My Top-5 AI Growth Stocks to Buy Hand Over Fist for 2024

The S&P 500 recently reached a new record high, signaling a bull market is here, and that means it's a fantastic time to bet on growth. Bull markets tend to favor growth stocks, and history shows us these times of market gains last longer than bear markets -- on average almost three years versus nine months. So there's reason right now to load up on stocks that may excel in this sort of environment and benefit from the momentum.

That's why I've got my eye on companies involved in the high-growth area of artificial intelligence (AI) from chipmakers that power AI tools to companies using this technology to improve their operations. At a compound annual growth rate of about 21%, the AI market is forecast to reach more than $2 trillion by 2030, according to Fortune Business Insights. Companies investing now could greatly benefit down the road -- and so could you. Here are my top-five AI growth stocks to buy hand over fist for 2024.

1. Nvidia

Nvidia (NASDAQ: NVDA) is almost synonymous with AI these days. The company's graphics processing units (GPUs) power the training of AI systems, the "deep learning" that allows them to understand complex concepts and deliver answers to our questions.

Nvidia has built an 80%-to-95% share of the AI chip market, according to analysts, and that's unlikely to change any time soon for two reasons. First, Nvidia now is a clear leader, so it may be difficult for rivals to attract customers away from the industry's "go-to" chipmaker. Second, Nvidia invests heavily in research and development (R&D), so it should stay ahead thanks to innovation too. In the most recent quarter, Nvidia's R&D spending increased 18% to more than $2.2 billion.

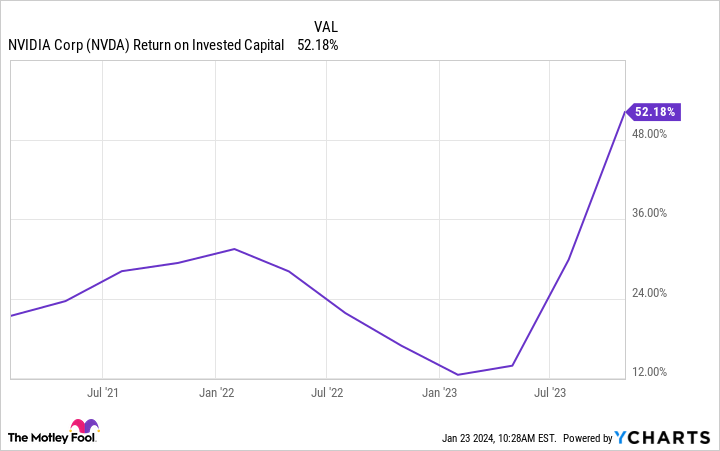

Importantly, Nvidia's investments are bearing fruit, with return on invested capital soaring in recent times.

NVDA Return on Invested Capital data by YCharts.

Nvidia's revenue has climbed over the past few years as it broadened its dominance from GPUs to power gaming and graphics to leadership in AI. And the company's profit has advanced too. Considering Nvidia's financial strength and AI market share, the stock is a no-brainer AI buy right now.

2. Amazon

AI is helping Amazon (NASDAQ: AMZN) excel in both its e-commerce and cloud-computing businesses. The company has used AI in e-commerce for a while now, in everything from making warehouse operations and fulfillment more efficient to helping you, the customer, find just the right item. So, here, AI helps Amazon gain in efficiency, thereby lowering costs. By offering you a positive shopping experience, you're likely to come back. That's a double victory for Amazon's earnings.

As for cloud computing, Amazon has developed several AI tools that it offers its customers. For example, Amazon Bedrock gives clients access to top foundation models they can customize for their own use -- without having to build from the ground up or manage infrastructure. Amazon Web Services (AWS) also offers Code Whisperer, a service that suggests code to developers, saving them valuable time.

Generative AI is "top of mind" for clients, Amazon said in its recent earnings call, so AWS, as the world's cloud-market leader, is in the perfect place to benefit in the years to come.

3. Moderna

Moderna (NASDAQ: MRNA) may not be the first company that comes to mind when you think of AI. After all, it's a biotech developing vaccines based on mRNA technology. But Moderna actually could be a winner of the AI revolution and is investing in the technology today to increase its chances of that happening.

Moderna uses AI across its entire business, even launching an "AI academy" to train employees. But where AI really might change the game is in the area of drug development.

Moderna applies AI to explore relationships between the vast amounts of data it's collected over the years to produce better candidates. The company even signed a collaboration with International Business Machines (IBM) last year to use its AI tools. For example, an IBM foundation model can help predict a molecule's properties, helping scientists immediately understand the characteristics of a potential medicine.

The idea is AI can help Moderna more quickly identify the best candidates, and that may speed up the drug-development process, bringing products to market faster. This could score a win for Moderna, patients, and investors.

4. Medtronic

Medtronic (NYSE: MDT) is another potential winner in the AI-in-healthcare market -- a market expected to reach $208 billion in 2030 from $32 billion today, according to Grand View Research. Like Moderna, Medtronic has put the focus on this hot technology, creating an AI Center of Excellence.

The medical device giant created the center of excellence to cost-effectively drive AI innovation across its businesses with the goal of maintaining leadership in AI-enabled healthcare. Medtronic already uses AI across many of its products from the GI Genius endoscopy tool to the Touch Surgery Enterprise platform for AI-enabled surgery. So, it's well on the way to being a major player in the AI-in-healthcare revolution.

On top of this, you'll like the fact that Medtronic, following a transformation plan to become more efficient, may be heading into a new era of growth. In the most recent quarter, Medtronic reported growth across its business segments and geographies. Considering Medtronic's products hold Nos. 1 to 3 market-share positions, this performance may continue over time.

5. Alphabet

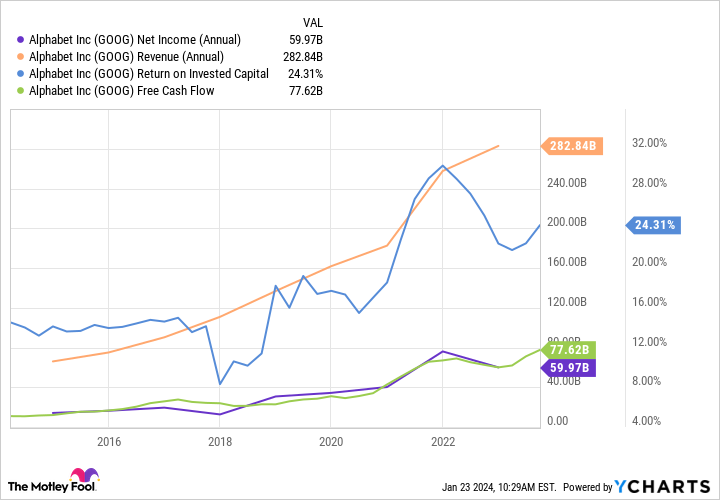

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), parent of search giant Google, already has delivered an impressive track record of growth, as seen in the chart below.

GOOG Net Income (Annual) data by YCharts.

Now, AI may be set to deliver a new boost. Your searches on Google are about to garner even better results thanks to Alphabet's focus on this potentially game-changing technology. Alphabet recently unveiled its most powerful AI tool yet, Gemini, and tests of Gemini in search have resulted in improvements in quality and speed.

Why is this important? Google holds more than 90% of the search market right now, making it the leader by far. Supercharging Google search's capabilities should reinforce this leadership. That, in turn, should keep advertisers flocking to Google. Since this is Alphabet's biggest source of revenue, keeping Google search at the top of its game is crucial.

Alphabet plans on applying Gemini across its products, from its smartphone to its cloud-computing offerings, so this investment in AI should go pretty far when it comes to driving growth. And that's why Alphabet is a top AI stock to buy this year in the new bull market.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Nvidia wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, and Nvidia. The Motley Fool recommends International Business Machines, Medtronic, and Moderna. The Motley Fool has a disclosure policy.

My Top-5 AI Growth Stocks to Buy Hand Over Fist for 2024 was originally published by The Motley Fool