Top Apparel Stocks to Buy on the Dip

The dwelling of a higher interest rate environment and economic uncertainty still has a cloud over consumer spending. Although many consumer staples and discretionary sector stocks have been volatile this year most avid investors will point to the notion that real money is made in the stock market after a downturn.

This points us to a few highly-ranked Zacks Textile-Apparel Industry stocks that may be worth buying on the dip.

Lululemon LULU

Sporting a Zacks Rank #2 (Buy), we’ll start with athletic apparel titan Lululemon which has become an iconic brand with a loyal customer base that should sustain the company even during an economic downturn.

To that point, Lulumen’s stock is up +26% this year to outperform the Textile-Apparel Markets’ -1% and roughly match the Nasdaq’s +27% while topping the S&P 500’s +15%. Double-digit percentage growth on Lululemon’s top and bottom lines suggests a selloff could present even better buying opportunities.

Image Source: Zacks Investment Research

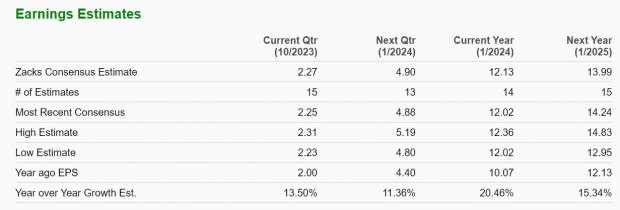

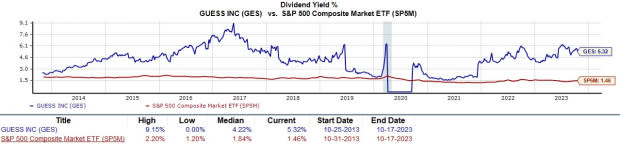

Guess GES

Investors love dividends and may find Guess stock very attractive. The iconic jeans and fashion apparel designer currently sports a Zacks Rank #1 (Strong Buy) with a 5.32% annual dividend yield that towers over the S&P 500’s 1.46% average and the industry average of 1.03%.

Up a respectable +9% YTD, Guess is starting to make a strong case as a lucrative value stock trading at just 7.5X forward earnings with EPS forecasted to jump 10% in its current fiscal 2024 and rise another 5% in FY25 to $3.17 per share.

Image Source: Zacks Investment Research

GIII Apparel Group GIII

Very compelling as well is G-III Apparel Group which covets a Zacks Rank #1 (Strong Buy). With licensed brands, G-III provides a wide range of apparel including outwear, dresses, sportswear, and swimwear among other women’s clothing and accessories.

GIII may be a prime buy the dip candidate as shares have rebounded and soared +84% this year but still trade at just 7.8X forward earnings. Even better, annual earnings are expected to climb 15% in its current FY24 and rise another 4% in FY25 to $3.41 per share.

Image Source: Zacks Investment Research

Bottom Line

Considering their stronger-than-expected outlooks, buying Lululemon, Guess, or G-III Apparel Group’s stock any cheaper may be a gift as they look likely to outperform many of their peers and perhaps the broader market.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Guess?, Inc. (GES) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report