Top Growth Stocks in June

Individual investors like stocks with a high growth potential. These companies have a strong outlook that can bring a significant upside to your portfolio, regardless of market cyclicality. The list I’ve put together below are of stocks that compare favourably on all criteria, which potentially makes them a good investment if you believe the growth has not already been reflected in the share price.

Revance Therapeutics, Inc. (NASDAQ:RVNC)

Revance Therapeutics, Inc., a biotechnology company, engages in the development, manufacturing, and commercialization of novel botulinum toxin products for various aesthetic and therapeutic indications. Established in 1999, and currently lead by L. Browne, the company size now stands at 136 people and with the stock’s market cap sitting at USD $1.16B, it comes under the small-cap stocks category.

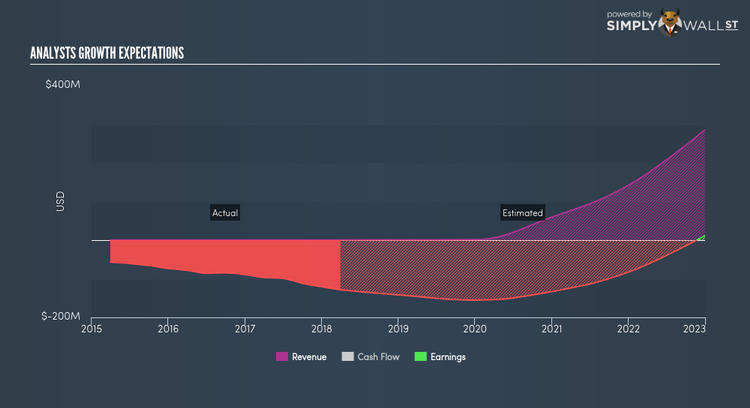

RVNC’s forecasted bottom line growth is an optimistic double-digit 28.23%, driven by underlying sales, which is expected to more than double, over the next few years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. RVNC’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add RVNC to your portfolio? Take a look at its other fundamentals here.

CUI Global, Inc. (NASDAQ:CUI)

CUI Global, Inc., through its subsidiaries, engages in the acquisition, development, and commercialization of power and electromechanical components worldwide. Formed in 1998, and currently headed by CEO William Clough, the company now has 333 employees and with the company’s market capitalisation at USD $76.68M, we can put it in the small-cap category.

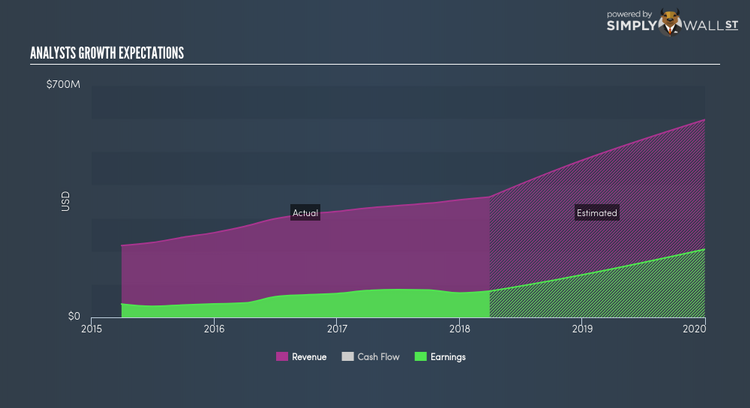

CUI’s forecasted bottom line growth is an exceptional triple-digit, driven by the underlying double-digit sales growth of 47.51% over the next few years. Although reduction in cost is not the most sustainable operational activity, the expanding top-line growth, on the other hand, is encouraging. CUI’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. A potential addition to your portfolio? Have a browse through its key fundamentals here.

Ameris Bancorp (NASDAQ:ABCB)

Ameris Bancorp operates as the holding company for Ameris Bank that provides banking services to retail and commercial customers primarily in Georgia, Alabama, Florida, and South Carolina. Established in 1971, and now run by Edwin Hortman, the company employs 1,460 people and with the company’s market capitalisation at USD $2.31B, we can put it in the mid-cap stocks category.

A potential addition to your portfolio? Take a look at its other fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.