Top 4th-Quarter Buys of Chuck Royce's Firm

Royce Investment Partners recently released its portfolio update for the fourth quarter of 2019, in which it established 80 new positions.

Renamed from Royce & Associates at the end of 2019, Royce Investment Partners is the investment firm founded by Chuck Royce (Trades, Portfolio) in 1972. The firm specializes in small-cap companies, which it chooses through a bottom-up, risk-conscious approach. The portfolio managers focus especially on quality and deep value.

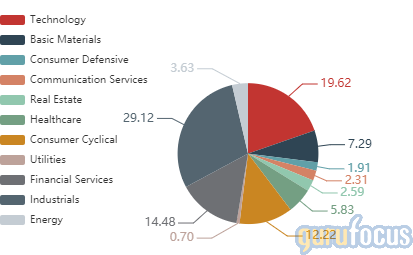

As of the quarter's end, the firm's equity portfolio was valued at $11.2 billion. In terms of sector weighting, it was most heavily invested in industrials (29.12%), technology (19.62%) and financial services (14.48%).

Based on the above-listed criteria, the firm's top five buys for the recent quarter were DMC Global Inc. (NASDAQ:BOOM), MSC Industrial Direct Co Inc. (NYSE:MSM), Livent Corp. (NYSE:LTHM), MGP Ingredients Inc. (NASDAQ:MGPI) and SmileDirectClub Inc. (NASDAQ:SDC).

DMC Global

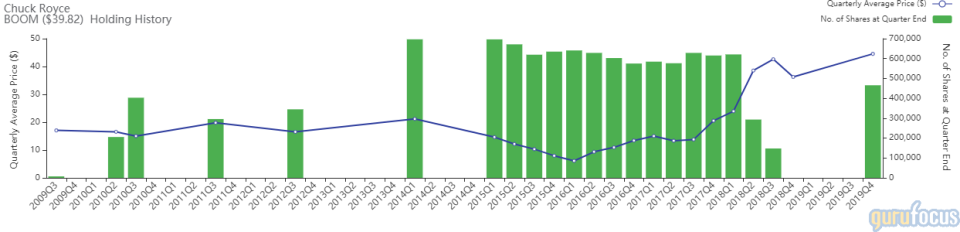

After selling out of DMC Global in the fourth quarter of 2018, the firm has established a new position of 465,599 shares, impacting the equity portfolio by 0.19%. Shares traded at an average price of $44.54 during the quarter.

DMC (Dynamic Materials Corp.) Global is a company that owns diversified metalworking and explosives assets, which it supports with long-term capital, legal assistance, technology, operating resources, etc.

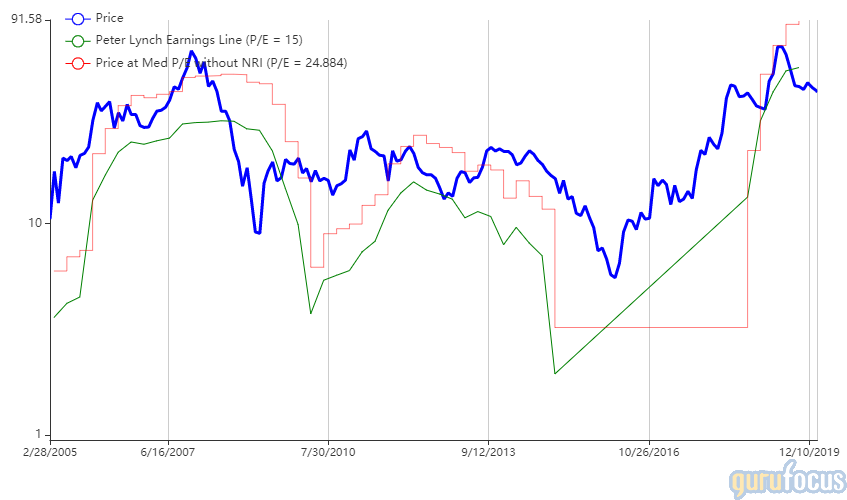

As of Feb. 7, the company has a market cap of $583.63 million, a price-earnings ratio of 10.97 and a return on capital of 47.05%. According to the Peter Lynch chart, the stock is trading below its fair value.

GMC Global has a GuruFocus financial strength rating of 7 out of 10; its low cash-debt ratio of 0.43 is offset by factors such as its high interest coverage and Altman-Z score of 6.62.

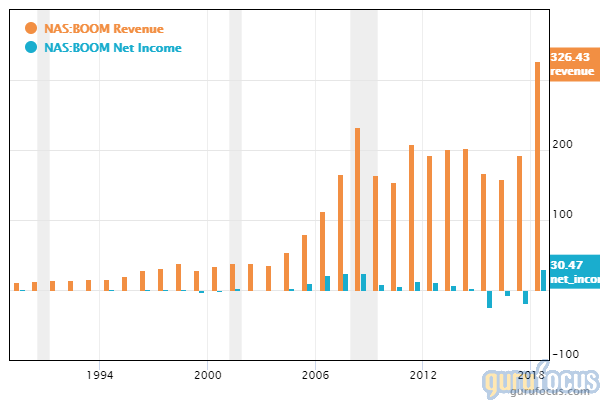

In terms of profitability, GuruFocus rated the stock 6 out of 10. As per the chart below, the company has seen strong revenue growth, but its net income has been more unstable.

Royce's firm holds 3.18% of the company's shares outstanding. Other guru shareholders of GMC Global include Jim Simons (Trades, Portfolio)' Renaissance Technologies with a 3.38% stake.

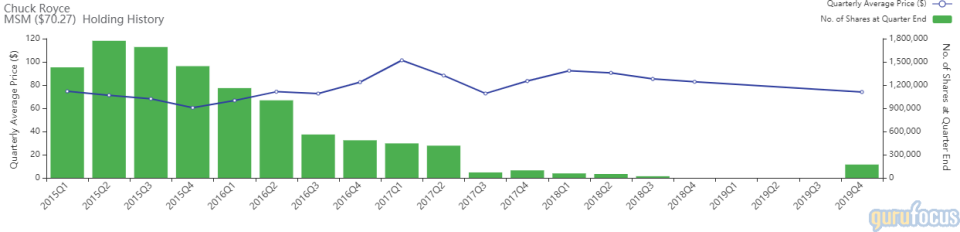

MSC Industrial Direct

Royce's firm also sold out of MSC Industrial Direct in the fourth quarter of 2018 and has now established a new position in the stock of 172,100 shares. The trade impacted the equity portfolio by 0.12%. During the quarter, shares traded at an average price of $74.01.

MSC Industrial Direct is one of the world's largest global distributors of industrial equipment. It operates through its subsidiaries, primarily MSC Industrial Supply, to sell metalworking, maintenance, repair and operations products and services to its clients.

As of Feb. 7, MSC Industrial has a market cap of $3.89 billion, a price-earnings ratio of 13.86 and a return on capital of 31.52%. According to the Peter Lynch chart, the stock is trading slightly below its fair value.

GuruFocus gives MSC Industrial a financial strength rating of 7 out of 10. Its low cash-debt ratio of 0.07 is offset by its equity-to-asset ratio of 0.65 and Altman-Z score of 5.85.

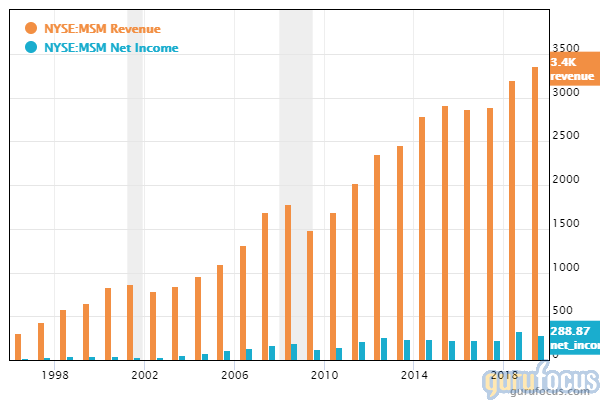

The company also has a high GuruFocus profitability rating of 8 out of 10 thanks to its three-year revenue growth rate of 8.9% and return on assets of 12.07% (better than 92.55% of competitors).

Livent

The firm established a new holding of 853,000 shares in Livent, impacting the equity portfolio by 0.07%. During the quarter, shares traded at an average price of $7.68 each.

Livent is a producer and distributor of lithium chemicals for applications in batteries, agrochemicals, aerospace alloys, pharmaceuticals and industrial applications. Lithium is an essential component in products such as smartphones and electric cars.

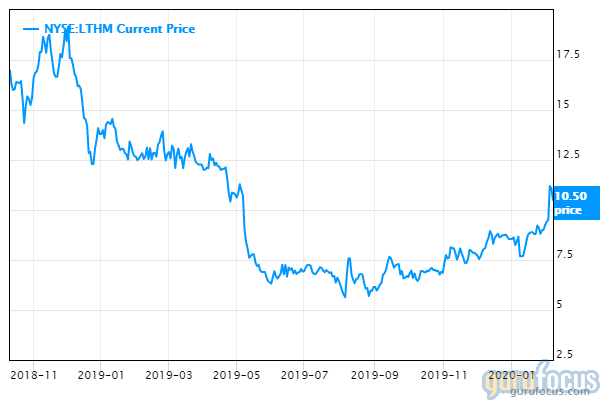

As of Feb. 7, the company has a market cap of $1.44 billion, a price-earnings ratio of 18.62 and a return on capital of 22.59%. Since the stock's initial public offering in October of 2018, the share price has declined 38.12% to trade around $9.79 per share.

In terms of financial strength, the company has a cash-debt ratio of 0.22 and a current ratio of 2.82, meaning it is reasonably able to meet its debt obligations. The Altman-Z score of 5.63 indicates that it is not in danger of bankruptcy.

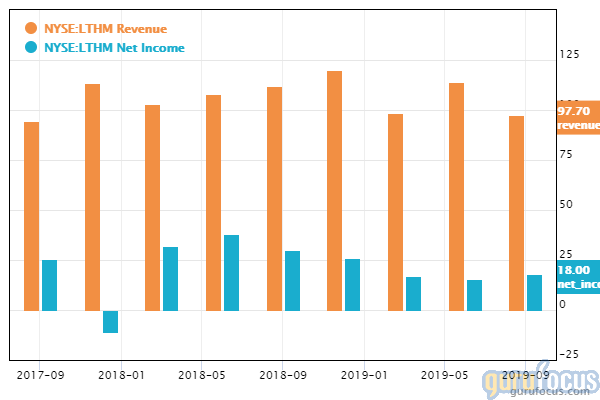

Its operating margin of 24.2% beats 93.83% of competitors, while its return on assets of 11.35% beats 84.49% of competitors. Over its short history as a publicly traded company, Livent has not seen much change in its profitability, though its fortunes may take a turn for the better with the increasing global demand of smartphones, electric cars and other tech that need lithium in order to operate.

MGP Ingredients

After selling out of a smaller position in MGP Ingredients in the second quarter of 2017, Royce's firm has established a new position in the company of 159,032 shares. The trade impacted the equity portfolio by 0.07%. Shares were trading at an average price of $46.80 during the quarter.

MGP Ingredients is a food ingredients company that offers products such as specialty wheat starches, proteins and fibers. It also distills non-branded alcohol products for sale to craft distillers and global beverage brands.

As of Feb. 7, MGP Ingredients has a market cap of $579.96 million, a price-earnings ratio of 15.49 and a return on capital of 19.17%. According to the Peter Lynch chart, the company is trading near its fair value.

GuruFocus has assigned the company a financial strength rating of 7 out of 10. It has a high equity-to-asset ratio (0.72) and an Altman-Z score of 7.25, but its cash-debt ratio is 0.1, ranking below 75.95% of industry competitors.

In terms of profitability, GuruFocus has given the stock a rating of 6 out of 10. Its three-year revenue growth rate is around the middle range at 5.2%, but it has a high operating margin at 12.69% and a high return on assets at 13.01%.

SmileDirectClub

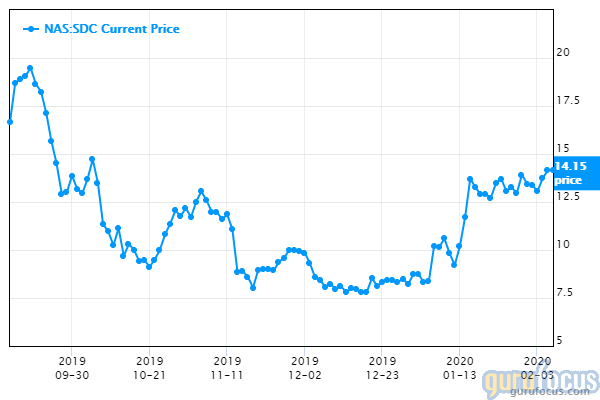

The firm established a new holding of 704,900 shares in SmileDirectClub, impacting the equity portfolio by 0.06%. Shares were trading at an average price of $9.93 during the quarter.

SmileDirectClub is a "teledentistry" company that offers custom clear aligners shipped directly to customers as an alternative to traditional braces. Sales are made online or over the phone and provide a lower-cost option for straightening teeth.

As of Feb. 7, the company has a market cap of $5.51 billion. Its initial public offering was launched in February 2019, so there is not yet much data on stock performance. Since the IPO, the price of the stock has fallen 13.01% to trade around $14.35 per share.

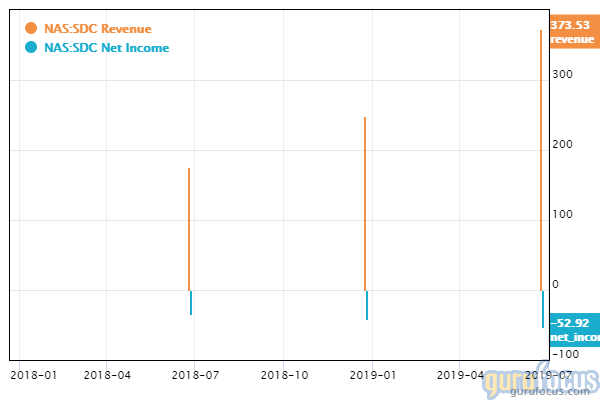

Over its three quarters of reported earnings as a public company, SmileDirectClub has seen increasing revenue, but its net income continues to dive into the negatives.

The company's products are priced 60% below traditional braces, so its scalable potential is high. It also makes sales over the phone or online, which cuts out a lot of office and sales costs. Over time, it seems the company has the potential to turn profitable for shareholders.

Royce's firm owns 0.18% of shares outstanding. Other guru shareholders of SmileDirectClub include Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.51% and Daniel Loeb (Trades, Portfolio)'s Third Point LLC with 0.20%.

Disclosure: Author owns no shares in any of the stocks mentioned.

Read more here:

Bristol-Myers Squibb Smashes Earnings Predictions Following Celgene Acquisition

Smead Value Fund's Biggest 4th-Quarter Trades

Mathews Pacific Tiger Fund Buys 4 Stocks in 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.