Top 5 Industrial Product Stocks Despite Weak Manufacturing Data

The U.S. manufacturing segment has been suffering a bloody blow since the beginning of this year. The Institute of Supply Management (ISM) reported that manufacturing PMI (purchasing managers’ index) came in at 46.9 in May. Notably, any reading below 50 indicates a contraction in manufacturing activities.

This marked the sixth consecutive month of contraction in U.S. manufacturing activities after 30 months of expansion. The sub-indexes for new orders, production and backlog of orders remained below 50. Demand remains weak in the face of a higher interest rate regime adopted by the Fed and concerns about a near-term recession.

However, not all manufacturing industries are suffering from demand shortages. The mining and construction industry and the farm equipment industry are doing well, defying the above-mentioned headwinds.

Strong Demand for Mining and Construction

The intensifying global focus on shifting from fossil fuels to zero emissions will require a large number of commodities, which, in turn, will support demand for mining equipment in the years to come. The U.S. government's plans to increase investment in infrastructure construction, particularly in critical subsectors, such as transportation, water and sewerage, and telecommunications, should support demand in the coming years.

The industry participants are investing in digital initiatives like AI, cloud computing, advanced analytics and robotics. Digital transformation aids organizations in boosting productivity and increasing efficiency, reliability and safety, thereby enriching customer satisfaction. With the pressing need to cut carbon emissions, companies worldwide are relying more on autonomous machinery.

Solid Demand for Farm Equipment

Growing demand for food to sustain the farm equipment industry and the need to replace aging equipment should spur demand. Farm size has been on the rise in the United States, which calls for more laborers. Given the escalation in labor costs every year, farmers are resorting to equipment to replace labor. Demand for agricultural equipment will continue to be supported by increased global demand for food, both from population growth and an increasing proportion of the population aspiring for better living standards.

Customers are increasingly relying on advanced technology, smart farming solutions and mechanization to run their operations. Thus, industry participants are enhancing investments in launching products equipped with advanced technologies and features to keep up with customers' evolving demands.

Initiatives to advance precision agriculture technology is likely to be a game-changer for the industry players, given its productivity-enhancing and sustainability benefits. Demand continues to grow for popular features, which include automatic guide machines in the field and equipment that plants seeds, and applies chemicals and fertilizers with exceptional accuracy.

Our Top Picks

We have narrowed our search to five industrial products stocks. These stocks have strong potential for the rest of 2023 with positive earnings estimate revisions in the last 60 days. Each of our picks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

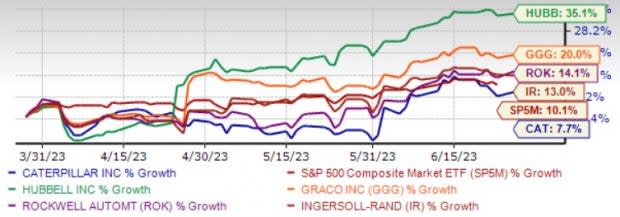

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

Caterpillar Inc. CAT has seen year-over-year revenue and earnings growth for nine straight quarters thanks to its cost-saving actions, strong end-market demand and pricing actions that offset the impact of supply-chain snarls and cost pressures. We expect the company’s adjusted earnings per share for 2023 to grow 19.5% and revenues to rise 7.6%.

Caterpillar has an expected revenue and earnings growth rate of 10% and 28.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last seven days.

Graco Inc. GGG is benefiting from strength in its Industrial segment due to a robust product portfolio of liquid finishing and sealant and adhesive equipment. In the quarters ahead, GGG will likely benefit from strong demand trends for new and existing products. For 2023, GGG predicts organic sales growth (on a constant-currency basis) in low-single digits.

Graco has an expected revenue and earnings growth rate of 5.3% and 16.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 10.9% over the last 30 days.

Rockwell Automation Inc. ROK has been witnessing improvement in order levels, indicating solid underlying demand from customers across many industries and regions. Backed by solid backlog levels and fiscal first-half performance, as well as assuming supply-chain stabilization, ROK updated its sales growth guidance to 12.6-16.5% for fiscal 2023. Organic sales growth is projected at 13-17% for the same fiscal year.

Rockwell Automation has an expected revenue and earnings growth rate of 14.3% and 26.9%, respectively, for the current year (September 2023). The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last 30 days.

Ingersoll Rand Inc. IR is set to gain from a healthy demand environment, solid product portfolio and innovation capabilities. Higher orders for compressors, and power tool and lifting are driving the growth of the Industrial Technologies & Services unit of IR. Benefits from acquired assets are aiding the Precision & Science Technologies segment.

Ingersoll Rand has an expected revenue and earnings growth rate of 12.2% and 14.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6.7% over the last 60 days.

Hubbell Inc. HUBB is engaged in the design, manufacture and sale of electrical and electronic products to commercial, industrial, utility and telecommunications markets. HUBB’s products include plugs, receptacles, connectors, lighting fixtures, high voltage test and measurement equipment and voice and data signal processing components.

Hubbell has an expected revenue and earnings growth rate of 8.3% and 30%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 22.6% over the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Hubbell Inc (HUBB) : Free Stock Analysis Report