Top 5 Utility Stocks to Protect Your Portfolio From Volatility

Wall Street witnessed an impressive bull run in 2023, but the utility sector suffered a blow. Of the 11 broad sectors of the market’s benchmark — the S&P 500 Index — the Utility sector declined more than 11%. Investors’ preference shifted to growth stocks from defensive sectors like utility as the Fed significantly reduced the magnitude of interest rate hikes.

However, the utility sector is likely to regain momentum in 2024. Last week, Fed Chairman Jerome Powell gave his testimony before the Senate after appearing before the House of Representatives a day before.

On Mar 6, Powell said the central bank is likely to initiate interest rate cuts this year but not any time soon. However, on Mar 7, he indicated that interest rate cuts may not be too far off if the inflation rate moves in line with the Fed’s expectations in the near future.

Utility operations are capital-intensive, as consistent investments are required to upgrade, maintain and replace older wires, electric poles and power stations. Hence, apart from internal fund sources, utilities depend on the credit market for funds to carry on upgrades.

Utilities Immune to Vagaries of Economic Cycle

The Utilities sector is mature and fundamentally strong as demand for such services is generally immune to the changes in the economic cycle. Such companies provide basic services like electricity, gas, water and telecommunications, which will always be in demand.

Consequently, adding stocks from the utility basket usually lends more stability to a portfolio in an uncertain market condition. Moreover, the sector is known for the stability and visibility of its earnings and cash flows. Stable earnings enable utilities to pay out consistent dividends that make them more attractive to income-oriented investors.

Utility companies enjoy a reputation for being safe, given the regulated nature of their business. This lends their revenues a high level of certainty. These companies also benefit from the domestic orientation of their business, which shields them from foreign currency translation issues.

Additionally, utilities are generally low-beta stocks (beta >0 but <1). These companies generally provide a good dividend. Investment in low-beta stocks with a high dividend yield and a favorable Zacks Rank may be the best option if volatility persists in early 2024.

If the market’s northbound journey is reestablished, the favorable Zacks Rank of these stocks will capture the upside potential. However, if the market’s downturn continues, low-beta stocks will minimize portfolio losses and dividend payments will act as a regular income stream. The Utilities Select Sector SPDR (XLU) is up 0.7% year to date.

Our Top Picks

We have narrowed our search to five low-beta utility stocks that are regular dividend payers. These stocks have good potential for 2024 and have seen positive earnings estimate revisions within the last 60 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

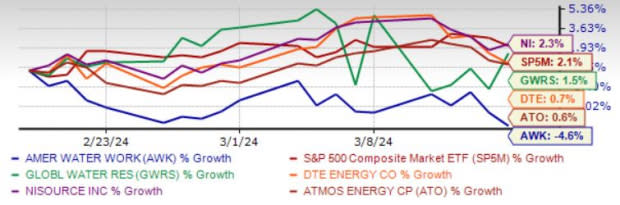

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

American Water Works Co. Inc. AWK is gaining from contributions from acquired assets and military contracts. Investments in infrastructure will assist AWK to efficiently serve its expanding customer base. Water and wastewater rate hikes are also boosting AWK’s performance.

AWK continues to expand operations through organic and inorganic initiatives. AWK has ample liquidity to meet its obligations. Cost management is boosting margins.

American Water Works Co. has an expected revenue and earnings growth rate of 0.6% and 6.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.6% over the last 30 days. AWK has a beta of 0.63 and a current dividend yield of 2.39%.

Global Water Resources Inc. GWRS is a water resource management company. GWRS owns and operates regulated water, wastewater and recycled water utilities in metropolitan Phoenix and Tucson, AZ.

Global Water Resources has an expected revenue and earnings growth rate of 0.1% and 19.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.3% over the last seven days. GWRS has a beta of 0.98 and a current dividend yield of 2.45%.

DTE Energy Co. DTE is a diversified energy company that follows a disciplined capital spending program to maintain and upgrade its infrastructure to enhance the reliability of its utility systems. In order to promote clean energy, DTE also invests heavily in renewable generation assets and aims to reduce its carbon footprint significantly.

DTE Energy has an expected revenue and earnings growth rate of 8.9% and 16.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last 60 days. DTE has a beta of 0.64 and a current dividend yield of 3.73%.

NiSource Inc. NI continues to add clean assets to the portfolio and retire coal-based units. NI expects to invest $15 billion in modernizing infrastructure, which will further enhance the reliability of its operations. Within 18 months, nearly 75% of its investment was recovered through rate hikes, providing NI with funds to carry on infrastructure upgrades. NI has enough liquidity to meet debt obligations.

NiSource has an expected revenue and earnings growth rate of 9.4% and 6.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 60 days. NI has a beta of 0.49 and a current dividend yield of 4%.

Atmos Energy Corp. ATO continues to benefit from rising demand, courtesy of an expanding customer base. ATO’s long-term investment plan will further help increase the safety and reliability of its natural gas pipelines. ATO gains from industrial customer additions and constructive rate outcomes. Returns within a year of capital investment will further boost the company’s performance. ATO has enough liquidity to meet debt obligations.

Atmos Energy has an expected revenue and earnings growth rate of 16.3% and 8%, respectively, for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 30 days. ATO has a beta of 0.66 and a current dividend yield of 2.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

Global Water Resources, Inc. (GWRS) : Free Stock Analysis Report