Top Dividend Stocks For The Week

Navient, Portland General Electric, and United Bankshares are three of the best paying dividend stocks for creating diversified portfolio income. Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. Today I will share with you my best paying dividend shares you should be considering for your portfolio.

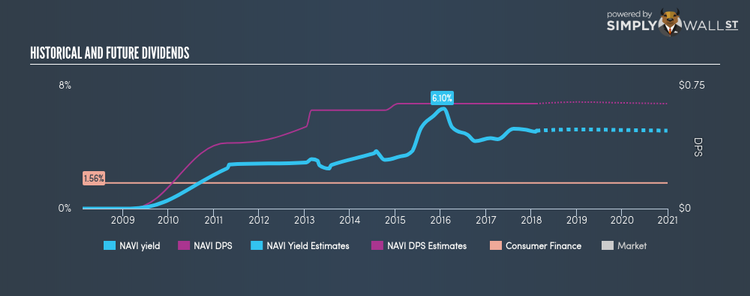

Navient Corporation (NASDAQ:NAVI)

Navient Corporation provides asset management and business processing services to education, health care, and government clients at the federal, state, and local levels in the United States. Formed in 1973, and currently headed by CEO John Remondi, the company provides employment to 6,773 people and with the company’s market cap sitting at USD $3.54B, it falls under the mid-cap category.

NAVI has a sumptuous dividend yield of 4.76% and their current payout ratio is 60.38% . While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time. Navient also looks promising for it’s growth over the next year, with analysts expecting a double digit earnings per share increase of 85.61%. Interested in Navient? Find out more here.

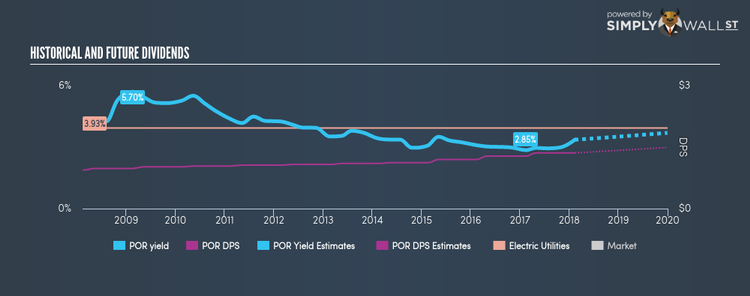

Portland General Electric Company (NYSE:POR)

Portland General Electric Company, an integrated electric utility company, engages in the generation, wholesale purchase, transmission, distribution, and retail sale of electricity in the state of Oregon. Founded in 1930, and currently headed by CEO Maria Pope, the company provides employment to 2,752 people and with the company’s market capitalisation at USD $3.61B, we can put it in the mid-cap category.

POR has a wholesome dividend yield of 3.36% and the company has a payout ratio of 57.04% , with the expected payout in three years being 58.42%. POR’s DPS have risen to $1.36 from $0.94 over a 10 year period. Much to the delight of shareholders, the company has not missed a payment during this time. Interested in Portland General Electric? Find out more here.

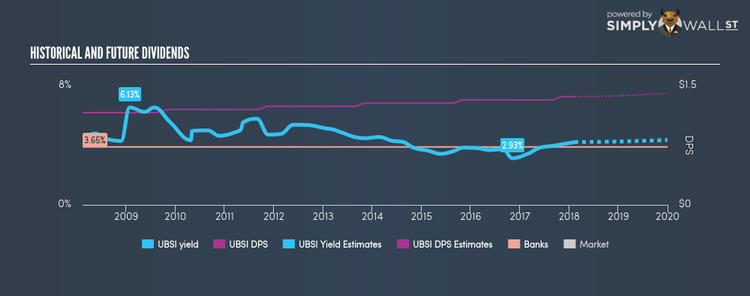

United Bankshares, Inc. (NASDAQ:UBSI)

United Bankshares, Inc. operates as the bank holding company for United Bank (WV) and United Bank (VA) that provide commercial and retail banking services and products primarily in the United States. Established in 1982, and currently run by Richard Adams, the company employs 2,381 people and with the company’s market capitalisation at USD $3.62B, we can put it in the mid-cap category.

UBSI has a good dividend yield of 3.95% and the company has a payout ratio of 86.12% . UBSI’s dividends have increased in the last 10 years, with DPS increasing from $1.16 to $1.36. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. Analysts are optimistic on the company’s earnings in the next 12 months, estimating a 60.84% increase in EPS. Continue research on United Bankshares here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.