Top 5 Momentum Stocks for August After a Strong July

Wall Street closed July on an impressive note. The broad-market benchmark — the S&P 500 Index — advanced 3.1%, marking its fifth consecutive positive month for the first time since its seven-month streak ending August 2021. The tech-laden Nasdaq Composite surged 4.1%, posting its fifth straight winning month for the first time since April 2021. The blue-chip Dow also experienced significant growth, appreciating 3.4%.

U.S. Economy Remains Strong

The Bureau of Economic Analysis reported that U.S. GDP grew 2.4% in second-quarter 2023 after rising 2% in the first quarter. The U.S. GDP increased 2.6% in fourth-quarter 2022. The second-quarter GDP growth rate eliminates the concerns of a large section of economists and financial researchers that the economy may fall into a recession in the near future.

In June 2023, the U.S. economy added 209,000 jobs, in line with the last 20-year average. Weekly jobless claims have been declining for the last four reported weeks. Month over month, personal expenditure — the largest driver of the GDP — rose 0.5% in June compared with 0.2% in May. The personal savings rate stayed healthy at 4.3%.

Momentum is Likely to Continue

The inflation rate is dwindling steadily since June 2022. Consequently, the Fed is approaching the end of its ongoing interest rate hike cycle. The central bank is now more confident about the soft landing of the economy.

Moreover, second-quarter 2023 earnings are stable and resilient at the middle of the reporting cycle. The earnings picture is not great, but it is not miserable either. Most of the companies, reported so far, have given upbeat guidance.

Our Top Picks

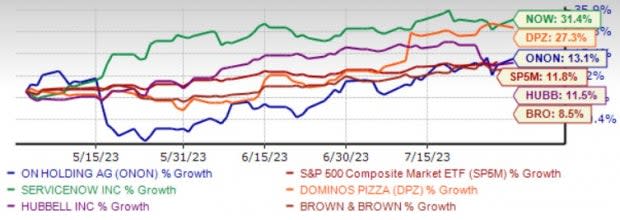

We have narrowed our search to five large-cap (market capital > $10 billion) stocks that have strong momentum for August. These companies have strong potential for the rest of 2023. These stocks have seen positive earnings estimate revisions in the last seven days. Each of our picks carries a Zacks Rank #1 (Strong Buy) and has a Momentum Score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

ServiceNow Inc. NOW has been benefiting from the rising adoption of its workflows by enterprises undergoing digital transformation. NOW’s expanding global presence, solid partner base and strategic buyouts are positives. New solutions — Automated Service Suggestions, Service Request Playbook and Workplace Scenario Planning — are helping NOW win new customers. An expanding portfolio with new generative AI solutions is expected to drive the top-line growth of NOW.

ServiceNow has an expected revenue and earnings growth rate of 22.7% and 27.3%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last seven days.

Domino's Pizza Inc. DPZ is benefiting from a solid digital ordering system and higher global retail sales. This and DPZ’s focus on menu additions bode well. Although the initiative paves the path for increased costs in delivery orders, attributes such as variety, great taste and competitive pricing are likely to have helped DPZ achieve balanced growth across tickets and orders in the long term.

Domino's Pizza has an expected revenue and earnings growth rate of 0.1% and 9.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.3% over the last seven days.

Hubbell Inc. HUBB is engaged in the design, manufacture, and sale of electrical and electronic products to commercial, industrial, utility and telecommunications markets. HUBB’s products include plugs, receptacles, connectors, lighting fixtures, high voltage test and measurement equipment and voice and data signal processing components.

Hubbell has an expected revenue and earnings growth rate of 9.2% and 41.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 8.2% over the last seven days.

Brown & Brown Inc.’s BRO compelling portfolio along with an impressive growth trajectory driven by organic and inorganic initiatives across all its segments bodes well. Buyouts and collaborations enhanced BRO’s existing capabilities and extended its geographic foothold. Strategic efforts continue to drive commission and fees. BRO’s solid capital position, backed by a strong operational environment, places it well for long-term growth.

Brown & Brown has an expected revenue and earnings growth rate of 17% and 16.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6% over the last seven days.

On Holding AG ONON develops and distributes sports products worldwide. ONON offers athletic footwear, apparel, and accessories. ONON offers its products through independent retailers and distributors, online, and stores.

On Holding has an expected revenue and earnings growth rate of 56.3% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.7% over the last seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Hubbell Inc (HUBB) : Free Stock Analysis Report

On Holding AG (ONON) : Free Stock Analysis Report