Top 5 High-Flying Mid-Cap Stocks Despite a Volatile August

Wall Street has been witnessing a volatile August after an impressive rally in the first seven months of 2023. Stock markets have suffered setbacks owing to various factors. Fed Chair Jerome Powell warned about more hikes in the interest rate on the back of a resilient U.S. economy.

Three major rating agencies have downgraded the U.S. banking industry, especially, small, and mid-sized banks. Yields of U.S. government bonds of various maturities have spiked recently. Moreover, a prolonged economic downturn in China, the epicenter of the global supply-chain system, generated concerns about U.S. and global economic growth.

Month to date, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — are down 3.4%, 4% and 5.3%, respectively. The mid-cap benchmark — the S&P 400 is also down 5.5% in the same period. However, a handful of mid-cap stocks have popped in the past month.

Why Mid-Cap Stocks

Investment in mid-cap stocks is often recognized as a good portfolio diversification strategy. These stocks combine the attractive attributes of both small and large-cap stocks. Top-ranked mid-cap stocks have a high potential to enhance their profitability, productivity, and market share. These may also become large caps in due course of time.

If the economic growth slows down due to any unforeseen internal or external disturbance, mid-cap stocks will be less susceptible to losses than their large-cap counterparts owing to less international exposure.

On the other hand, if the economy continues to thrive, these stocks will gain more than small caps due to established management teams, a broad distribution network, brand recognition and ready access to the capital markets.

Our Top Picks

We have narrowed our search to five mid-cap (market capital > $5 billion < $10 billion) stocks that have provided double-digit returns in the past month. These companies have solid growth potential for the rest of 2023 and have seen positive earnings estimate revisions in the last 30 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

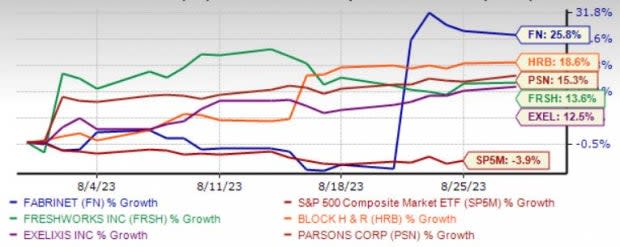

The chart below shows the price performance of our five picks in the past month.

Image Source: Zacks Investment Research

Fabrinet FN provides precision optical, electro-mechanical and electronic manufacturing services to original equipment manufacturers of complex products, such as optical communication components, modules and sub-systems, industrial lasers, and sensors.

FN offers a broad range of advanced optical capabilities across the entire manufacturing process, including process engineering, design for manufacturability, supply chain management, manufacturing, final assembly, and test.

Fabrinet has an expected revenue and earnings growth rate of 6.6% and 5.5%, respectively, for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 3% over the last seven days. The stock price of FN has soared 25.8% in the past month.

H&R Block Inc. HRB is well poised to gain from its five-year strategy known as Block Horizons. HRB is expected to deliver sustainable revenues, operating profit growth and healthy returns on investments, while maintaining a strong balance sheet and liquidity position in the foreseeable future.

The main drivers of H&R Block’s post-pandemic performance will be the digital enablement of business, client addition and retention in both Assisted and DIY, greater usage of AI, along with machine learning for product improvement and expansion in small businesses.

H&R Block has an expected revenue and earnings growth rate of 2.5% and 8.9%, respectively, for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 1.5% over the last 30 days. The stock price of HRB has jumped 18.6% in the past month.

Parsons Corp. PSN is a provider of technology-driven solutions. PSN is focused on the defense, intelligence and critical infrastructure markets. PSN offers technical design and engineering services and software, which consists of cybersecurity, intelligence, defense, military training, connected communities, physical infrastructure, and mobility solutions.

Parsons has an expected revenue and earnings growth rate of 18.7% and 23.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6.9% over the last 30 days. The stock price of PSN has climbed 15.3% in the past month.

Freshworks Inc. FRSH is a software development company that provides modern software-as-a-service products worldwide. FRSH offers Freshdesk Support Desk that enables businesses to delight their customers at every service engagement touchpoint across traditional channels, including email, and modern channels, such as messaging and social media;

Freshdesk Contact Center offers agents with cloud-based telephony system to connect with customers. The system supports complex call-flows, number, and call management, IVR, and routing needs, as well as live dashboard and reports. Freshdesk Customer Success helps customer success managers at business-to-business subscription companies.

Freshworks has an expected revenue and earnings growth rate of 18.7% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 90% over the last 30 days. The stock price of FRSH has surged 13.6% in the past month.

Exelixis Inc. EXEL maintains momentum on the back of growth in consistent demand for the combination of the lead drug Cabometyx and Opdivo in the first-line setting for renal cell carcinoma. Cabometyx is also approved for hepatocellular carcinoma and the uptake of the drug for this indication has also been encouraging. In addition, EXEL is striving to develop its portfolio beyond Cabometyx. Our estimates for EXEL’s top line projects a CAGR of around 12.2% over the next three years.

Exelixis has an expected revenue and earnings growth rate of 14.7% and 19.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 10.1% over the last 30 days. The stock price of EXEL has advanced 12.5% in the past month.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

H&R Block, Inc. (HRB) : Free Stock Analysis Report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

Fabrinet (FN) : Free Stock Analysis Report

Freshworks Inc. (FRSH) : Free Stock Analysis Report

Parsons Corporation (PSN) : Free Stock Analysis Report