Top AIM High Growth Stock

Investors seeking to increase their exposure to growth should consider companies such as Gaming Realms and Brady. Analysts are generally optimistic about the future of these stocks, based on how much they’re expected to earn and return. Below I’ve put together a list of great potential investments for you to consider adding to your portfolio if growth is a dimension you would like to firm up.

Gaming Realms plc (AIM:GMR)

Gaming Realms plc develops, publishes, and licenses mobile gaming content in the United Kingdom, the United States, Canada, and internationally. Established in 2001, and currently run by Patrick Southon, the company currently employs 150 people and has a market cap of GBP £24.32M, putting it in the small-cap group.

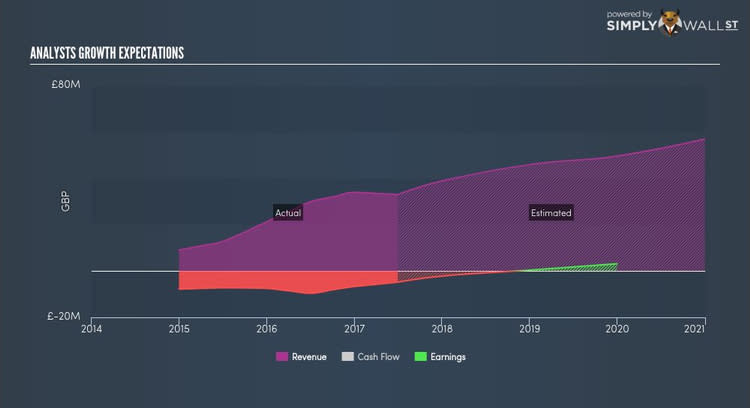

Extreme optimism for GMR, as market analysts projected an outstanding earnings growth rate of 80.88% for the stock, supported by a double-digit sales growth of 44.56%. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of GMR, it does not appear extreme. Moreover, the substantial growth of over 100% in operating cash flows shows that a decent part of earnings is driven by robust cash generation from operational activities, not one-off or non-core activities. GMR ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Interested to learn more about GMR? I recommend researching its fundamentals here.

Brady plc (AIM:BRY)

Brady plc provides integrated trading, process, and risk management software solutions to the commodity, energy, and recycling markets worldwide. Formed in 1985, and run by CEO Ian Jenks, the company employs 253 people and has a market cap of GBP £54.60M, putting it in the small-cap group.

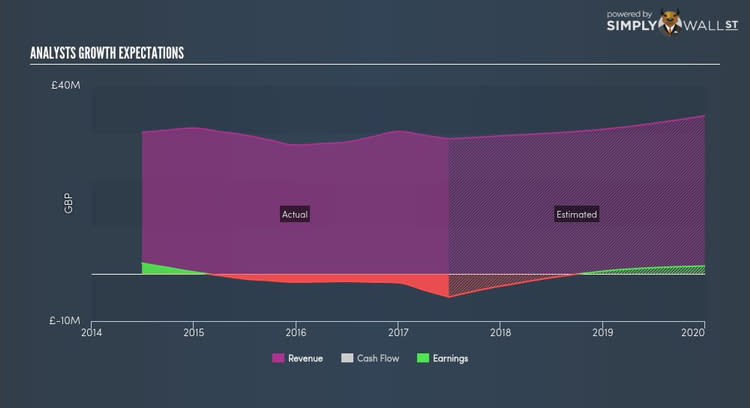

BRY is expected to deliver an extremely high earnings growth over the next couple of years of 79.75%, driven by a positive revenue growth of 12.00% and cost-cutting initiatives. Although reduction in cost is not the most sustainable operational activity, the expanding top-line growth, on the other hand, is encouraging. BRY ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Thinking of investing in BRY? Check out its fundamental factors here.

Premier Technical Services Group plc (AIM:PTSG)

Premier Technical Services Group PLC provides façade access and fall arrest equipment, lightning protection, electrical services, cleaning, and industry training solutions in the United Kingdom. Established in 2006, and headed by CEO Paul Teasdale, the company employs 600 people and with the market cap of GBP £198.59M, it falls under the small-cap category.

PTSG is expected to deliver a triple-digit high earnings growth over the next couple of years, bolstered by an equally impressive revenue growth of 53.82%. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. Furthermore, the high growth of over 100% in operating cash flows indicates that a large portion of this earnings increase is high-quality, day-to-day cash generated by the business, rather than one-offs. PTSG’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. A potential addition to your portfolio? Check out its fundamental factors here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.