Challenges

The company's fourth quarter net sales showed a 4% increase, amounting to $195.4 million, while the twelve-month net sales surged by 12% to $763.3 million. This growth was attributed to effective sales and marketing strategies, including seasonal sales programs. Tootsie Roll Industries Inc also achieved a higher sales price realization, which contributed to the sales increase.

However, the company faced significant headwinds due to rising input costs, which included expenses for ingredients, packaging materials, labor, and manufacturing operations. These higher costs have impacted the gross profit margins and net earnings, despite the increase in sales. Ellen R. Gordon, Chairman of Tootsie Roll Industries, highlighted that the input costs for 2023 were among the highest experienced over any two-year period in recent decades.

Financial Achievements and Industry Significance

Despite the challenges, Tootsie Roll Industries Inc managed to post a 16% increase in fourth quarter net earnings, reaching $29.4 million, and a 23% increase in twelve-month net earnings, which stood at $91.9 million. The earnings per share for the fourth quarter were $0.42, up from $0.36 in the previous year, and $1.32 for the twelve months, compared to $1.07 year-over-year. These achievements are particularly important for a company in the consumer packaged goods industry, where margins can be tight and competition is fierce.

The company's ability to improve margins, albeit not yet to historical levels, demonstrates its resilience and adaptability in a challenging economic environment. Tootsie Roll Industries Inc's focus on long-term investments in manufacturing operations to meet new consumer demands and improve product quality is indicative of a strategic approach to maintaining its market position and delivering value to consumers.

Analysis of Financial Performance

While Tootsie Roll Industries Inc has successfully increased its net sales and earnings, the company's performance must be viewed in the context of the broader industry trends. The consumer packaged goods sector has been facing inflationary pressures, and Tootsie Roll's ability to pass some of these costs onto consumers without significantly harming demand is a testament to the strength of its brand and product portfolio.

The company's supply chain improvements and strategic pricing adjustments have been crucial in navigating the inflationary environment. Additionally, the reduction in shares outstanding due to stock purchases in the open market has favorably impacted earnings per share, providing a boost to shareholder value.

Overall, Tootsie Roll Industries Inc's financial results for 2023 reflect a company that is effectively balancing growth and profitability with the challenges of increased costs and competitive pressures. As the company continues to invest in its operations and adapt to market conditions, investors and stakeholders will be watching closely to see if these positive trends continue into 2024.

For a detailed view of Tootsie Roll Industries Inc's financial performance and strategic outlook, investors and interested parties can access the full 8-K filing.

Explore the complete 8-K earnings release (here) from Tootsie Roll Industries Inc for further details.

This article first appeared on GuruFocus.