Top 3 Stocks To Buy

High-growth may be important to some investors, whereas steady dividend payments or great value for money may be a deciding factor for others. There are many factors that make up a great investment. In this article, I’ve composed a list of companies which provide investors with two or more favourable aspects, causing them to be sought-after investments .

PetMed Express, Inc. (NASDAQ:PETS)

PetMed Express, Inc. and its subsidiaries, doing business as 1-800-PetMeds, operates as a pet pharmacy in the United States. Established in 1996, and currently lead by Menderes Akdag, the company currently employs 187 people and with the market cap of USD $931.43M, it falls under the small-cap category.

PETS is an attractive stock for growth-seeking investors, with an expected earnings growth of 20.41% in the upcoming year underlying the notable 34.30% return on equity over the next few years. PETS’s previous bottom-line expansion of 59.21% in the prior year, producing an outstanding triple-digit return to shareholders, is what investors like to see. Furthermore, PETS has sufficient cash and investments to meet its upcoming liabilities, and the company has no debt in its accounts, portraying its strong financial capacity. Dig deeper into PetMed Express here.

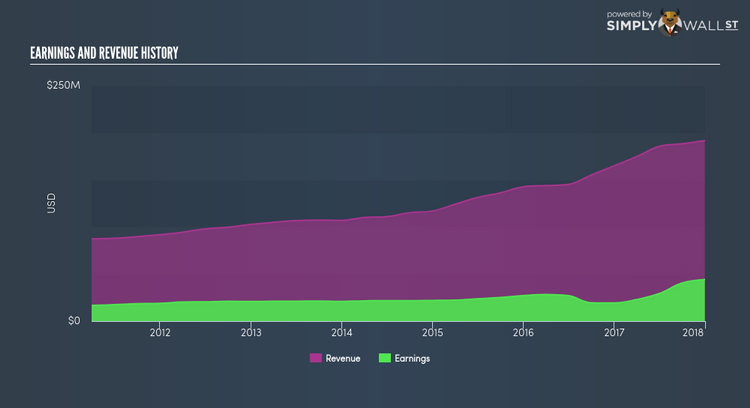

Manning & Napier, Inc. (NYSE:MN)

Manning & Napier, Inc. is publicly owned investment manager. Founded in 1970, and run by CEO William Manning, the company currently employs 468 people and has a market cap of USD $276.40M, putting it in the small-cap category.

MN has ample cash coverage over its short term liabilities, and the company has no debt in its accounts, demonstrating financial stability and good capital management. Likewise, MN’s share price is below its intrinsic value based on its discounted cash flows, and its relative PE ratio compared to its industry, meaning those that are interested in the stock can buy it for cheap. More on Manning & Napier here.

Univest Corporation of Pennsylvania (NASDAQ:UVSP)

Univest Corporation of Pennsylvania operates as the holding company for Univest Bank and Trust Co. Formed in 1876, and headed by CEO Jeffrey Schweitzer, the company currently employs 840 people and with the market cap of USD $836.83M, it falls under the small-cap stocks category.

UVSP’s earnings growth in the past year reaching triple-digits, surpassing its industry profit growth level of 4.26%, is what investors like to see. UVSP’s asset-to-equity ratio of 7.56x indicates a solid equity position, with an appropriate level of leverage for a financial company. In addition to this, UVSP’s ample net income is able to cover all of its dividend payments, which has been higher than the low-risk savings rate, sufficiently rewarding shareholders for taking on the risk of investing in the stock market. Dig deeper into Univest of Pennsylvania here.

For more fundamentally-robust companies with industry-beating characteristics to enhance your portfolio, use our free platform to explore our interactive list of big green snowflake stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.