Top 3rd-Quarter Trades of the Smead Value Fund

- By Margaret Moran

The Smead Value Fund (Trades, Portfolio) recently disclosed its portfolio updates for its fiscal third quarter of 2020, which ended on Aug. 31.

The fund operates under Smead Capital Management. Its contrarian investing strategy is based on large-cap stocks that meet the following criteria: serve an economic need, have a strong competitive advantage, have a long history of profitability and strong operating metrics, generate high levels of free chase flow, are undervalued, have a strong balance sheet, show insider ownership and have a history of friendly relations between management and shareholders. The fund is managed by lead portfolio manager Bill Smead, along with co-portfolio managers Tony Scherrer, CFA and Cole Smead, CFA.

Based on its investing criteria, the fund's top buy for the quarter was Amerco Inc. (NASDAQ:UHAL), followed by Chevron Corp. (NYSE:CVX). The fund also significantly reduced its position in Accenture PLC (NYSE:ACN) and sold out of its investment in PayPal Holdings Inc. (NASDAQ:PYPL).

Amerco

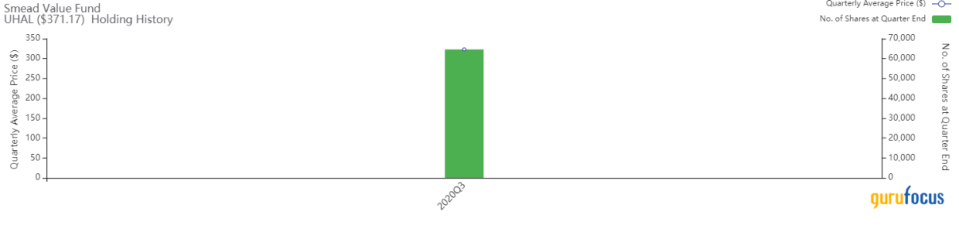

The Smead Value Fund (Trades, Portfolio) established a new position of 64,551 shares in Amerco, impacting the equity portfolio by 2.12%. Shares traded for an average price of $323.15 during the quarter.

Nevada-based Amerco is the parent company for U-Haul, AMERCO Real Estate Company, Republic Western Insurance Company and Oxford Life Insurance Company. Its subsidiaries mainly deal with insurance, real estate and the moving process.

On Oct. 23, shares of Amerco traded around $372.65 for a market cap of $7.31 billion and a price-earnings ratio of 18.4. The GuruFocus Value chart rates the stock as fairly valued.

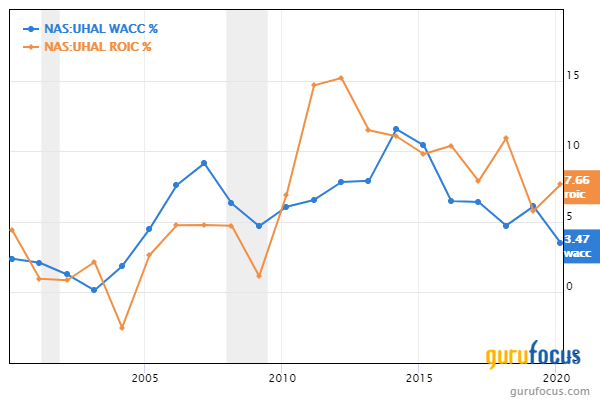

GuruFocus gives the company a rating of 4 out of 10 for financial strength and a rating of 8 out of 10 for profitability. The cash-debt ratio of 0.17 and Altman Z-Score of 1.33 suggest that the company could be at risk of bankruptcy in the next couple of years. The return on invested capital is typically higher than the weighted average cost of capital, indicating that the company is creating value for shareholders.

Chevron

The fund also added 179,790 shares, or 51.83%, to its investment in Chevron for a total holding of 526,679 shares. The trade had a 1.40% impact on the equity portfolio. During the quarter, shares traded for an average price of $89.39.

Chevron is a member of the "Big Six" multinational oil companies that dominate the U.S. market share. Headquartered in San Ramon, California, the company explores for and refines oil and natural gas and produces a variety of chemicals, including ethylene, polyethylene, aromatics and styrenics.

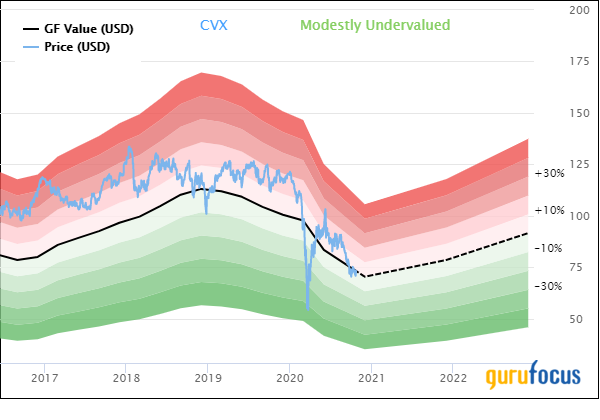

On Oct. 23, shares of Chevron traded around $72.37 for a market cap of $139.14 billion. According to the GuruFocus Value chart, the stock is modestly undervalued.

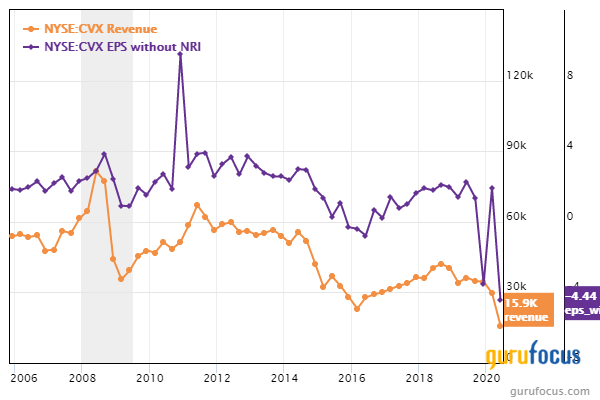

GuruFocus gives the company a rating of 5 out of 10 for financial strength and a rating of 6 out of 10 for profitability. While the cash-debt ratio of 0.2 is lower than 61% of competitors, the Altman Z-Score of 2.37 suggests the potential risk of bankruptcy is minor. Revenue and earnings per share have both been in a steady decline in recent years.

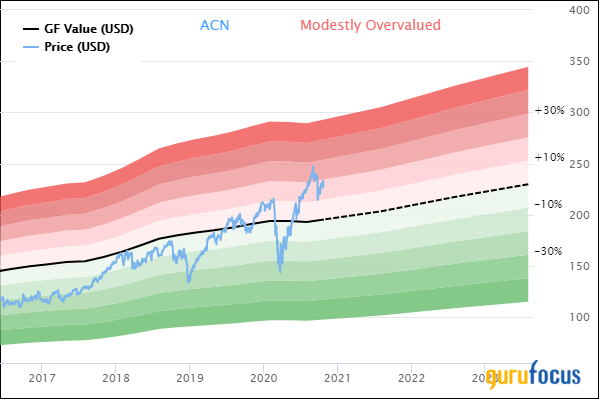

Accenture

The fund reduced its Accenture holding by 47,259 shares, or 35.61%, for a remaining position of 85,470 shares. The trade had a -1% impact on the equity portfolio. Shares traded for an average price of $219.93 during the quarter.

Accenture is a multinational professional services company based in Ireland. It operates a network of businesses that provide corporate clients with consulting, technology, outsourcing and alliance solutions.

On Oct. 23, shares of Accenture traded around $229 for a market cap of $145.37 billion and a price-earnings ratio of 28.97. The GuruFocus Value chart rates the stock as modestly overvalued.

GuruFocus gives the company a rating of 8 out of 10 for financial strength and a rating of 9 out of 10 for profitability. The interest coverage ratio of 196.96% and Altman Z-Score of 6.41 indicate a strong balance sheet. The company has managed to grow both the operating margin and net margin over time, with the current levels beating more than 80% of peers.

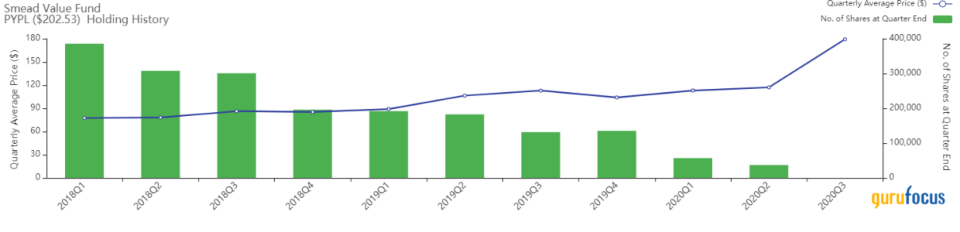

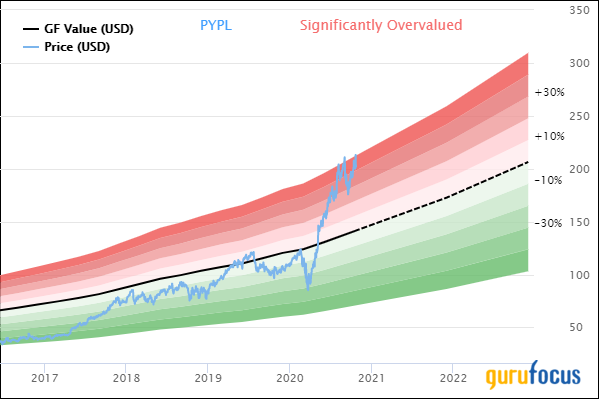

PayPal Holdings

The fund sold all 36,753 of its remaining shares in PayPal Holdings, which had a -0.60% impact on the equity portfolio. During the quarter, shares traded for an average price of $179.10.

PayPal is a worldwide online payments system operator that increases the flexibility, accessibility and security of various methods of electronic transactions.

On Oct. 23, shares of PayPal traded around $201.93 for a market cap of $236.65 billion and a price-earnings ratio of 92.54. The GuruFocus Value chart rates the stock as significantly overvalued.

GuruFocus gives the company a rating of 6 out of 10 for financial strength and a rating of 8 out of 10 for profitability. The interest coverage ratio of 18.49 is lower than 69% of other companies in the credit services industry, but the cash-debt ratio of 1.46% is outperforming 72% of peers. Revenue has steadily grown over the years, though earnings per share has been highly inconsistent.

Portfolio overview

As of the quarter's end, the Smead Value Fund (Trades, Portfolio) held common stock positions in 29 companies valued at a total of $1.08 million, with a turnover rate of 6% for the period. The top holdings were NVR Inc. (NVR) with 7.05% of the equity portfolio, Target Corp. (TGT) with 7.05% and Amgen Inc. (AMGN) with 6.41%.

In terms of sector weighting, the fund was most invested in the consumer cyclical, financial services and health care industries.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Intel's 3rd-Quarter Earnings: Hopping on the Legacy-Dumping Train

American Airlines: 3rd-Quarter Earnings Continue to Disappoint

5 Solar Stocks Outperforming FAANG in 2020

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.